Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

This is project presentation for Management Practices course at Dayalbagh Educational Institute. It includes: Nature, Source, Competitive, Advantage, Sustaining, Types, Cost, Differentiation, Strategic, Innovation

Typology: Slides

1 / 24

This page cannot be seen from the preview

Don't miss anything!

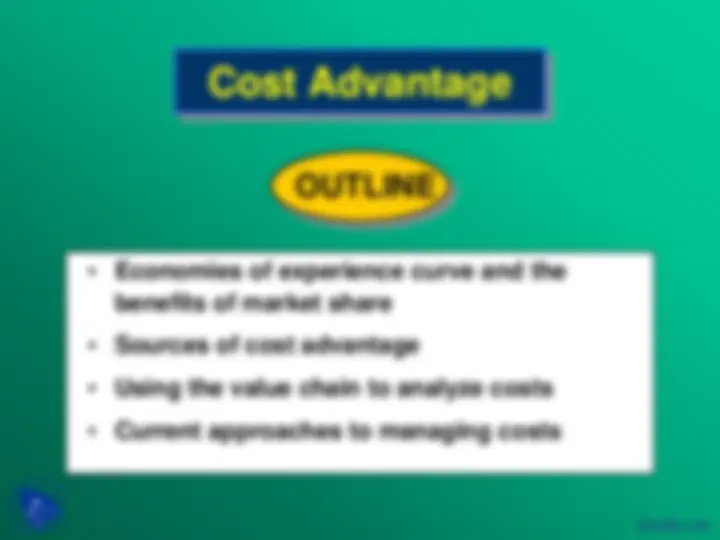

OUTLINE

Competitive Advantage from Internally-

Generated Change: Strategic Innovation

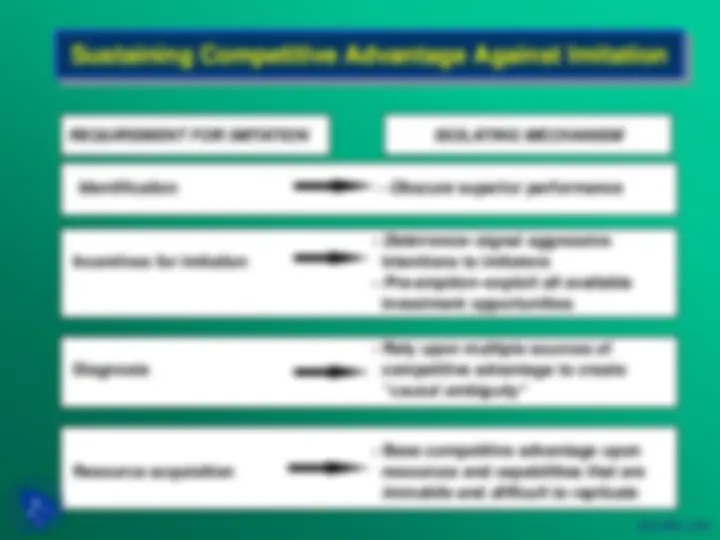

Identification - Obscure superior performance

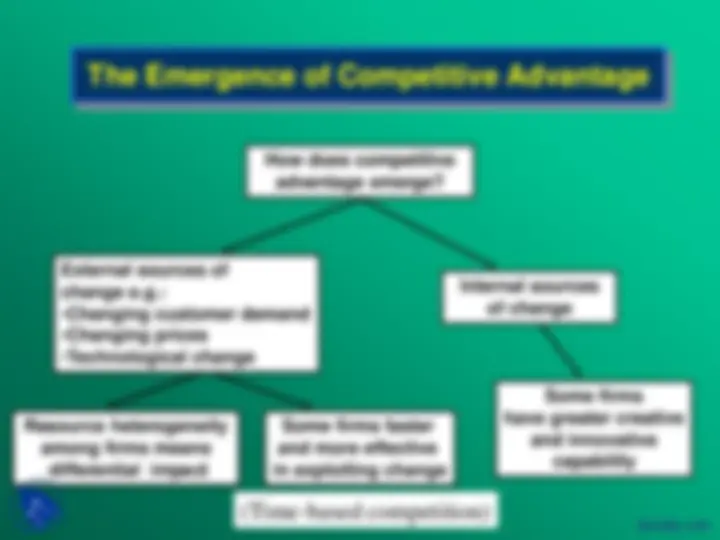

Sources of Competitive Advantage

COST ADVANTAGE

DIFFERENTIATION ADVANTAGE

COMPETITIVE

ADVANTAGE

Porter’s Generic Strategies

SOURCE OF COMPETITIVE ADVANTAGE Low cost Differentiation

Industry-wide COST DIFFERENTIATION

COMPETITIVE LEADERSHIP

SCOPE

Single Segment F O C U S

OUTLINE

The Experience Curve

The “Law of Experience”

The unit cost value added to a standard product declines by a constant % (typically 20-30%) each time cumulative output doubles.

