Problem Set 5

Econ 101

1. Suppose you have the following data for capital and investment in an economy:

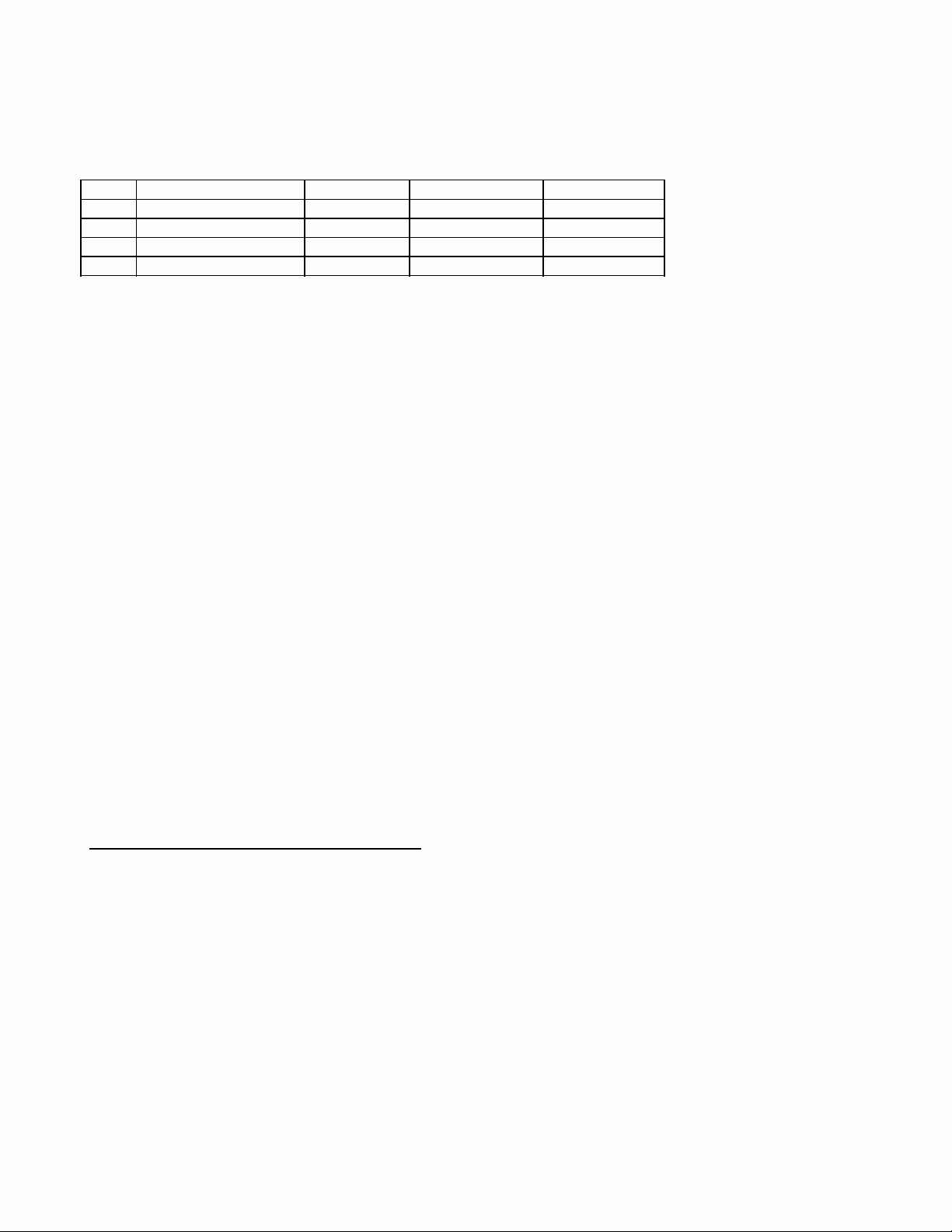

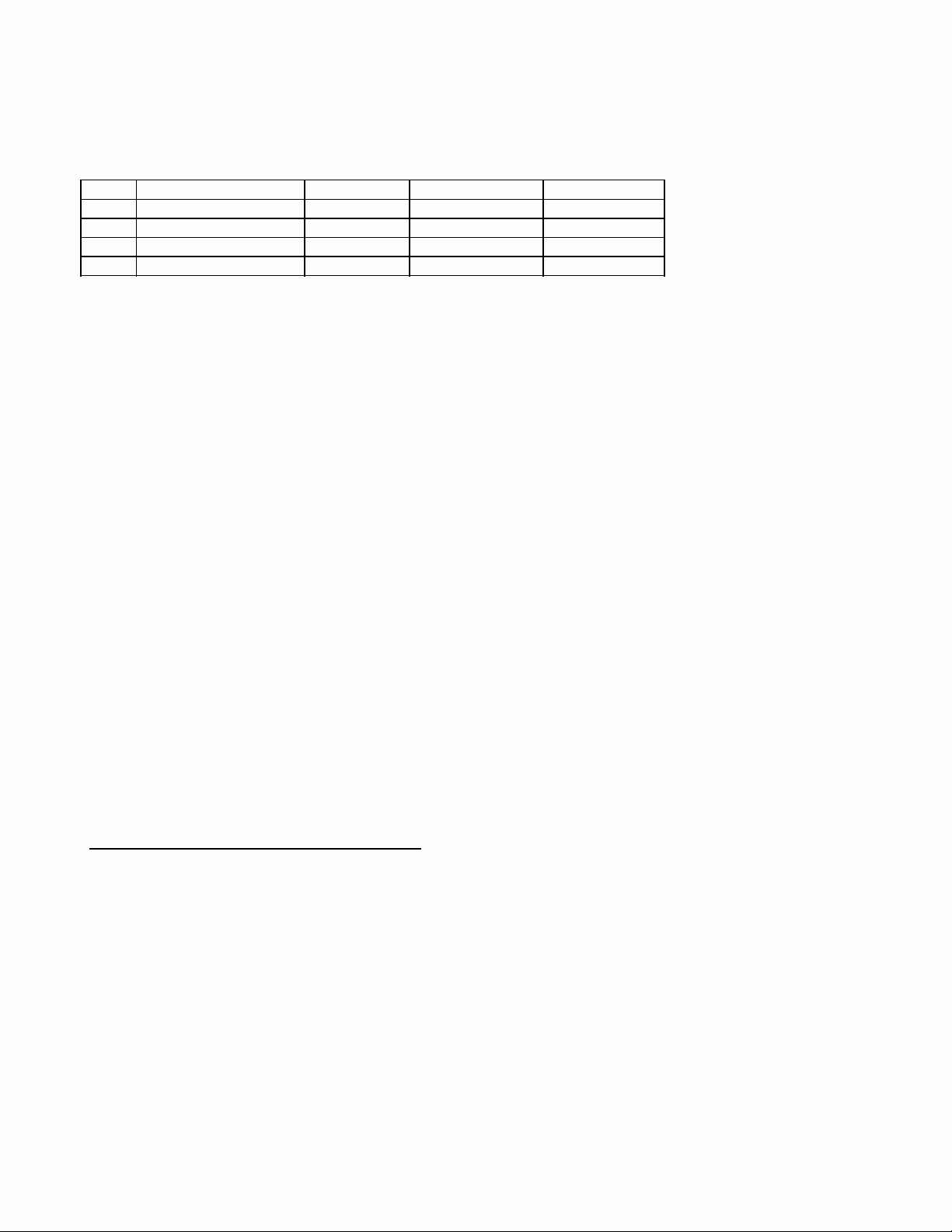

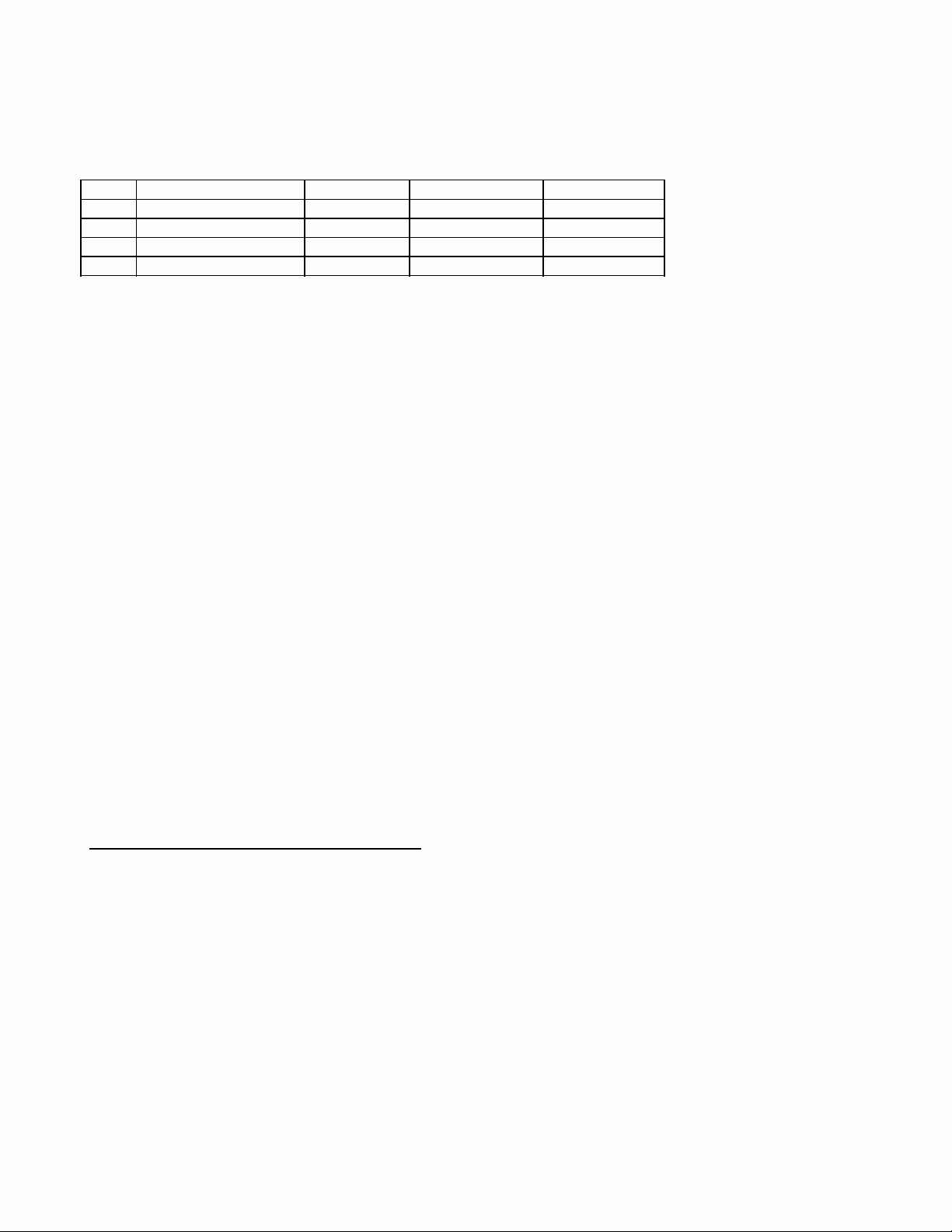

Year Capital Stock on Jan. 1 Depreciation Gross Investment Net Investment

1993 1000 200

1994 310

1995 120

1996 200

a. Assume that depreciation during any year is 10% of the January 1 level of the capital stock. Calculate the missing

values in the table.

b. Is net investment negative in any year? What does such a situation mean?

2. Suppose that the government wants to increase public infrastructure investment.

a. If government purchases increase, what happens to government’s share in total spending? Is there crowding out?

Why or why not?

b. Suppose instead that the government encourages private business to purchase the public infrastructure. Where will

