Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

An overview of a binary choice model used in economics to predict individual behavior in decision-making scenarios. The model is based on utility maximization and revealed preference assumptions. An application of the model to commuters' choices between different modes of transportation and an econometric analysis using regression-like methods.

Typology: Slides

1 / 89

This page cannot be seen from the preview

Don't miss anything!

15. Nonlinear Effects Models (1) and

Models for Binary Choice

Agenda and References

Behavioral Assumptions

Random Utility Functions

U it = α + β’x it + γ’z i + u

i

x it = Attributes of choice presented to person

β = Taste or preference weights

z i = Characteristics of the person

γ = Weights on person specific characteristics

εit = Unobserved random component of utility

Mean: E[εit] = 0, Var[εit] = 1

attributes change

Application

A Regression - Like Model

INDEX

.

.

.

.

.

-3.0 -1.8 -.6 .6 1.8 3.

Pr[Fly]

Econometrics

i

i

i

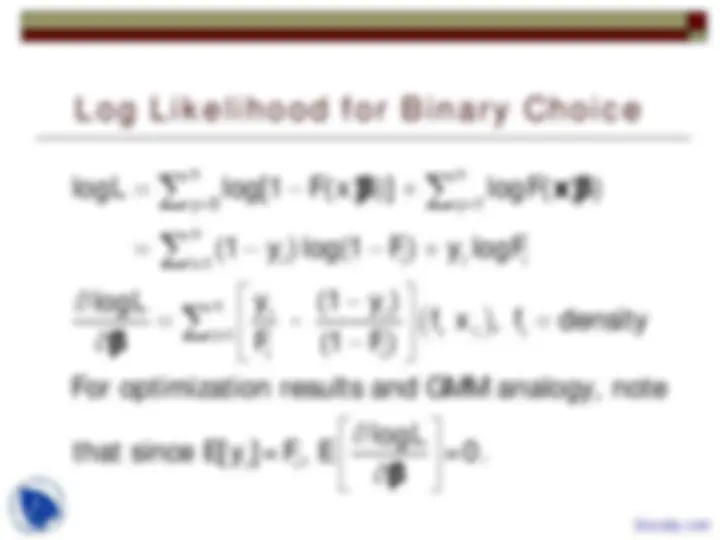

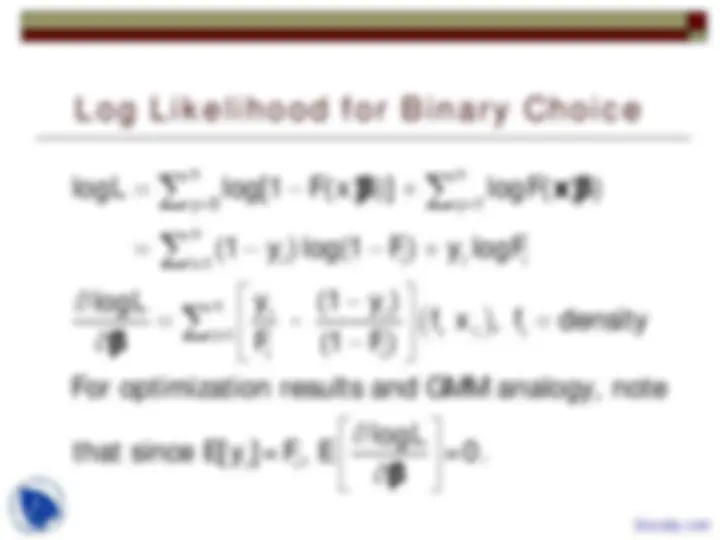

0 1

Prob[ 0] Prob[ 1]

y y

L y y

= =

= = =

∏ ∏

= =

=

=

n n

i i

y 0 y 1

n

i i i i

i 1

n

i i

i i

i 1

i i

i i

i

Special Case: Probit

i

i

n

i i i

i=

n

i

i i i

i=

i

F ( ) standard normal CDF

f ( ) standard normal density

Symmetric density implies 1-F(t) = F(-t)

