Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

The ongoing demand for software development and engineering jobs in Northern Ireland and the concerns regarding the disruption of skills supply from educational institutions. It highlights the importance of collaboration between industry, government, and academia to address the skills gap and proposes the establishment of a single organization to represent the software sector. The document also mentions several sector attractiveness programs and the need for improved alignment between industry and education.

What you will learn

Typology: Study notes

1 / 19

This page cannot be seen from the preview

Don't miss anything!

August 2021 Michael Gould People Development International Ltd.

To achieve this goal, it is likely that this innovation will be based on digital technologies and so there will be an increasing demand for a digitally competent workforce and an even greater demand for the software engineering skills that develop the technologies that enable digital technologies to function. There are concerns in the software sector that there will not be sufficient people with the software skills to support the growth of the 10X Economy. The demand for software development and engineering jobs in Northern Ireland has remained strong throughout the Pandemic. This demand is across all sectors of the economy as organisations moved to remote working and digitising their supply chains. International evidence indicates that this demand trend will continue well into the future as the nature of work continues to change. The software sector in Northern Ireland relies heavily on the education system to provide the majority of its new entrants each year but there are worrying signs that this supply of skills could be disrupted. The number of applications to university courses in computer science and software engineering has declined. The number of post-primary schools offering ‘A’ Level and GCSE courses in the subjects valued by industry is too small resulting in fewer people seeking places in tertiary education in these subject areas. There are alternative pathways into the sector but issues remain with these programmes resulting in numbers from these interventions remaining small. Like other industry sectors the software sector works hard to make itself an attractive career choice for young people. There are multiple sector attractiveness initiatives organised by industry, government and the third sector. These initiatives are well meaning, generate a lot of activity and are staffed by highly motivated people but given the decline in university applications and the low numbers of post- primary pupils undertaking the courses valued by the software sector there must be a doubt over the effectiveness and impact of these sector attractiveness programmes. Finally, the software sector needs a voice. The software sector in Northern Ireland employs 30,000 people, in jobs paying above the national average, in over 2,200 companies and generates £1.5bn annually yet there is no one single organisation that represents the sector either in Northern Ireland internally, nationally or internationally. There are multiple groups established to take the views of employers in the software sector but these are for the purposes of the organisations that have established these groups, not to represent the views of the sector as a whole. Companies in the software sector should come together to form a single representative body to raise issues of concern to the sector, develop a strategy for the sector and to represent the software sector to government, academia and the general public.

Forward

In July 2020 McKinsey Global Institute commissioned a survey amongst 800 business executives across nine countries: Australia, Canada, China, France, Germany, India, Spain, the United Kingdom and the United States. The results showed that 68% of the 800 surveyed (544) indicated they have plans to increase adoption of automation and AI. A similar number indicated that they expect more deployment of digital working tools, e-commerce platforms and digital supply chain platforms. The same report ‘The Future of Work after Covid-19’ also predicts a sustained rise in the use of e-commerce with 56% of consumers in eight countries stating that they planned to continue using online grocery shopping after the pandemic. The pandemic has also seen consumers increase their use of telemedicine. For businesses the increase in e-commerce may cause a shift in occupations away from customer facing roles e.g. traditional retail to roles that require digital skills. McKinsey also predicts the increase use of digital platforms will change pre-pandemic working practices such as a decrease in business travel as home working remains and areas such as manufacturing where automation maybe used to reduce workspace proximity of workers. The scoping study exists to provide clear, logical and evidence-based recommendations aimed at addressing the ever-increasing need for digital skills. The purpose of the Digital Skills NI Network is to collectively assess how best to address the software skills (computing science, software engineering) issues in the short, medium and long term. The purpose of this Scoping Study, funded by Invest NI Collaborative Growth Programme, was to assess the impact of the Covid-19 Pandemic and EU Exit on the CBI NI report ‘Opportunities Available’ from February 2020 by Dr Owen Sims and to explore other issues relating to the supply and demand for software skills. The research was undertaken between April – July 2021. 41 individuals assessed and commented on the policy recommendations and 36 face-to-face interviews and structured conversations were held with stakeholder organisations. The findings and recommendations are collated under the headings:

