Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

The origin of the word bank is shrouded in mystery. According to one view point the Italian business house carrying on crude from of banking were called banchi bancheri" According to another viewpoint banking is derived from German word "Branck" which mean heap or mound. In England, the issue of paper money by the government was referred to as a raising a bank.

Typology: Summaries

1 / 63

This page cannot be seen from the preview

Don't miss anything!

Definition Of Bank: Banking Means "Accepting Deposits for the purpose of lending or Investment of deposits of money from the public, repayable on demand or otherwise and withdraw by cheque, draft or otherwise." -Banking Companies (Regulation) Act, ORIGIN OF THE WORD “BANK”: - The origin of the word bank is shrouded in mystery. According to one view point the Italian business house carrying on crude from of banking were called banchi bancheri" According to another viewpoint banking is derived from German word "Branck" which mean heap or mound. In England, the issue of paper money by the government was referred to as a raising a bank. ORIGIN OF BANKING: Its origin in the simplest form can be traced to the origin of authentic history. After recognizing the benefit of money as a medium of exchange, the importance of banking was developed as it provides the safer place to store the money. This safe place ultimately evolved in to financial institutions that accepts deposits and make loans i.e., modern commercial banks. Banking system in India Without a sound and effective banking system in India it cannot have a healthy economy. The banking system of India should not only be hassle free but it should be able to meet new challenges posed by the technology and any other external and internal factors. For the past three decades India's banking system has several outstanding achievements to its credit. The most striking is its extensive reach. It is no longer confined to only metropolitans or cosmopolitans in India. In fact, Indian banking system has reached even to the remote corners of the country. This is one of the main reasons of India's growth process.

Banking in India has its origin as early or Vedic period. It is believed that the transitions from many lending to banking must have occurred even before Manu, the great Hindu furriest, who has devoted a section of his work to deposit and advances and laid down rules relating to the rate of interest. During the mogul period, the indigenous banker played a very important role in lending money and financing foreign trade and commerce. During the days of the East India Company, it was the turn of agency house to carry on the banking business. The General Bank of India was the first joint stock bank to be established in the year 1786. The other which followed was the Bank of Hindustan and Bengal Bank. The Bank of Hindustan is reported to have continued till 1906. While other two failed in the meantime. In the first half of the 19th century the East India Company established their banks, The bank of Bengal in 1809, the Bank of Bombay in 1840 and the Bank of Bombay in1843. These three banks also known as the Presidency banks were the independent units and functioned well. These three banks were amalgamated in 1920 and new bank, the Imperial Bank of India was established on 27th January, 1921. With the passing of the State Bank of India Act in 1955 the undertaking of the Imperial Bank of India was taken over by the newly constituted SBI. The Reserve Bank of India (RBI) which is the Central bank was established in April, 1935 by passing Reserve bank of India act

Government took major steps in this Indian Banking Sector Reform after independence. In1955, it nationalized Imperial Bank of India with extensive banking facilities on a large scale especially in rural and semi-urban areas. It formed State Bank of India to act as the principal agent of RBI and to handle banking transactions of the Union and State Governments all over the country. Seven banks forming subsidiary of State Bank of India was nationalized in 1960 on 19th July,1969, major process of nationalization was carried out. It was the effort of the then Prime Minister of India, Mrs. Indira Gandhi. 14 major commercial banks in the country was nationalized. Second phase of nationalization Indian Banking Sector Reform was carried out in 1980 with seven more banks. This step brought 80% of the banking segment in India under Government ownership. The following are the steps taken by the Government of India to Regulate Banking Institutions in the Country: 1949: Enactment of Banking Regulation Act. 1955: Nationalization of State Bank of India. 1959: Nationalization of SBI subsidiaries. 1961: Insurance cover extended to deposits. 1969: Nationalization of 14 major banks. 1971: Creation of credit guarantee corporation. 1975: Creation of regional rural banks. 1980: Nationalization of seven banks with deposits over 200 crores. After the nationalization of banks, the branches of the public sector bank India rose to approximately 800% in deposits and advances took a huge jump by 11,000%. Banking in the sunshine of Government ownership gave the public implicit faith and immense confidence about the sustainability of these institutions.