logL= log (q ), q 2y 1

logL

q , and evaluated at t q

For

= φ =

∂ φ

= φ Φ =

i

i

i

i i

x β

x β

x β

x x β

β

i i i

2 2

2

n

i i i i

i i i

i=

i i i i

2

the Hessian, use (repeatedly), t , so

logL

t. Note, t <0 t

This is the actual Hessian. The expectation is

logL

φ = − φ

φ φ φ φ ∂

i i

x x

β β

β β

2

n

i

i=

i i

φ

i i

x x

Special Case: Logit

′

= = Λ

′

′ Λ

= Λ − Λ

∂

′ = − Λ Λ

∂

∑

i i

n

i

i=

i i i

i i i i

exp( )

For the logit model, F

1 exp( )

This is also symmetric.

logL= log (q )

Derivatives have a special form: f (1 ) so

logL

q (1 ) , with evaluated at q.

The Hessian i

i

i

i

i i

x β

x β

x β

x x β

β

∂

′ = −Λ − Λ

′ ∂ ∂

2

i i

i

s even simpler;

logL

(1 )

This is not a function of y , so this is the expectation.

i

x x

β β

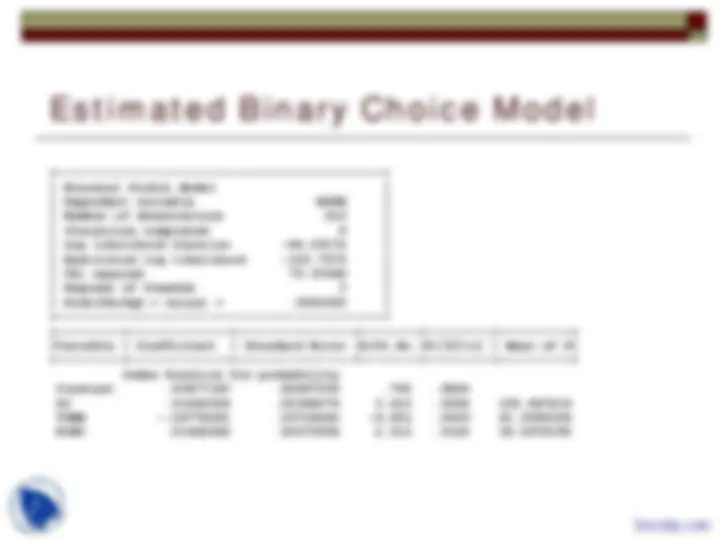

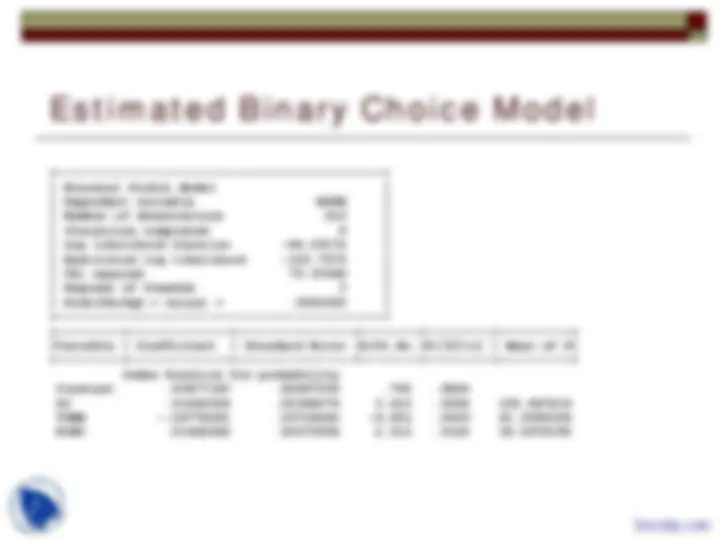

