Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

The study is primarily focused on the market structure, supply and demand, the mitigation of the level, and risk management strategies to.

Typology: Study notes

1 / 67

This page cannot be seen from the preview

Don't miss anything!

Centria University of Applied Sciences Date July 2021 Author Bikesh Maskey Degree programme Bachelor of Business Management Name of thesis SMART-MONEY CONCEPTS IN THE FOREX MARKET. A strategy for individual traders Centria supervisor Paula Tornikoski Pages 60 + 3 The foreign exchange market, Forex is the most liquid and the most popular market. The main goal of this study was to create a simple profitable trading strategy for new traders using smart money con- cepts in the Forex Exchange (Forex) market. The author has a strong passion for this market. The au- thor has tested and tried many different strategies and has found this smart concept strategy to be most useful and profitable. The thesis consists of an introduction, and the theoretical and empirical research parts. The thesis gives us the introduction to the forex market and terms used in forex trading, the movement behind the price in the market, the analysis, and the risk and capital management in the currency market. The empirical part consists of a trading strategy which was created combining various smart money con- cepts and strategies found on the internet along with the experience of the author trading forex. The complete strategy was kept and explained in a simple way along with the methods to implement it. With lots of different strategies online, the author found out this smart money concept strategy to be the most successful. The risk management in the strategy is developed in a way that the traders will be profitable even if their ratio of losing trade is bigger than their winning trade. The main points to con- sider using this strategy is to get a good knowledge of the market structure, supply and demand, and risk management and practice it a lot in a demo account before using it to trade with real money. Key words Break of structure, Forex Exchange Market (Forex), mitigation, smart money, supply and demand.

The foreign exchange (Forex market) is a multi-trillion-dollar market and is the largest financial mar- ket in the world and one of the most volatile. Banks, institutions, investment management firms, wealthy investors, and retail individuals mainly participate in the forex market for the process of buy- ing, selling, and exchanging currencies. The financial market is worth 1.93 quadrillion dollars with an average transaction of 6.6 trillion dollars every day in 2019. (James Chen, 2021). The U.S dollar is the most traded currency in the forex market while euros and Japanese yen come in the second and third place, respectively. It is found that about 70% - 80% of retail investors lose money in the currency market. (Forex Ninja, 2019). The main objective of the thesis is to understand the price action and movement in the forex market and to develop a profitable trading strategy for retail traders and investors mainly using smart money concepts. The thesis also comprises the technical patterns and analysis used by the retail trader for trading. The study consists of analysing the advanced price action and structures in the market and trading with a smart money footprint left by institutions and banks. The thesis also introduces the technical analysis used by the retail traders to help the new traders un- derstand the way the majority of retail traders trade in this market. The study is primarily focused on the market structure, supply and demand, the mitigation of the level, and risk management strategies to creating a profitable strategy used by institutions and banks. The strategy will be kept simple so that the new traders can understand it easily. The research on the thesis is based on materials available on the internet and the author's experience in the field of trading the forex market. More than 70% of re- tail traders lose money in the forex market. This topic has been chosen because of the author's strong interest in forex trading and to help new traders get information about smart money concepts along with the strategy required for the trader to become profitable.

2.2 Forex Terms Forex Terms or Forex terminology is the simple term used in the forex market. These terms must be well known and understood before starting to trade. Forex terms help new investors and traders to get ac- quainted with the forex market and help them to execute a trade in the currency market. Among several forex terms, some of the most common and important terms are explained below. 2.2.1 Currency Pairs More than 180 currencies are being used in 195 countries (Finance Magnet, 2019). Forex is traded with the change or performance of one currency in correspondence to another. It is usually traded in pairs and correlation to one another, for example GBP/USD. The base currency here is GBP while the quote cur- rency is USD. If GBP/USD is increasing in price of the exchange rates, then the pound is getting stronger against the dollar while a decrease in the exchange rates indicates the dollar is getting stronger against the pound. There are more than 55 currency pairs available to trade. Among them, EURUSD, USDJPY, GBPUSD, AUDUSD, NZDUSD, USDCAD, USDCHF are the major currencies pairs where more than 85% of the total forex market are held. (Ibeth Rivero, 2020). 2.2.2 Leverage Leverage in forex trading refers to the borrowing of money. Leverage happens in the trading account, and it allows a trader to execute a position of bigger lots with a very little balance. It allows a trader to open large position orders with the balance he has. Using high leverage is a very effective method to profit and trade in the currency market without the investment of a huge amount of capital and targeting to earn high profits in a short period. To open a position of a standard lot in the EUR/USD currency pair, a trader needs to have 120000$ in his account. But using 1:500 leverage he can open the position with just $240 and can control 120000$ worth of position with just 240$. But high leverage also means high risk. With 1:500 leverage, the trader could easily lose all their margin used to open the position if the market moved a little pip against them.