it enter GDP? If government’s share in spending is fixed, what happens to the other shares when this

infrastructure is built?

3. Suppose that there is a leftward shift in the C/Y line due to higher consumption taxes, but at the same time, the

government increases its share in GDP to maintain the same interest rate. Describe graphically how this affects each of

the shares of GDP. If investment’s share is the only thing that affects growth in this system, what will happen to

growth as a result of this government policy?

4. Suppose C = 1,400, I = 400, G = 200, X = 0.

a. What is GDP? Calculate each component’s share of GDP.

b. Suppose government spending falls to 100 and GDP does not change. What is government spending’s share of

GDP now? What is the new nongovernment share?

c. What happens to C/Y, X/Y, and I/Y? (Do not calculate anything—just give a direction.) Explain the mechanism

by which each of these changes happens.

5. Draw two sets of diagrams like Figure 22.7 to depict two situations. In one set, draw investment and net exports being

very sensitive to interest rates—that is, the I/Y and X/Y curves are very flat. In the other set, draw investment and net

exports as insensitive to interest rates—that is, the I/Y and X/Y curves are nearly vertical. For the same increase in the

government’s share in GDP, in which set of diagrams will interest rates rise more? Why?

Practice Multiple Choice Questions (not for quiz):

1. The actual amount of purchases of new goods for use in production by businesses each year is referred to as

a. gross investment.

b. net investment.

c. private-sector expenditures.

d. nongovernment expenditures.

2. The term I does not include

a. depreciation.

b. net investment.

c. public infrastructure investment.

d. investments that improve the capital stock.