This phase has introduced many more products and facilities in the banking sector in its reforms measure. In 1991, under the chairmanship of M Narasimham, a committee was set up by his name which worked for the liberalization of banking practices. The country is flooded with foreign banks and their ATM stations. Efforts are being put to give a satisfactory service to customers. Phone banking and net banking is introduced. The entire system became more convenient and swifter. Time is given more importance than money. The financial system of India has shown a great deal of resilience. It is sheltered from any crisis triggered by any external macroeconomics shock as other East Asian Countries suffered. This is all due to a flexible exchange rate regime, the foreign reserves are high, the capital account is not yet fully convertible, and banks and their customers have limited foreign exchange exposure.

In India the banks are being segregated in different groups. Each group has their own benefits and limitations in operating in India. Each has their own dedicated target market. Few of them only work in rural sector while others in both rural as well as urban. Many even are only catering in cities. Some are of Indian origin and some are foreign players. All these details and many more is discussed over here. The banks and its relation with the customers, their mode of operation, the names of banks under different groups and other such useful information’s are talked about. One more section has been taken note of is the upcoming foreign banks in India. The RBI has shown certain interest to involve more of foreign banks than the existing one recently. This step has paved a way for few more foreign banks to start business in India.

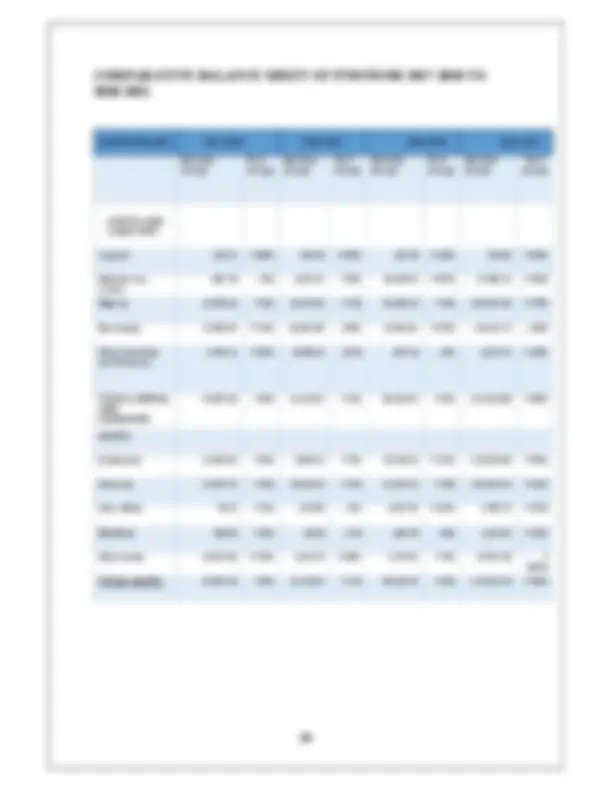

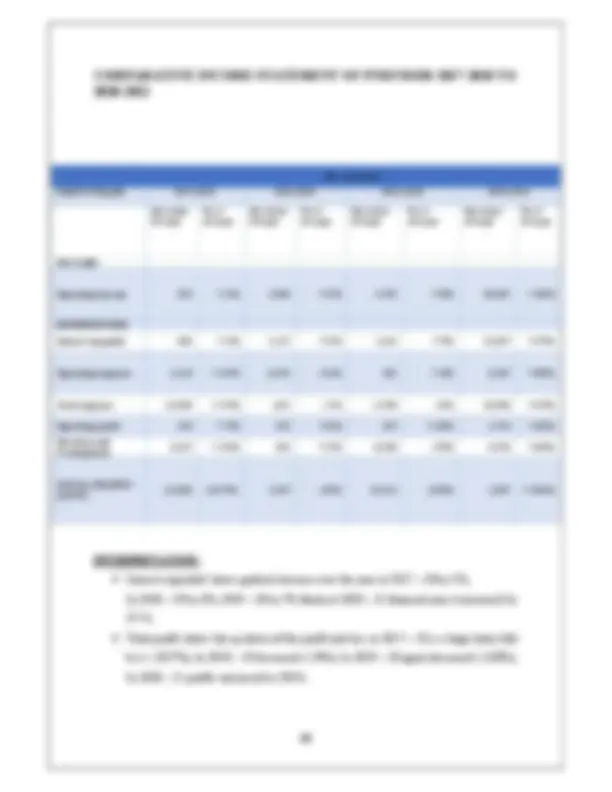

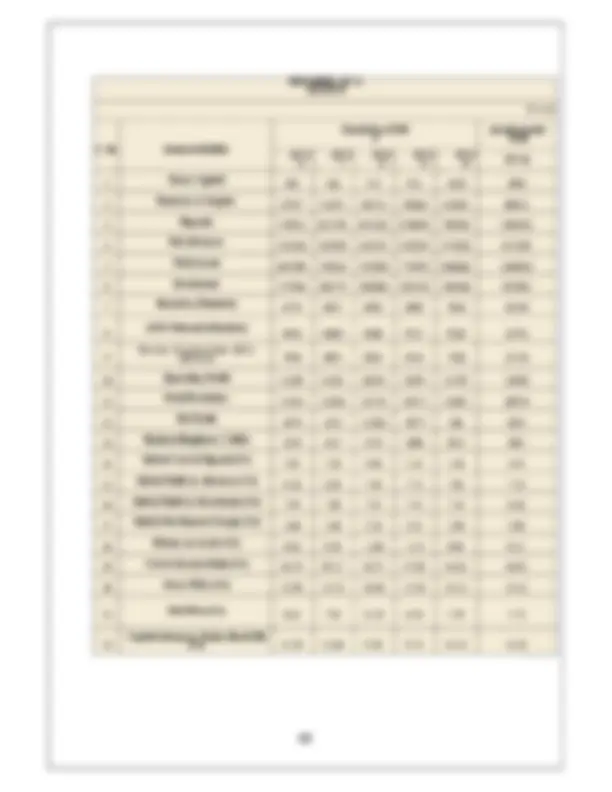

Public Sector Banks (PSBs) are a major type of government owned banks in India, where a majority stake (i.e., more than 50%) is held by the Ministry of Finance of the Government of India or State Ministry of Finance of various State Governments of India. The officers working for these entities and their subsidiaries are non-gazette officers. The employees subordinate to the officers working for these respective entities and their subsidiaries are also full-fledged government employees. The shares of these banks are listed on stock exchanges. Their main objective is social welfare. Nationalized Banks (Government Shareholding %, as of 30 June 2021)