So, it is very important to keep the leverage below 1:100 while starting and then slowly increasing it with experience and time. 2.2.3 Bid/Ask price & Spread In the forex market, when one currency is bought at the same time the other one is being sold. Bid refers to the highest price the trader has to pay for an asset whereas ask price refers to the lowest price a trader will take for the same asset. The ask price is never lower than the bid price. Spread refers to the difference in the price between ask and bid. Brokers in the forex market earn by the commission charged to open a position or through the spread between the prices. (Elizabeth Belugina, 2021). When opening the position in the broker platform, every trade starts slightly with a negative pip. This is because of the spread. In forex, spread refers to the difference between ask price and bid price of the broker. Spread in the forex market is not constant and varies a lot with the broker. When entering the long position in the currency pair or buying the base currency in the pair, then the quote currency must be closed to sell it, which causes the price difference. This price difference is called the spread. Spread in the currency pairs depends on various factors like volatility, liquidity, and volume of the currency pairs. (Harion Camargo, 2021). FIGURE 1. Bid/Ask price (Darwinex).

(0.0001). (James Chen, 2021). Pips are used to calculate the movement in the forex market. For exam- ple, in EUR/USD chart, suppose the latest price is 1.2052. It means with 1 Euro we will be able to buy 1.2052 dollars. If the trader predicts the market accurately expecting euros to get stronger against the US dollar and buys the Euros for 1.2052 and get out of the position or exit the trade at 1.2080, then he/she will make a total profit of 28 pips. But if the euros weaken against the US dollar and the falls market fall to 1.2022 then he will lose a total of 30 pips. 2.2.7 Lot size The lot size is the currency unit, or the size of the order or position executed in the trade. In the stock market, the number of stocks bought is calculated in shares like 100 shares, but in the forex market, the contracts are bought in the lot. A standard lot in forex is 100,000 units of currency. Also, there is a mini lot which is 10,000 units of the currency, a micro lot which is 1,000, and a nano lot which is 100 units of the currency. (Finance Magnet, 2019). E.g., in a EUR/USD pair, opening a standard lot posi- tion in a dollar will mean the size of the trade is $100,000, where one pip is equal to 10$. Similarly, a 10 pips movement in the favour of a trader means a profit of 100$. 2.2.8 Bullish and Bearish trend In simple terms, a bullish trend refers to the rising of the price in the market while a bearish trend means falling of the price in the market. These trends are also called the bull and bear trend. This is because bulls often hit upward with their horns and bears try to hit with their paws downward. In a bullish trend, the market makes new highs. (Finance Magnet, 2019). A bullish trend is a candlestick chart often made by series of blue or green candles moving rapidly up- wards while a bearish trend in a candlestick chart is made by series of red or black candles moving downwards quickly.

2.2.9 Stop-loss and Take profit order Stop loss and take profit order, both refer to signalling the trader when the position of the trade should be closed. A stop-loss order refers to placing the order at a certain position for the risk a trader is will- ing to take, while take profit order means placing the order in a certain position for the profit the trader wants to make. (Axiory, 2020). Stop-loss or stop-loss order means protecting the trade executed from further loss by stopping it at a certain price. The order remains even if the trader is not using his trading device. It helps to protect the capital of the trader if the currency fluctuates, or the trade goes against the position executed by the trader. (Axiory, 2020). E.g., if a trader executes a long position at a certain price, then he put a stop- loss at a certain pip below the entry price so that the trade executed closes as soon as the market reaches that price. Similarly, if a trader executes a short position at a certain price, he put a stop-loss at a certain pip above the entry price so that the trade executed closes as soon as the market reaches the level of that price. Similarly, taking profit or take profit order is the opposite of stop-loss order. It means closing the al- ready executed position by taking some profit. Even a profitable trade can sometimes turn to loss. Take profit order helps to prevent the trader from committing such a loss by placing a pending order. (Axi- ory, 2020). By placing take profit order the trader will be able to take profit by closing the buy position a few pips above the entry price or taking profit by selling the close position a few pips below the entry price. 2.3 Forex vs Stock markets Forex and stocks are two of the most popular and the most traded markets. Forex is the buying and selling of currency pairs while stocks are the buying and selling of shares of the company. Forex mar- ket does not require a commission to execute an order and the commission is paid in a spread whereas a trader needs to pay a commission to execute an order in the stock market. (Becca Cattlin, 2020). Forex market operates 24 hours a day for five days a week. The trader can execute his order at any time in this market during these hours. The opening hour of the stock market is quite different and de-