Estimated Binary Choice Model

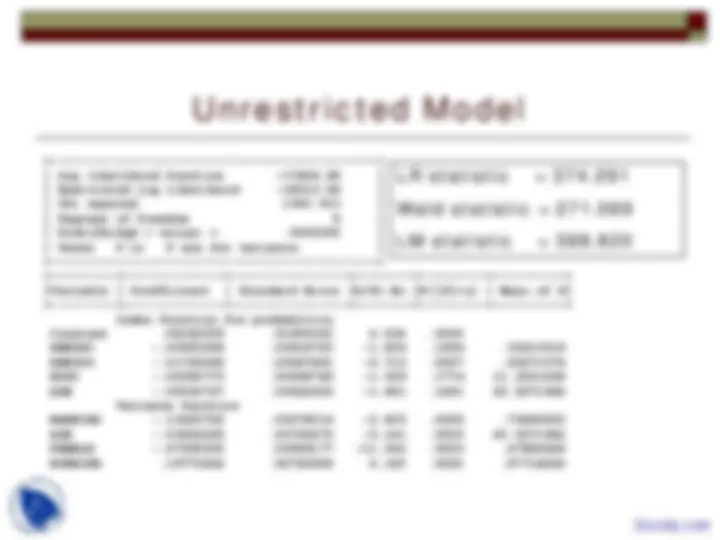

+---------------------------------------------+

| Binomial Probit Model |

| Dependent variable MODE |

| Number of observations 210 |

| Iterations completed 6 |

| Log likelihood function -84.09172 |

| Restricted log likelihood -123.7570 |

| Chi squared 79.33066 |

| Degrees of freedom 3 |

| Prob[ChiSqd > value] = .0000000 |

+---------------------------------------------+

+---------+--------------+----------------+--------+---------+----------+

|Variable | Coefficient | Standard Error |b/St.Er.|P[|Z|>z] | Mean of X|

+---------+--------------+----------------+--------+---------+----------+

Index function for probability

Constant .43877183 .62467004 .702.

GC .01256304 .00368079 3.413 .0006 102.

TTME -.04778261 .00718440 -6.651 .0000 61.

HINC .01442242 .00573994 2.513 .0120 34.