The CBI subsequently facilitated several well attended roundtable discussions with CEOs and other stakeholders to understand the issues and how to address them. This core group of companies attending the discussions have traditionally competed with each other for talent, but it was perceived that wage inflation and general skills availability was having a negative impact on the overall competitiveness of the sector and there was agreement to work together to try and resolve these issues. This early engagement work identified the following concerns:

Purpose

The high-level strategy will realise this ambition by focussing on innovation in areas where the economy has real strengths and making sure these gains mean something to all businesses, people and places in Northern Ireland. Overall, the aim is to see a positive impact on economic, societal and environmental wellbeing. This level of ambition to build a ‘10x Economy’ reflects the scale of the challenges ahead, and the opportunity to make a generational change. The ambition in this vision is to drive economic growth through a focus on innovation, whilst also achieving a fairer distribution of opportunities for all people to participate in, and benefit from, this growth. Innovation is at the centre of this vision as it will unlock a higher number of better jobs. Innovation can mean different things to different people. Some may view it as the outcome of research, others as new technology. In its most basic form, innovation simply means the development of creative ideas and methods into new products or services. Innovation can be harnessed to keep Northern Ireland relevant to the generational challenges we face today. The scale of ambition we are setting is a tenfold increase in innovation. In education and the workplace this means giving people the necessary training, reskilling and upskilling in order to maximise their potential, both within existing and future growth sectors. There is a need to inspire future generations to work in and create their own businesses and provide opportunities for talented young people, with the ultimate goal of developing and retaining the entrepreneurs and innovators of tomorrow.

Executive Summary

Key Cluster The development of key strategic clusters is acknowledged as an important driver of competitiveness in economies around the world. Internationally orientated firms are frequently embedded in deep clusters with highly integrated supply chains. Other small, advanced economies with successful clusters include Switzerland (finance, pharma, precision engineering), the Netherlands (logistics, food), Denmark (shipping, renewable energy, pharma), Israel (high tech) and Hong Kong (finance, logistics). There are five priority clusters identified to deliver this ambitious growth; they relate to areas where the emergence of significant capability and capacity with the potential to drive the economy forward has been identified. A number of local businesses within these specialisms, both Small and Medium Enterprises (SMEs) and large companies, have already demonstrated an appetite for collaborative working and have come together with academic partners and other key stakeholders to develop new products, services and ways of working. These technologies and clusters will evolve and change and these clusters may change over time too. However, the commitment to ‘tightening an economic strategy from broad sectors to strong or emerging specialisations will remain. The priority Clusters are:

Alternative Pathways Whilst the main pathway into a job in the software sector is through the university there are alternative pathways. These include Assured Skills Academies, Higher Level Apprenticeships and other apprenticeships and individuals undertaking training to up-skill or re-skills themselves through the DfE funded short term, on-line courses. The under-representation of HLAs and apprenticeships in the software sector is not through a lack of motivation or effort on behalf of the companies, the Department for the Economy or the training providers. Rather it is likely more structural and a consequence of both demand and supply factors. The research has identified positive and negative aspects of the current alternative pathways and recommends:

Sector Attractiveness Activities There are seven main sector attractiveness programmes operating in Northern Ireland and one education programme that could have a long-term impact on young people choosing a career in the software sector. The current sector attractiveness programmes are:

Professor David Jones , Pro-Vice Chancellor , Queens University Belfast Professor Liam Maguire , Pro-Vice Chancellor , Ulster University Professor Peter Finn , Principal , St Mary’s University College Belfast Dr. Irene Bell , Head of Science, Technology and Mathematics , Stranmillis University College Michael Bower , Director of Strategy , Open University Professor Philip Hanna , Dean of Education , Queens University Belfast Professor Johnny Wallace , Professor of Innovation , Ulster University Dr Jonathan Hegarty , Deputy Director , Belfast Metropolitan College Eamonn Brankin , ICT Hub Manager , Belfast Metropolitan College David Mawhinney , CEO , Equiniti Tara Simpson , CEO , Instil Peter Shields , Managing Director , Etain Mark Owens , CEO , Civica Andrew Gough , Managing Director , GCD John Healy , Managing Director , Allstate NI Tom Gray , Chief Technology Officer , Kainos William Hamilton , Managing Director , Liberty-IT Angela McGowan , Regional Director , Confederation of British Industries NI Columb Duffy , Allstate NI Brian Douglas , CEO , Codingfury Mark McCormack , Chief Technology Officer , Aflac Andrew Cuthbert , Technical Director , GCD Steve Orr , CEO , Catalyst Inc. Joanne Best , Personnel Director , Catalyst Inc. Anne O’Neill , HR Director , Alchemy Frank O’Grady , Bottle Top Media Graeme Wilkinson , Director of Skills and Policy , Department for the Economy Niall Casey , Director of Skills and Competitiveness , Invest NI Jim Wilkinson , Director , Apprenticeships, Careers and Vocational Education, Department for the Economy Frances O’Hara , Head of the Careers Service , Department for the Economy Julianne Kieran , Deputy Principal Economist , Department for the Economy Karen McCullough , Director of Curriculum and Qualifications , Department of Education Deirdre Ward , Director or Work and Wellbeing , Department of the Communities Gareth Heatherington , Director , Ulster University Economic Policy Centre Mark Magill , Senior Economist , Ulster University Economic Policy Centre Ruth Ray , Skills Manager , Belfast Region City Deal Jayne Brady , Northern Ireland Digital Commissioner Tina Gillespie , Skills Manager , Derry Strabane District Council Claudine McGuigan , Mid-South West Region Team, Armagh, Banbridge and Craigavon Council Helen Gormley , Mid-South West Region Team, Armagh, Banbridge and Craigavon Council Carol Fitzsimons MBE , Chief Executive , Young Enterprise Northern Ireland Ciara Mulgrew , Manager , “Time to Code”, Business in the Community Margaret Farragher , Acting Chief Executive , Council for Curriculum, Examinations and Assessment Michael McEnry , Programme Manager, Education Team (Digital and Assessment), CCEA Rory Clifford , Interactive Manager , Northern Ireland Screen Key Stakeholders Who Contributed to this Scoping Study

In addition, 11 members of the Ulster University Computing, Engineering and Built Environment Faculty Computing Employer Advisory Board (CEAB) and Invest NI ICT Forum submitted their scores on the Policy Recommendations anonymously through a Survey Monkey questionnaire prepared by Professor Johnny Wallace.