Private Sector Banks are those banks in which the majority of the stake is held by shareholders of the bank and not by the government. RBL bank, HDFC Bank, ICICI Bank, Yes Bank, etc. are the private sector banks in India. They provide all the banking products and services to the customers. Private banks are managed and controlled by private promoters. There are 2 different categories in which these private banks have been divided: Pre-liberalization Post-liberalization

Pre-liberalisation There is total 12 banks which exist from the period before liberalisation in India that took place in 1990. These banks include Federal Bank, Karnataka Bank, Karur Vysya Bank, RBL Bank, etc. Post-liberalisation There is total 9 banks which got licenses and came into being after liberalisation in India that took place in 1990. These banks are called new age banks and include HDFC Bank, ICICI Bank, Axis Bank, Yes Bank, etc. Private Sector Banks offer innovative products and better services as compared to public sector banks but they charge some extra amount for providing such additional services. It has been seen that the financial performance of private banks has remained better than that of public banks as they have managed their net interest margin (NIM) and non-performing assets (NPA) very well. Below are private sector banks in India. All banks have their branches in different states of India. Currently around 22 private sector banks in India. There is total 93 commercial banks in India.

Au Small Finance Bank Axis Bank Bandhan Bank Capital Small Finance Bank Catholic Syrian Bank City Union Bank Dcb Bank Dhanalakshmi Bank Equitas Small Finance Bank Esaf Small Finance Bank Federal Bank Finacle Small Finance Bank Ltd HDFC Bank ICICI Bank IDFC Bank IndusInd Bank Jammu And Kashmir Bank Karnataka Bank Karur Vysya Bank Kotak Mahindra Bank Laxmi Vilas Bank North East Small Finance Bank South Indian Bank Sarvodaya Small Finance Bank Tamilnad Mercantile Bank

Andhra Pragathi Grameena Bank Andhra Pradesh Grameena Vikas Bank Arunachal Pradesh Rural Bank Aryavart Bank Assam Gramin Vikash Bank Bangiya Gramin Vikas Bank Baroda Gujarat Gramin Bank Baroda Rajasthan Kshetriya Gramin Bank Baroda UP Bank Chaitanya Godavari Grameena Bank Chhattisgarh Rajya Gramin Bank Dakshin Bihar Gramin Bank Ellaquai Dehati Bank Himachal Pradesh Gramin Bank J&K Grameen Bank Jharkhand Rajya Gramin Bank Karnataka Gramin Bank Karnataka Vikas Grameena Bank Kerala Gramin Bank Madhya Pradesh Gramin Bank Madhyanchal Gramin Bank Maharashtra Gramin Bank Manipur Rural Bank Meghalaya Rural Bank Mizoram Rural Bank Nagaland Rural Bank Odisha Gramya Bank Paschim Banga Gramin Bank Prathama UP Gramin Bank Puduvai Bharathiar Grama Bank Punjab Gramin Bank Rajasthan Marudhara Gramin Bank Saptagiri Grameena Bank Sarva Haryana Gramin Bank Saurashtra Gramin Bank Tamil Nadu Grama Bank Telangana Grameena Bank