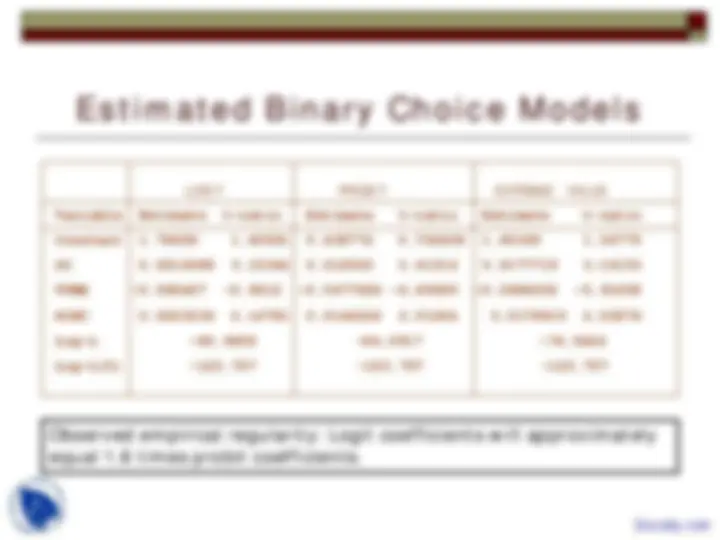

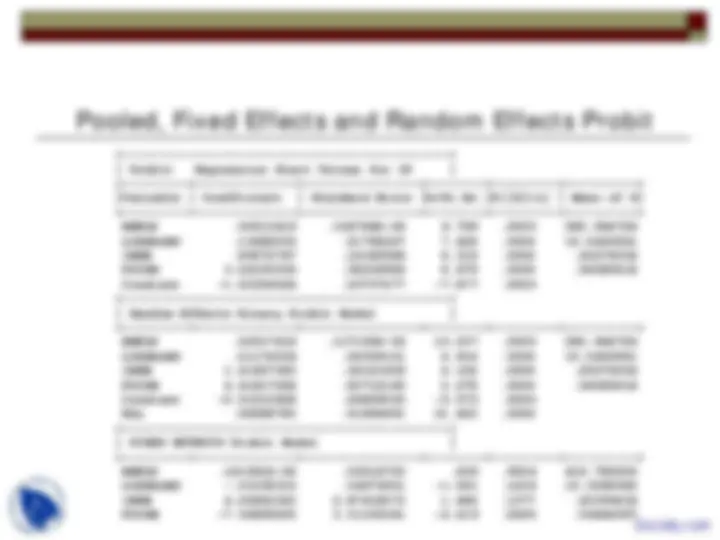

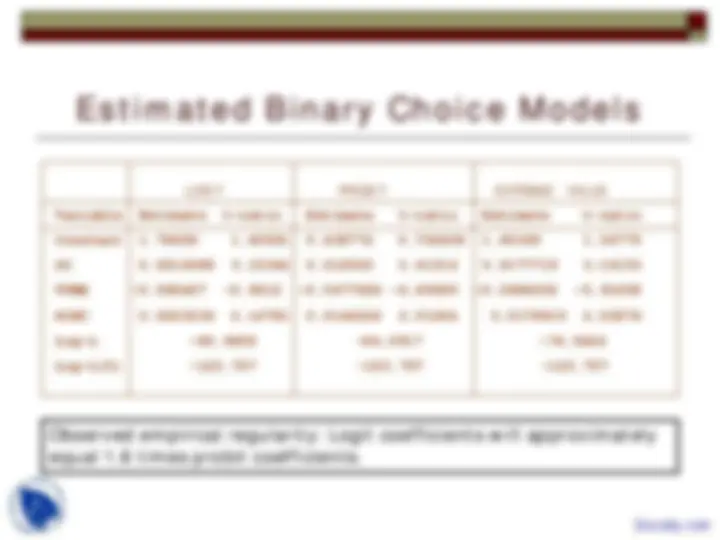

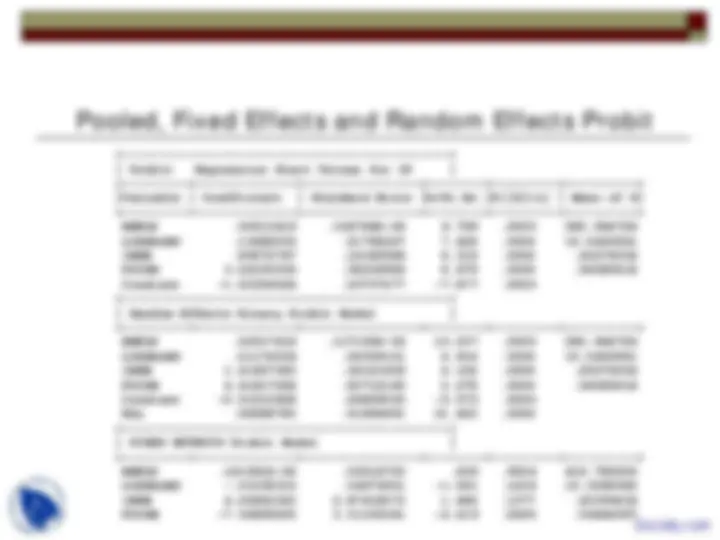

Estimated Binary Choice Models

LOGIT PROBIT EXTREME VALUE

Variable Estimate t-ratio Estimate t-ratio Estimate t-ratio

Constant 1.78458 1.40591 0.438772 0.702406 1.45189 1.

GC 0.0214688 3.15342 0.012563 3.41314 0.0177719 3.

TTME -0.098467 -5.9612 -0.0477826 -6.65089 -0.0868632 -5.

HINC 0.0223234 2.16781 0.0144224 2.51264 0.0176815 2.

Log-L -80.9658 -84.0917 -76.

Log-L(0) -123.757 -123.757 -123.

Observed empirical regularity: Logit coefficients will approximately

equal 1.6 times probit coefficients.