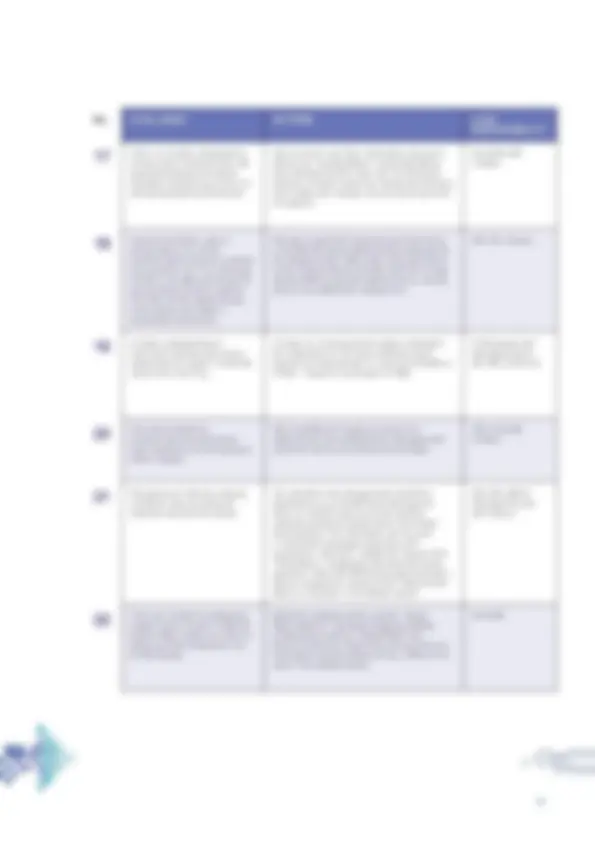

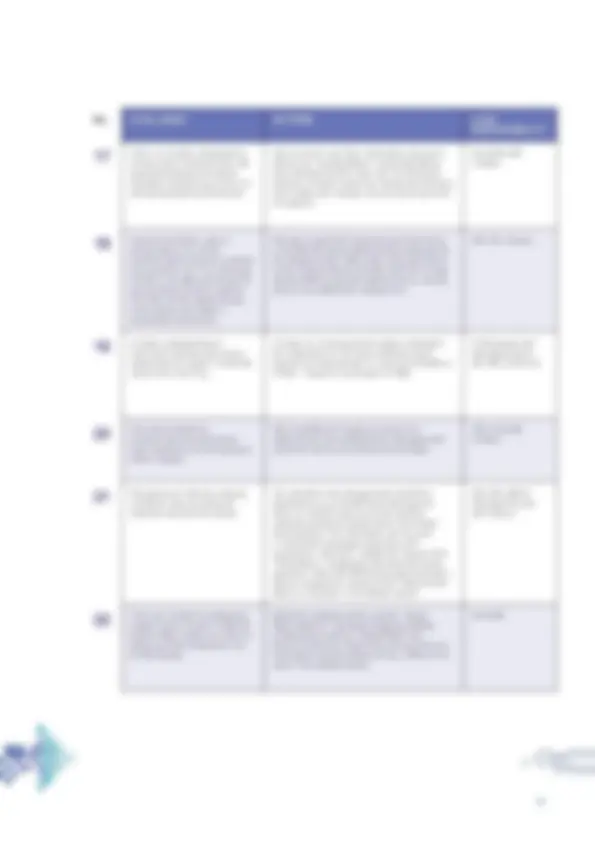

No. CHALLENGE ACTIONS LEAD RESPONSIBILITY 1 There are 10 separate employer advisory groups within the software sector, yet the sector does not have a single representative body to represent the views of the sector as a whole. A single organisation should be established that can represent fully the interests of the software sector in Northern Ireland. Consultation with the sector should take place to understand the purpose and full remit of this organisation and how it should be constituted. Industry, Invest NI 2 Undergraduate applications in Computer Scence have fallen between 17%- 43% and ‘A’ Level and GCSE Awards have also reduced by 13% and 30% respectively. If this decline continues it will reduce the number of young people available to work in this sector. A group of educators from along the education “supply chain” should be formed to examine all the barriers to teaching computer science in the school’s system. This group should have members representing the Initial Teacher Education establishments, school leadership and subject teachers, further education, higher education, CCEA, EA and policy makers from the Department of Education and the Department for the Economy. Representation from the software sector should also be part of this group. Industry, St Mary’s University College, Stranmillis College, school leadership, subject teachers, colleges, universities, CCEA, EA, DE, DfE 3 There is low availability of Computer Science and Software Systems Development ‘A’ Levels (27% of schools) and GCSEs (7% of schools) in the 193 Post-Primary Schools. This limits pupil choice, inclusive economic growth and is contrary to the Entitlement Framework policy. The industry will actively support the schools’ system in developing actions that will address the low availability of Computer Science and Software qualifications. This could include improving low teacher confidence in teaching computing through Professional Teacher Learning, supporting school leadership to increase the capability to teach these qualifications and assist in developing positive messaging for pupils and parents to encourage the demand of these subjects. Industry, EA, universities, FE Colleges, CCEA, DE, DfE 4 Small and Medium size companies are keen to have access to the Assured Skills programme. Software companies should work with the Department’s Assured Skills team to develop Assured Skills Academies on a collaborative basis. Consideration should also be given to extending the Academy model to a part-time, on-line delivery model. Industry, DfE Assured Skills 5 There may be an over- reliance by companies on the graduate entry route into the software sector. This is limiting the growth opportunities for the sector. Industry should engage more deeply with the Belfast Met IT Hub to explore opportunities for student placements for Foundation Degree students on software courses and to assess whether there may be job opportunities in companies at the NQF Level 5 competence. Industry, Belfast Met IT Curriculum Hub Policy Recommendations Table