Rural banking in India started since the establishment of banking sector in India. Rural Banks in those days mainly focussed upon the agro sector. Regional rural banks in India penetrated every corner of the country and extended a helping hand in the growth process of the country. SBI has 30 Regional Rural Banks in India known as RRBs. The rural banks of SBI is spread in 13 states extending from Kashmir to Karnataka and Himachal Pradesh to North East. The total number of SBIs Regional Rural Banks in India branches is 2349 (16%). Till date in rural banking in India, there are 14,475 rural banks in the country of which 2126 (91%) are located in remote rural areas. Apart from SBI, there are other few banks which functions for the development of the rural areas in India. Few of them are as follows. Presently there are 43 Regional Rural Banks in India Since 1 April 2020

The first Bank in Northern India to get ISO 9002 certification for their selected branches. Punjab and Sind Bank The first Indian Bank to have been started solely with Indian capital. Punjab Bank National The first among the Private Sector Banks in Kerala to become Scheduled Bank in 1946 under the RBI act. South Indian Bank India’s oldest, largest and the most successful commercial bank offering the widest possible range of domestic, international and NRI products and services, through its vast network in India and overseas. State Bank of India India’s second largest Private Sector Bank and is now the largest scheduled commercial bank in India. The Federal Bank Limited Bank which shareholders. started as Private Shareholders Banks, mostlyEuropean Imperial IndiaBank The first Indian Bank to open a branch outside India in London in 1946 and the first to open a branch in continental Europe at Paris in 1974 Bank of India, founded in 1906 in Mumbai. The oldest Public Sector Bank in India having branches all over India and serving the customers for the last 132 years. Allahabad Bank The first Indian Commercial Bank which was wholly owned and managed by Indians. Central India Bank The first Bank in India to be given an ISO certification. Canara bank

Literature survey is generally conducted to review the present status of a particular research topic. It helps the researcher to know the quantum of work already done on the particular topic and the area not yet touched. Relevant literature is accessed through research reports, articles, books, journals, magazines and other relevant materials. Some studies related to the evaluation of financial performance are discussed below. Kumbirai and Webb (2010) investigated the performance of South Africa’s commercial banking sector for the period 2005- 2009. Financial ratios were employed to examine the profitability, liquidity and credit quality performance of five South African based commercial banks. The study concluded that overall bank performance increased considerably in the first two years and a significant change in trend was noticed at the onset of the global financial crisis in 2007, reaching its peak during 2008-2009. This resulted in falling profitability, low liquidity and deteriorating credit quality in the South African Banking sector. Kumar, B.S. (2008), evaluated the financial performance of Indian private sector banks. The study revealed that Private sector banks play an important role in the development of Indian economy. The economic reforms totally have changed the banking sector. RBI permitted new banks to be started in the private sector as per the recommendation of Narasimhan committee. The Indian banking industry was dominated by public sector banks, but now the situation has changed. New generation banks with better technology and professional management have gained a reasonable position in the banking industry. Koeva, P. (2003), examined the performance of Indian Banks. The analysis focused on evaluating the behavior and determinants of bank intermediation costs and profitability during the liberalization period. The results of the study suggested that ownership pattern had a significant effect on performance indicators and the observed increase in competition during financial liberalization which has been associated with lower intermediation costs and profitability of the Indian banks.

Almazari (2011) in his study analyzed the financial performance of seven Jordanian commercial banks for the period 2005-2009. Simple regression was used to estimate the impact of independent variable i.e. the bank size, asset management, and operational efficiency on dependent variable represented by return on assets and interest income size. The study concluded that banks with higher total deposits, credits, assets, and shareholders’ equity did not always have better profitability performance. It was also found that there exists a positive correlation between financial performance and asset size, asset utilization and operational efficiency. Regression analysis also confirmed that financial performance is greatly influenced by these independent factors. Abdulrahman and Al-Sabaawee (2011) in their study tried to assess the performance of Islamic banks through the use of complex financial analysis based on the use of two tools using financial ratios and analysis of change and the general trend on the basis of the base year. The study was conducted to judge the performance of these banks and the efficiency of management in utilizing financial resources optimally and to achieve economic and social objectives. The study sample consisted of Iraqi Islamic Bank and Jordan Islamic Bank for the period 2000-

