Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

This lecture is part of lecture series for Engineering Economics course at M. J. P. Rohilkhand University. It was delivered by Dr. Badrinath Singh to cover following points: Theory, Cost, Opportunity, Concepts, Decision, Alternative, Explicit, Implicit, Fixed, Variable

Typology: Slides

1 / 16

This page cannot be seen from the preview

Don't miss anything!

Theory of Cost

Engineering

Economics

Should I go to work today? Should I go to college after high school? Should the government spend money on a new weapon system?

These are decisions that are made everyday; however, what is the cost of our decisions? What is the cost of going to work, or the decision not to go to work? What is the cost of University, or not to go to University? Finally what is the cost of buying that weapon system, or the cost of not buying that weapon?

In economics it is called opportunity cost.

Accounting Costs and Economic Costs

A firm’s cost of production includes all the opportunity costs of making its output of goods and services.

Explicit and Implicit Costs

A firm’s cost of production include explicit costs and implicit costs.

Explicit costs: All cash payments which the firm makes to other factor owners for purchasing or hiring the various factors.

Implicit costs: The normal return on money-capital invested by the entrepreneur and wages or salary of his services and money rewards for other factors which the entrepreneur himself owns and employs them in his own firm.

Economic Cost = Accounting costs + Implicit costs

The total expenditure put up by an entrepreneur to produce a certain amount of a good is called TC:

C(Q) = FC + VC

Fixed costs are those costs that do not vary with the quantity of output produced Variable costs are those costs that do vary with the quantity of output produced

C(Q) = VC + FC

VC(Q)

FC

Fixed costs or overhead cost can be classified into factory overhead, administration overhead, selling overhead and distribution overhead. Variable costs can be further classified into direct material, direct labor and direct expenses. Market price ; it is the price that a good or service is offered at, or will fetch, in the marketplace; The selling price is derived as shown below a) Direct material cost + Dir. labor cost + Direct expenses = Prime cost b) Prime cost + Factory overhead = factory cost c) Factory cost + office and administrative overhead = cost of production d) Cost of production + opening finished stock – Closing finished stock = cost of goods sold e) cost of goods sold + selling and distribution overhead = cost of sales f) cost of sales + profit Sales g) Sales/quantity sold selling price per unit

