Download Cost-Benefit Analysis for Ganges River Cleaning Policy and more Slides Environmental Economics in PDF only on Docsity!

Valuation and Policy

Objective

• To show the utility of valuation in setting

policy

• Cost-Benefit Analysis method

• Use of Valuation in setting taxes

STAGE 1: Project Definition - Baseline Definition and

Incremental Analysis

Project Scenario

with FGD

Baseline Scenario

without Trap

Project Appraisal

Impacts on Health -ve £5 million

FGD + Normal O & M +ve £10 million

Impacts on Health -ve £40 million

Incremental Benefit +ve £35 million

Normal O & M Costs +ve £2 million

Incremental Cost +ve £8 million

Incremental Net Benefit +ve £27 million

Total Net Cost -ve £42 million

Total Net Benefit -ve £15 million

- + -

Big external cost ( = benefit if reduced)

STAGE 1: Project Definition - Baseline Definition and

Incremental Analysis

Project Scenario

with Trap

Baseline Scenario

without FGD

Project Appraisal

Impacts on Health -ve £5 million

Trap + Normal O & M +ve £10 million

Impacts on Health -ve £40 million

Incremental Benefit +ve £35 million

Normal O & M Costs +ve £2 million

Incremental Cost +ve £8 million

Incremental Net Benefit +ve £27 million

Total Net Benefit -ve £42 million

Total Net Cost -ve £15 million

However, project to reduce emissions and associated impacts still has negative value Therefore, bad project, or is it?

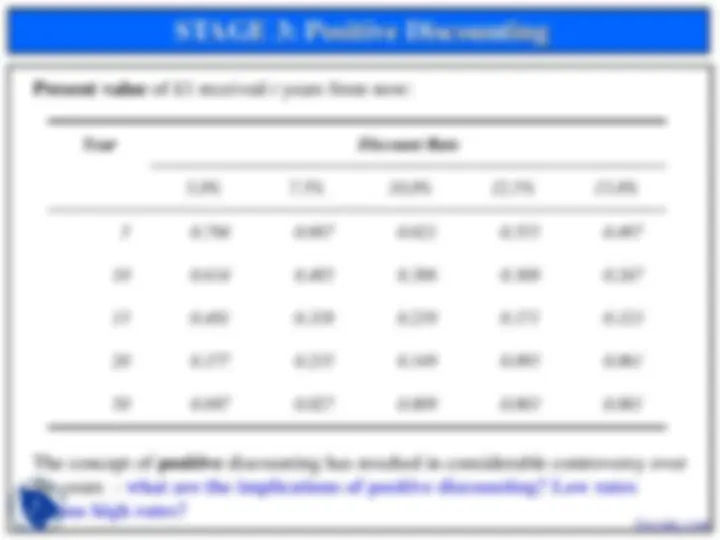

STAGE 3: Discounting Future Costs and Benefits

Projects typically involve costs and benefits occurring over long periods of time.

We need to add up benefits/costs in each time period to derive a measure of total

net benefit at the time of the (investment) decision.

-£10 million + £4 million + £4 million + £4 million = £2 million ( 1 ) * -£10 million + ( 1 ) * £4 million + ( 1 ) * £4 million + ( 1 ) * £4 million = £2 million

The simplest way to do this would be to say that a benefit of £1 to individual 1 in

year 1 should be added to a £1 benefit to that individual in year 2, and so on.

This would be correct if the individual concerned did not care when benefits and

costs occurred.

But typically people do care. Why?

STAGE 3: Discounting the Future: the Bird in the Hand

Money available now can be put to productive use, at the very least

earning interest; money in the hand offers scope, including capital

productivity and the ability to purchase today.

The bird in the hand is worth three in the bush, for the future is always

uncertain with risks of death and illness, a return to high inflation rates,

collapse of markets, bankruptcies, scams and fraud etc.

People also prefer money in the present because of impatience.

The general outcome is that people discount future benefits and returns,

and to induce people to forgo present consumption requires positive rates

of interest and other assurances. This brings us to the phenomenon of

discounting.

STAGE 3: Implications of Positive Discounting

Fewer investments are undertaken, which have large initial costs and long

term returns or benefits, e.g. hydroelectric and water irrigation projects. The

benefits of long-term projects such as hardwood plantations are grossly

minimized in terms of present values.

Major future costs are not given much importance, e.g. the need to

decommission large undertakings such as a nuclear or conventional power

plant, or the cleaning up of contaminated land. The cost of storing and

disposing of nuclear or toxic wastes is significantly minimized.

The higher the rate of discount, the greater the discrimination against

future generations :

future generations may bear a disproportionate share of the future

costs of the project (or forego future benefits)

the lower will be the level of overall investment and hence the

lower (higher) the capital (natural) stock inherited.

STAGE 3: Project Selection

Year 0 1 2 3 → 30

1 Discount factor 1.000 0.9259 0.8573 0.7938 (^) → 0. 2 Investment cost £800,000 - - - (^) → - 3 Annual cost - £10,000 £10,000 £10,000 (^) → £10, 4 Total cost (3 + 4) £800,000 £10,000 £10,000 £10,000 (^) → £10, 5 Discounted total cost (4 * 1) £800,000 £9,259 £8,573 £7,938 (^) → £ 6 PVC (sum line 5) £912, 7 Annual benefit - £100,000 £100,000 £100,000 (^) → £100, 8 Discounted benefit (7 * 1) - 92,593 85,734 79,383 (^) → 9, 9 PVB (sum line 8) £1,125, 10 NPV (9 - 6) £203,

Net Present Value

Present Value Benefits

Present Value Costs

If NPV is:

Positive

Negative

Why?