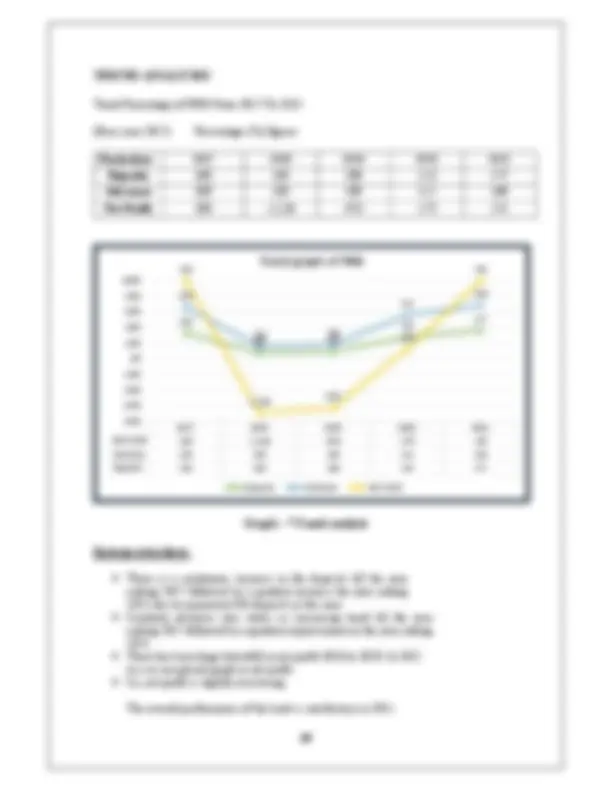

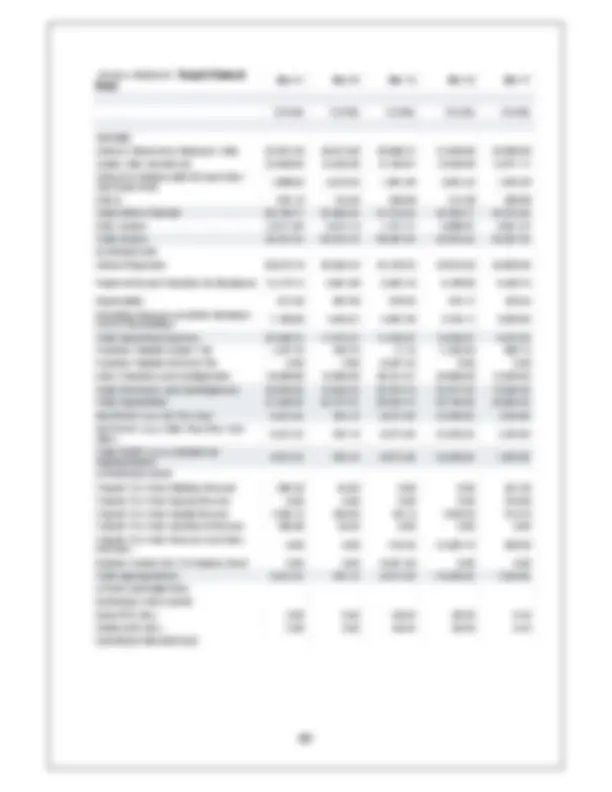

This study is undertaken to measure the financial performance of Punjab National Bank. The study will provide details about the growth of deposits and advances, profitability analysis of PNB. It is hoped that the result of this study will propose policy measures for the better performance of this bank in order to achieve the financial goals along with customer satisfaction.

The hypotheses of the study are as follows: H01: there is no significant impact of total deposit on net profit of Punjab National Bank. H02: there is no significant impact of total advances on net profit of Punjab National Bank.

