Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

This lecture is from Finance. Key important points are: Mutual Funds, Segregated Fund, Hedge Funds, Pension Fund, Wealth Management, Clone Fund, Load Fund, No Load Fund, Open End Mutual Fund, Closed End Mutual Fund

Typology: Slides

1 / 48

This page cannot be seen from the preview

Don't miss anything!

Soft dollars – a service seller uses gains from an overpriced service to give the service buyer’s investment dealer a free or underpriced service.

Here, for example, the investment fund manager (who is also an investment dealer) uses mutual fund revenue to purchase advisory, data, or other services in return for the seller’s commitment of the services to divert a certain volume of brokerage transactions to the investment fund manager.

Mutual Fund

Mutual Fund

About The Mutual Fund

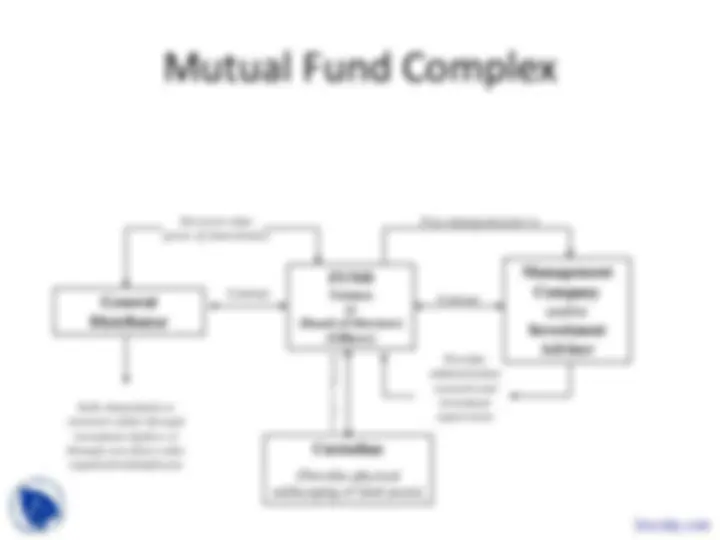

The Mutual Fund Complex