No. CHALLENGE ACTIONS LEAD RESPONSIBILITY 6 Industry is keen to utilise Higher Level Apprenticeships but the current training delivery model does not suit the software sector. Industry, the Department for the Economy and Belfast Metropolitan College should explore the possibilities of changing the training delivery balance for the first year of the IT Apprenticeships from four days per week in on-the-job training and one day per week in off-the-job training to four days per week in off-the-job training and one day per week on-the-job training. Industry, DfE, Belfast Met 7 Apprenticeships and Higher-Level Apprenticeships are under- represented in the Software Sector compared with other engineering sectors. This is limiting the growth of the sector. Industry should engage with the Department and organisations such as Work Plus to understand the changes made to the apprenticeship system to reassess the value of the apprenticeship system to their businesses. Industry, DfE Apprenticeships, Work Plus. 8 There has been a major investment in funding for re-skilling and up- skilling through short term, on-line courses and this may create future job opportunities for individuals. Government, education and industry should establish a mechanism to monitor the destinations of those who have undertaken the short term, on- line courses to assess if the training has led to new employment outcomes for individuals. DfE, QUB, Ulster University, industry 9 There are seven different Sector Attractiveness programmes for the software sector in Northern Ireland. There is a risk of fragmentation and duplication of effort and inconsistency of messaging. A meeting of the delivery organisations is to be held to raise awareness of each other’s work and to explore the possibility of establishing a group of employers and delivery organisations to plan and deliver a new sector attractiveness programme. DfE, DE, Industry, Delivery organisations. 10 Government funds many of these sector attractiveness programmes either directly or indirectly. Evaluations are provided by each programme but there needs to be a comprehensive review of them all to ensure they are effective and are having an impact on numbers applying for software courses. There should be a small group of the government funders established to review all of the sector attractiveness activities under their direction. This review should examine the objectives of each programme, the target audiences for each programme, the consistency of messaging between each programme the outcomes and impact each is making on the number of young people entering the software sector by whichever career pathway. The need to rationalise government funded programmes should also be examined along with the possibility of consolidating funding into fewer programmes for greater impact. DfE, DE, Invest NI

No.. CHALLENGE ACTIONS LEAD RESPONSIBILITY 17 There is a limited understanding of future skills needs and this can delay development of suitable education and training curriculum and development and provision. Use of current “real-time” information sources to develop an “Iceberg Watch” report forecasting likely demand for skills over next 12-18 months. Develop a ‘horizon scanning’ mechanism for future skills needs with industry input on future technical innovations. Invest NI, DfE, industry 18 Careers information, advice and guidance is a critical communications channel to advise young people but it is a challenge to keep up to date and relevant to young people and their parents. This may limit the attractiveness of the sector and uptake in appropriate courses etc. Industry to assist with developing and delivering a new NI wide sector attractiveness campaign for the software sector. New portal being developed by the Careers Service to better serve the all-age careers offering. Specific testimonials on new job roles to be created with industry help. DfE, DE, industry 19 A better understanding of future skills demand and supply bottlenecks will assist in improved labour force planning. A model will be developed to better understand the relationship on the future workforce when availability of appropriate ‘A’ Levels and GCSEs is limited – impact on application to HEIs. IT Employers and Educators Forum, DE, DfE, CCEA, EA 20 Poor work shadowing opportunities and placements have reportedly put young people off the industry. DfE, Invest NI and industry to explore the establishment of a professionally managed work placement service for schools and colleges. DfE, Invest NI, industry 21 Perceptions of inflexible working conditions may be putting off potential recruits to the sector. The pandemic has changed work conditions dramatically (e.g. remote/home working) and there is a need to map out current working practices across the sector and to benchmark best practices. This information can be used in recruitment campaigns especially with prospective “returners”. Assess the impact of the “Press Return” programme delivered during the pandemic. Work with BRCD Employability & Skills Group to assess the impact of their Task & Finish Group on diversity in the software sector. DfE, DfC, BRCD Employability and Skills Group 22 There are limitations to attracting migrant labour to work in Northern Ireland. More needs to be done to attract qualified professions into the NI industry. Establish a software sector specific “Attract Back/ Attract In” campaign targeting software professionals working in Great Britain and Ireland. Explore the possibilities of recruitment of international remote workers for key “difficult to fill” roles in the software sector. Invest NI