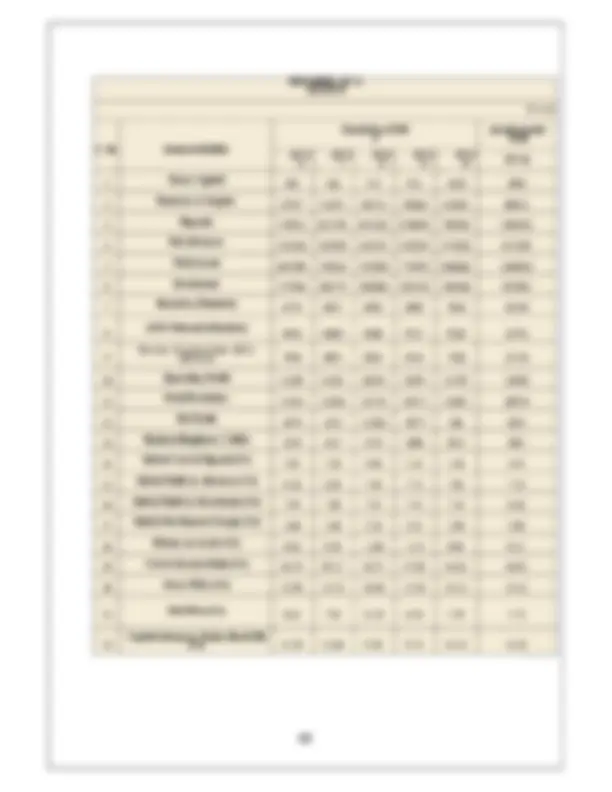

The data used for the present study has been taken from published annual reports of Punjab National Bank. Other relevant data sources are journals, newspapers, magazines and internet sources.

It is first hand data, which is collected by researcher itself. Primary data is collected by various approaches so as to get a precise, accurate, realistic and relevant data. The main tool in gathering primary data was investigation and observation. It was achieved by a direct approach and observation from the officials of the company.

It is the data which is already collected by someone else. Researcher has to analyze the data and interprets the results. It has always been important for the completion of any report. It provides reliable, suitable, adequate and specific knowledge.

Although some studies have been conducted on financial performance analysis of banks, performance comparison between government and private banks and other financial institutions but analysis in the case of Punjab National Bank still remains unexplored. The researchers try to fill this lack of evidence by extending the issue to the specific context of the bank. Therefore, the main purpose of this study is to evaluate the financial performance of Punjab National Bank by observing different variables, ratios and measures, the impact of deposits and advances on the profitability of PNB’s past five years performance results in order to improve its banking business.

The main purpose of this study is to examine the financial performance of Punjab National Bank for investment and finance and to improve the bank’s operations and technology. Since the study revolves around one of the popular issues of current business scenario, the following are the expected significances.

The study suffers from certain limitations and some of these are mentioned below so that finding of the study can be understood in a proper perspective. The limitations of the study are as follows:

Punjab National Bank (PNB), India’s first Swadeshi Bank, commenced its operations on April 12, 1895 from Lahore, with an authorized capital of? 2 lac and working capital of? 20,000. The Bank was established by the spirit of nationalism and was the first bank purely managed by Indians with Indian Capital. During the long history of the Bank, 9 banks have been merged/ amalgamated with PNB. Post amalgamation of eOBC & eUNI w.e.f 01.04.2020, PNB has expanded its presence across India. As at the end of September’ 2021, Bank has total 36,514 delivery channels with a network of 10,528 domestic branches, 2 International branches, 13,506 ATMs & 12, Business Correspondents. PNB is the second largest Public Sector Bank (PSB) in the country with Global Gross Business at Rs. 18,51,097 crore. The Bank continues to maintain its forte in low-cost CASA deposits with a share of 45.42%. Bank’s focus has been on qualitative business growth, recovery and arresting fresh slippages.

Heritage: Saga of Excellence in Banking Fired by the spirit of nationalism and founded on the idea that Indians should have a national bank of their own, Punjab National Bank Ltd was the result of the efforts of far-sighted visionaries and patriots, among whom were persons like Lala Lajpat Rai, Mr. E C Jessawala, Babu Kali Prasono Roy, Lala Harkishan Lal and Sardar Dyal Singh Majithia. Incorporated under the Act VI of 1882, Indian Companies Act, the Bank commenced operations on April 12, 1895 from Lahore, with an authorised total capital of Rs 2 lac and working capital of Rs 20,000. Prophetically, the Bank chose "Stability" as its telegraphic address, as the future course of events were to prove - the Bank withstood various financial crises including the trauma in the form of partition of India when the Bank had to close 92 offices (33%) in west Pakistan which constituted 40% of its deposits and 15 of its staff fell victims to the frenzy. The registered office was shifted to Delhi and the Bank honoured all the deposit claims of the refugees even on the basis of whatever little evidence they could produce. Subsequently, the Bank registered impressive performance and grew from strength to strength.