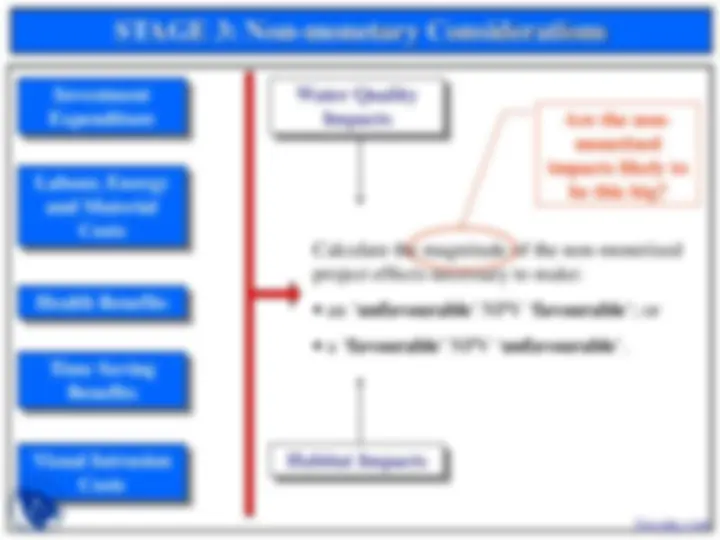

Investment

Expenditure

Labour, Energy

and Material

Costs

Health Benefits

Time Saving

Benefits

Visual Intrusion

Costs

Calculate the magnitude of the non-monetised

project effects necessary to make:

- an ‘ unfavourable ’ NPV ‘ favourable ’; or

- a ‘ favourable ’ NPV ‘ unfavourable ’.

Habitat Impacts

Water Quality

Impacts

STAGE 3: Non-monetary Considerations

Are the non-

monetised

impacts likely to

be this big?

Cleaning the Ganges

A Cost Benefit Analysis

Based on Markandya and Murty

Environment and Development

Economics, Volume 9, Issue 01,

Feb 2004, pp 61-

Some Pictures!

Background

• Result has been an erosion of river quality, by

1970s over 600km were effectively dead

(anaerobic).

• Ganga Action Plan (GAP) originated from

personal intervention of Indira Gandhi and her

son. It was launched in 1985 and first phase

was largely completed in 1988. Second phase

completed in 1998

• Investment costs estimated at about $320 million

and operating costs at around $10 million a

year.

Bathing in Ganga

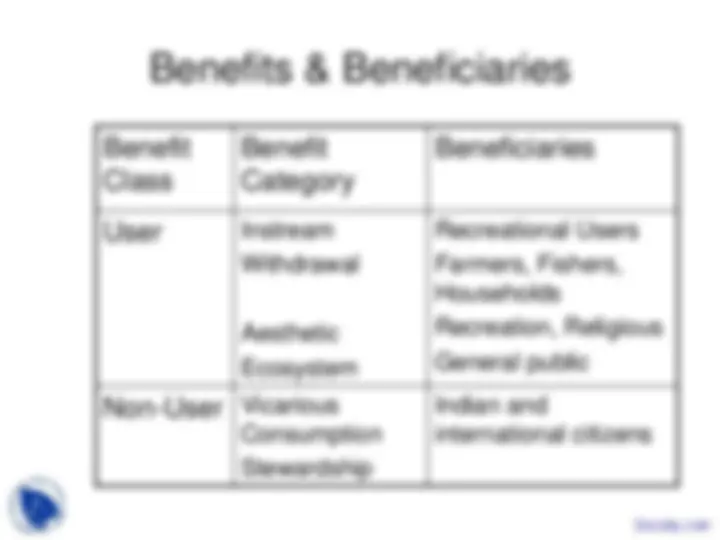

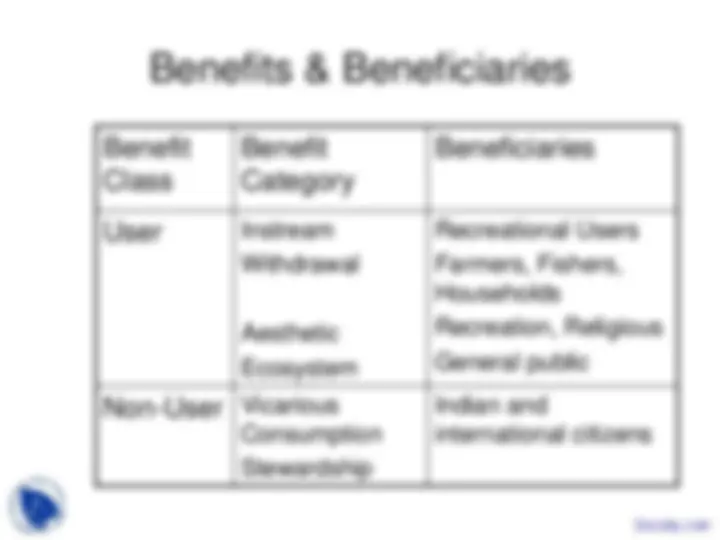

Benefits & Beneficiaries

Benefit

Class

Benefit

Category

Beneficiaries

User Instream

Withdrawal

Aesthetic

Ecosystem

Recreational Users

Farmers, Fishers,

Households

Recreation, Religious

General public

Non-User Vicarious

Consumption

Stewardship

Indian and

international citizens