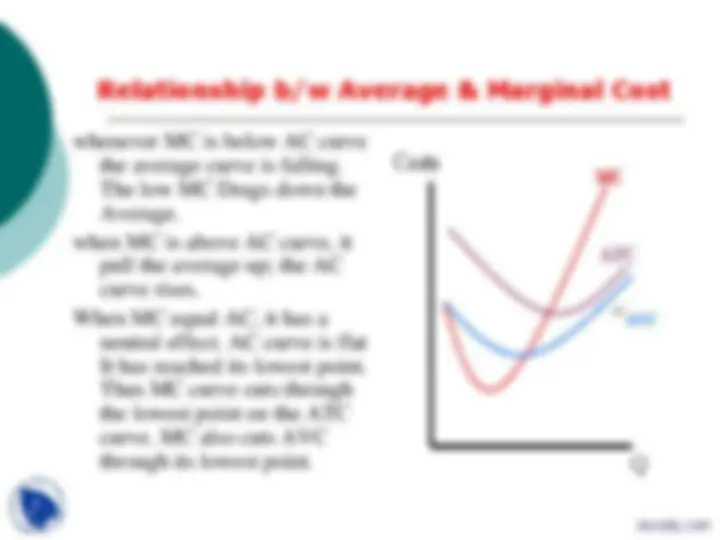

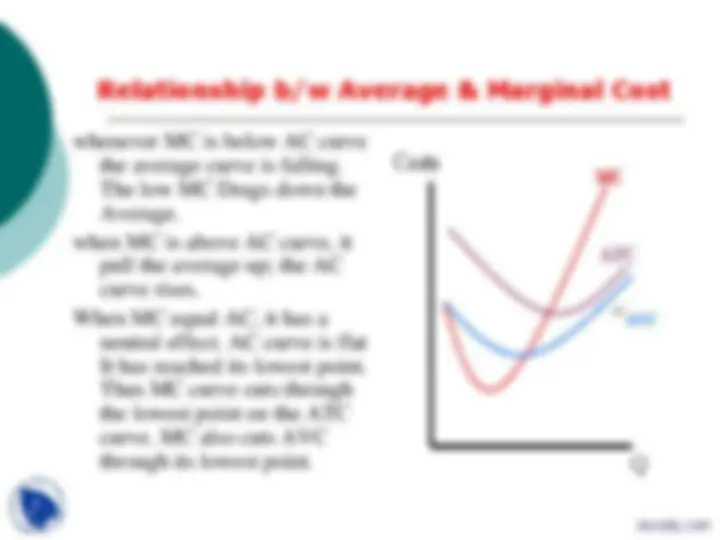

Marginal Cost: The marginal cost of a product is the cost of producing an additional unit of that output. More formally, the marginal cost is the derivative of total production costs with respect to the level of output. Marginal Revenue (MR) is the extra revenue that an additional unit of product will bring. It is the additional income from selling one more unit of a good; sometimes equal to price. It can also be described as the change in total revenue divided by the change in the number of units sold. i.e. Q = 40,000 − 2000 P Marginal cost and average cost can differ greatly. For example, suppose it costs $1000 to produce 100 units and $1020 to produce 101 units. The average cost per unit is $10, but the marginal cost of the 101st unit is $

Break-even point (BEP) is the point at which cost or expenses and revenue are equal: there is no net loss or gain. The main objective of break-even analysis is to find the cut-off production volume from where a firm will make profit. X = TFC/P-V X = TFC/Unit Contribution Contribution = Sales – TVC Margin of Safety = Sales – Break Even sales

