Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

This lecture is from Finance. Key important points are: Options, Option Basics, Call Options, Put Options, Option Pricing, Options Markets, Basic Nature of Options, Long and Short Positions, Factors Affecting Option Values, Put Call Parity

Typology: Slides

1 / 85

This page cannot be seen from the preview

Don't miss anything!

Options

Options

Call Options

buy the underlying asset at the strike price

prior to the expiry of the option.

for the price of the underlying asset (they

will profit if the underlying stock price rises

prior to expiry of the option.)

Options

Call Options

Call Option Defined

Exercise Price or Strike Price

Exercise

Expiration Date

Payoff

Call Holder’s Option Basics

underlying asset.

Out-of-the-Money

‘intrinsic value’ of the call option is $0.00.

In-the-Money

intrinsic value of the call option climbs above $0.00.

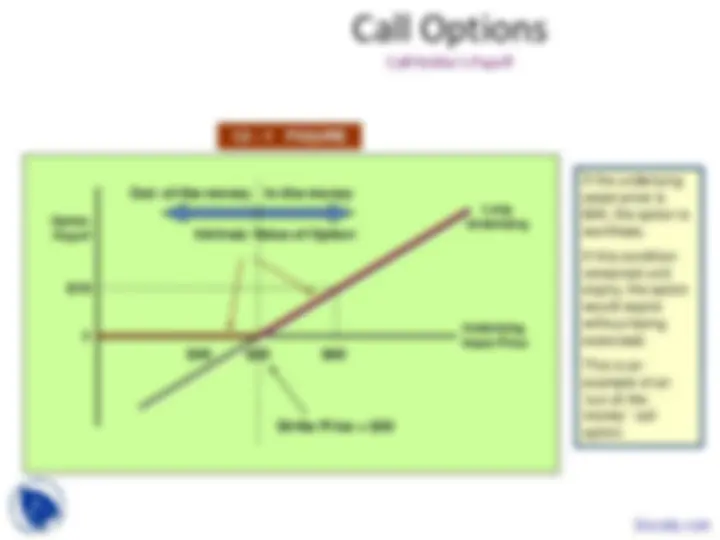

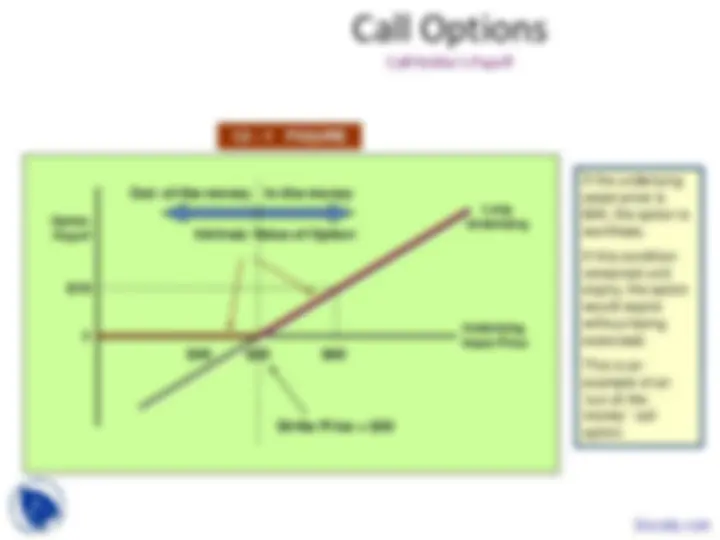

Call Options

$

Option Payoff

0 UnderlyingAsset Price

Long Underlying Intrinsic Value of Option

Out- of-the-money In-the-money

Strike Price = $

If the underyling Asset Price was $60, then the intrinsic value would be $10. ($60 – strike price). This would be an in-the-money call option at the $60 $60 price.

$

$

If the underlying asset price is $40, the option is worthless. If this condition remained until expiry, the option would expire without being exercised. This is an example of an ‘out-of-the- money’ call option.

underlying asset and hopes to profit from that.

the option.

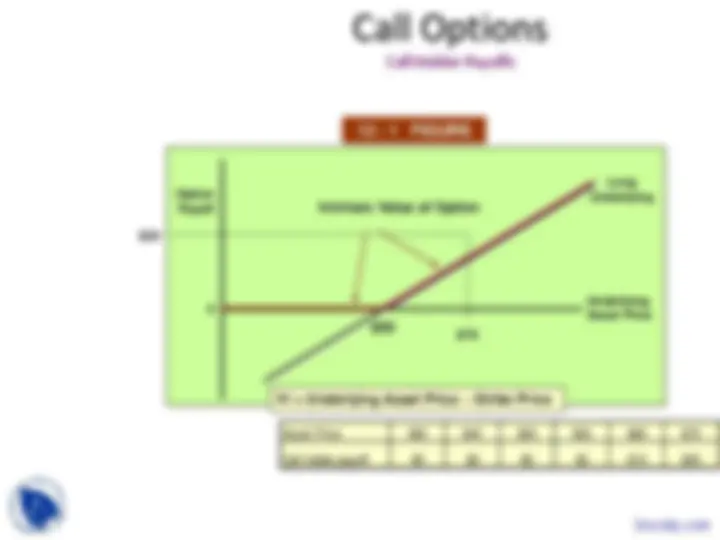

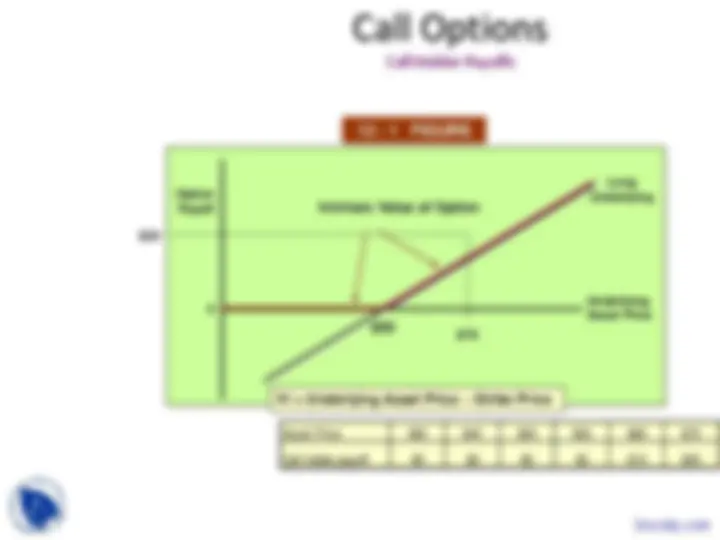

Call Options

$

Short Option Payoff

0 UnderlyingAsset Price

Call Option Values

[12-2] Option^ premium =IV +^ TV

Call Options

(See Figure 12 – 3 that illustrates the Call Option Premium)

[12-3] TV =Option Premium+ IV