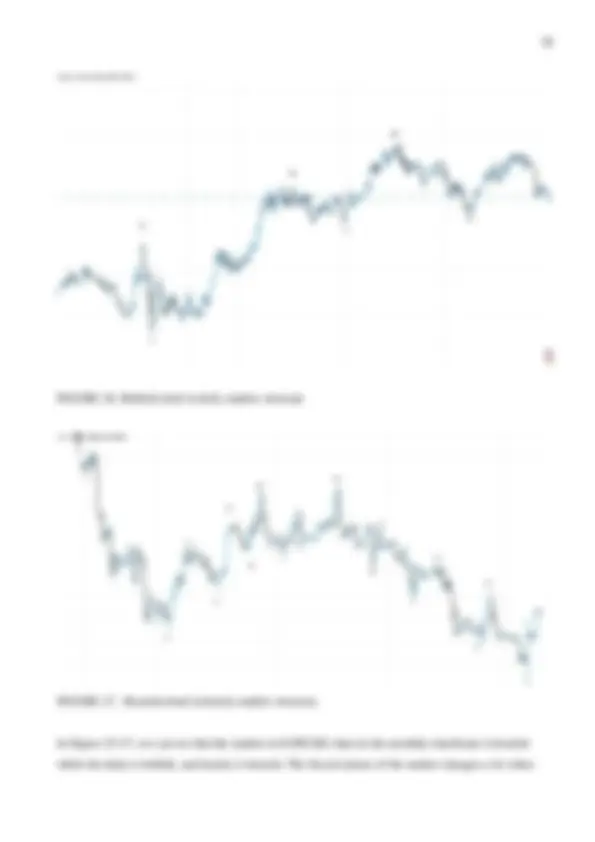

Technical analysis is the most common way of trading in the forex market. It is mostly used by indi- viduals like us who are also called retail traders and investors. The rise and fall of the price are indi- cated by patterns. These patterns are made by the movement of the price using trend lines or curves. (Adam Hayes, 2021). Reversal patterns are the technical analysis patterns signalling a change in direction of the trend while the continuous pattern is the trend continuing pattern signalling to continue in the direction of the ex- isting trend. These patterns are mostly used by retail traders to analyse the current price moments and predict the future market. (Adam Hayes, 2021). Below are some of the most common technical analy- sis and chart patterns traded by retail traders. 3.1 Support and resistance Support and Resistance are the most common technical analysis used by traders to enter a position in the forex market. Traders use support and resistance to identify the level in the chart where price could reverse or consolidates from. Support is formed where a bearish trend pauses due to the demand of the orders while resistance is formed when a bullish trend pauses because of the selling interest. (Casey Murphy, 2021). Support acts as a floor that does not let the price fall further down and resistance act as a ceiling that does not let the price rise further up. When the price reaches the zone of support or resistance, the price either breaches the level or bounces back from the level till the next support or resistance zones. (Ca- sey Murphy, 2021). Also, if a price breaks support, then that area of support is treated as resistance and if a price breaks a resistance, then that area of resistance is treated as support.