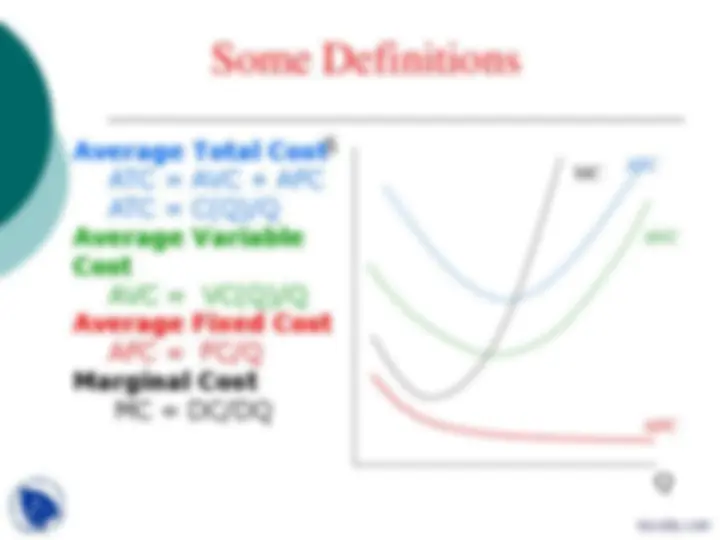

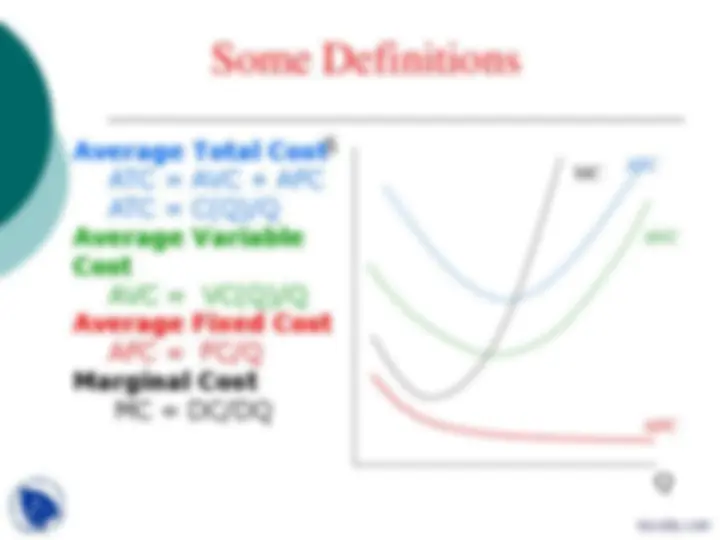

Average Total Cost ATC = AVC + AFC ATC = C(Q)/Q Average Variable Cost AVC = VC(Q)/Q Average Fixed Cost AFC = FC/Q Marginal Cost MC = DC/DQ

ATC

AVC

AFC

MC

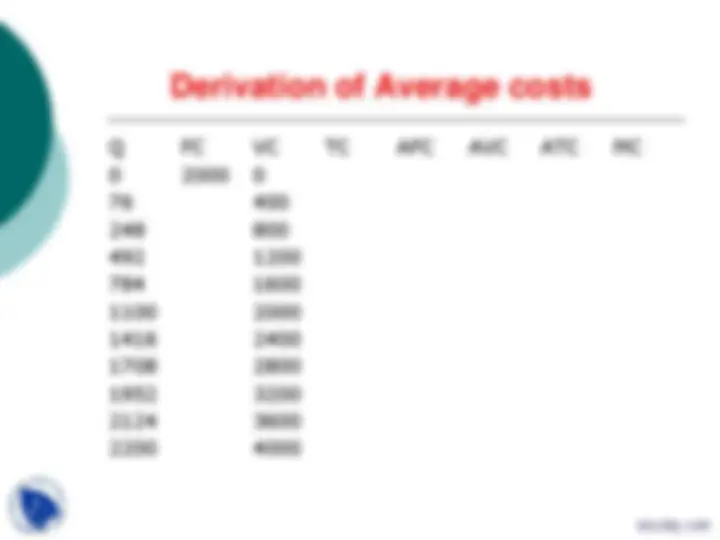

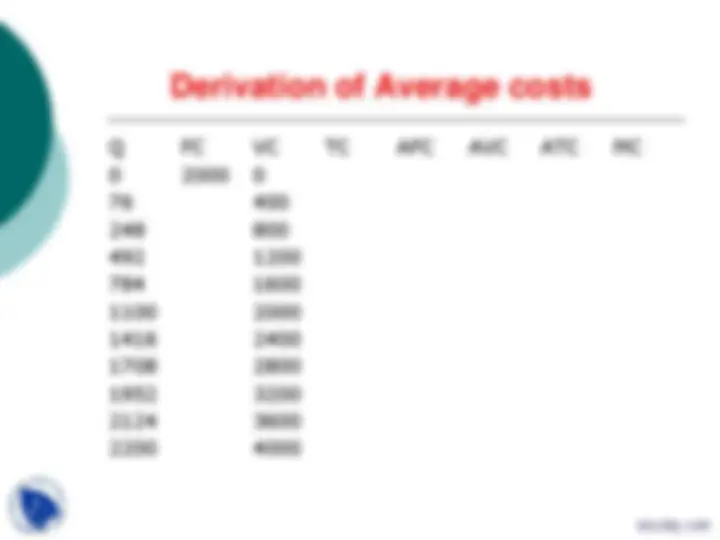

Q FC VC TC AFC AVC ATC MC 0 2000 0 76 400 248 800 492 1200 784 1600 1100 2000 1416 2400 1708 2800 1952 3200 2124 3600 2200 4000

Economies of scale arise when the cost per unit falls as output increases. Economies of scale are the main advantage of increasing the scale of production Bulk-buying economies Technical economies Financial economies Marketing economies Managerial economies lower unit costs as a result of the whole industry growing in size. Training and education becomes more focused on the industry Other industries grow to support this industry