Cost per unit of output (in real $)

Cumulative Output

The Importance of Market Share

0-10 10-20 20-30 30-40 over 40 Market Share (%)

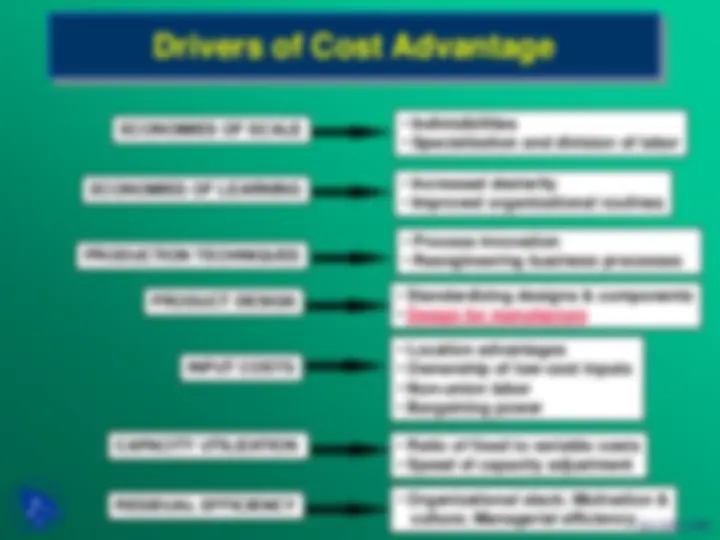

Drivers of Cost Advantage

The Costs Developing New Car Models

$ billion

GM Saturn 5

Ford Taurus (1996 model) 2. Ford Escort (new model 1996) 2

Renault Clio (1999 model) 1.

Chrysler Neon 1.

Honda Accord (1997 model) 0.

BMW Mini 0.

Rolls Royce Phantom (2003 model) 0.

10 20 50 100 200 500 1, Annual sales volume (millions of cases)

Advertising Expenditure ($ per case)0.

Pepsi Coke

Seven Up

Sprite^ Dr. Pepper

Diet Pepsi

Tab

Fresca

Diet Rite

Diet 7-Up

Schweppe s (^) SF Dr. Pepper

Despite the massive advertising budgets of brand leaders Coke and Pepsi, their main brands incur lower advertising costs per unit of sales than their smaller rivals.

STAGE 1. IDENTIFY THE PRINCIPAL ACTIVITIES

STAGE 2. ALLOCATE TOTAL COSTS

PURCH- ASING

PARTS INVEN- TORIES

R&D DESIGN ENGNRNG

COMPONENT MFR

ASSEMBLY

TESTING, QUALITY CONTROL

GOODS INVEN- TORIES

SALES & MKITG

DISTRI- BUTION

DEALER & CUSTOMER SUPPORT

PURCH- ASING

PARTS INVEN- TORIES

R&D DESIGN ENGNRNG

COMPONENT MFR ASSEMBLY^

TESTING, QUALITY CONTROL

GOODS INVEN- TORIES

SALES & MKITG

DISTRI- BUTION

DEALER & CUSTOMER SUPPORT

--Plant scale for each -- Level of quality targets -- No. of dealers component -- Frequency of defects -- Sales / dealer -- Process technology -- Level of dealer -- Plant location support -- Run length -- Frequency of defects -- Capacity utilization under warranty

Prices paid --Size of commitment -- Plant scale --Cyclicality & depend on: --Productivity of -- Flexibility of production predictability of sales -- Order size R&D/design - - No. of models per plant --Customers’ --Purchases per --No. & frequency of new -- Degree of automation willingness to wait supplier models -- Sales / model -- Bargaining power -- Wage levels -- Supplier location -- Capacity utilization

STAGE 3. IDENTIFY COST DRIVERS