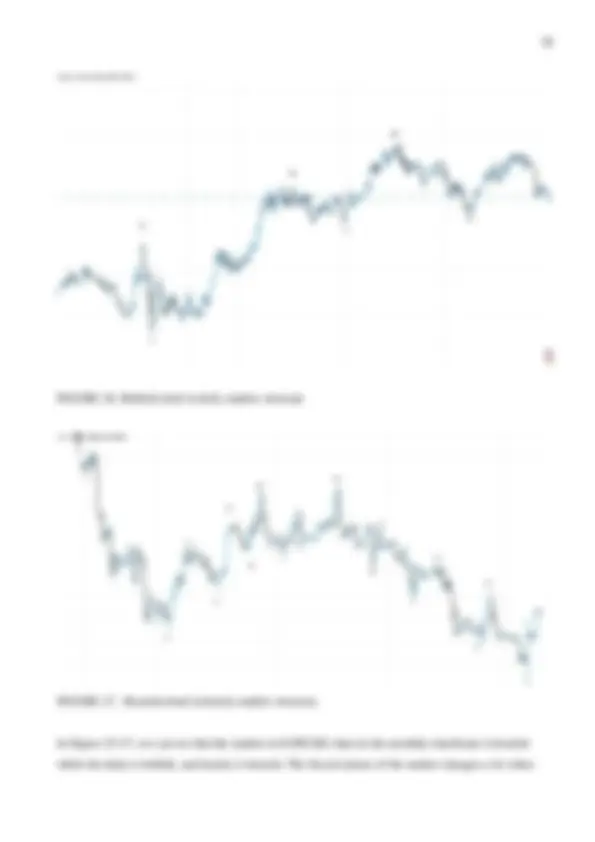

FIGURE 2. Support and Resistance Zone on EURUSD chart. In Figure 2, we can see support and resistance levels. The support zone can be seen as the level where price could not breach further, hence acting as a floor, and the resistance zone can be seen as the level where the price is not being able to breach further upwards hence acting as a ceiling. 3.2 Trend line Trend lines are the diagonal lines connecting the lows of the candlesticks in an uptrend and the high of the candlesticks in a downtrend. It is one diagonal form of support and resistance levels. It is drawn when the price moves in a zigzag direction but is continuing in one direction of the trend. When the market is in bullish momentum, levels of resistance form, and the trendline is drawn by connecting a series of low peaks moving in an upward direction, while in a downtrend, a trendline can be drawn by connecting a series of high peaks moving in a downward direction. Trend lines are believed to be stronger when the price fails to breach the level multiple times. (Casey Murphy, 2021).

FIGURE 4. Head and Shoulder pattern In Figure 4 , we can see head and should pattern forming with the small two peaks or shoulder on the two sides and a large peak in the middle. The trend reverses when the neckline is broken by the third shoulder reversing the trend to a downward direction. 3.4 Pennants Pennants are the price continuing trend chart pattern which is mainly formed when there is a large movement in price and then the consolidation. Pennants are drawn by two trendlines that in the end meet at a point. These trendlines must be moving in two opposite directions: one upwards and one downwards. When a pennant is formed, there will be a decrease in the volume of the price and then a sudden increase after the break of the pennant. (Adam Hayes, 2021).

FIGURE 5. Breakdown of the Bearish Pennant and downward continuation of price. In Figure 5, we can see that in the price trend price consolidates and forms pennant. This is the price continuing pattern and once, the price breakout of the pennant it continued to move in its existing di- rection of the trend. 3.5 Flags Flags are the trend continuing patterns that are usually made from the two parallel trendlines that can either be sloping up or down or moving sideways. The up-sloping flags can be considered as consoli- dation of price in a downtrend while down sloping flags can be considered as a consolidation of price in an uptrend. (Adam Hayes, 2021). When a flag is formed after a huge moment of price, then there can be seen a decrease in the volume of the price. Once the price breaks down of the flag the decreased volume will recover. (Adam Hayes, 2021).

FIGURE 7. Breakout of the falling wedge in downtrend and continuation of price. In Figure 7, we can see the falling wedge, which is similar to flag patterns, but with both trend lines moving towards the downward direction. When the falling wedge is formed, the price consolidates and there can be seen a decrease in the volume of the price. After the breakout of the wedge, the price con- tinues its bullish trend. 3.7 Triangles Triangles are the continuous and the most occurring price pattern in the candlesticks chart. These are also the most popular technical patterns. This chart patterns often signal trend continuation. Symmet- rical, Ascending, and Descending triangles are the triangle patterns widely popular among retail trad- ers. These triangular patterns usually occur in the middle of the trend and last up to several weeks or months. (Adam Hayes, 2021). The symmetrical triangle is the convergence of two opposite trendlines connecting in two opposite di- rections, which signals the breakout about to occur. While an ascending triangle is a trend continuing triangle occurring mostly in bullish trend having flat upper trend line and rising lower trend line sug- gesting the higher breakout of the price. And the descending triangle is the opposite of the ascending triangle, having a horizontal lower trendline and rising upper trendline suggesting a breakout of the

trend. (Adam Hayes, 2021). The size of the break of the patterns is usually similar to the height of the triangle as shown in the figure below. FIGURE 8. Break down of the ascending triangle In Figure 8, we can see the descending triangle breaking down and continuing its existing bearish trend. When the triangle forms and consolidates we can see the decrease in the volume of the price. The size of the breakdown of the triangle can be seen likely to be the size of the triangle which we can use as a profit taking area. 3.8 Double Top and Double Bottom Double top and Double Bottom are the most common reversal pattern used by retail traders. Double top indicates the reversal of price from bullish to bearish trend, while double bottom indicates the re- versal of price from the bearish to a bullish trend. Double tops often look like the letter M where the price first pushes to the resistance and then tries to push again to the resistance but fails in the second attempt which outcomes in the trend reversal. (Adam Hayes, 2021).