Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

1/2/3-1. Introduction to Econometrics. Third Edition. James H. Stock. Mark W. Watson. The statistical analysis of economic (and related) data ...

Typology: Exams

1 / 64

This page cannot be seen from the preview

Don't miss anything!

The statistical analysis of economic (and related) data

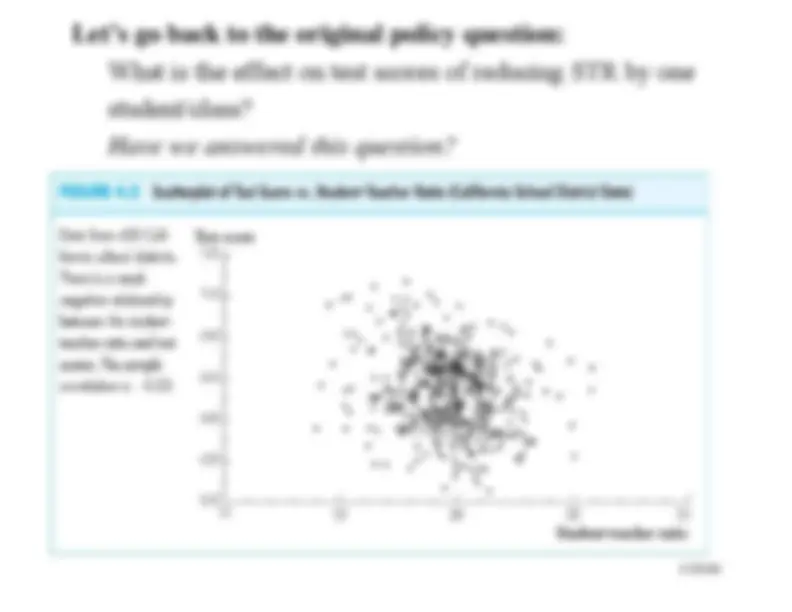

This course is about using data to measure causal effects. ^ Ideally, we would like an experiment

o^ What would be an experiment to estimate the effect ofclass size on standardized test scores?

^ But almost always we only have observational(nonexperimental) data.

o^ returns to education o^ cigarette prices o^ monetary policy

^ Most of the course deals with difficulties arising from usingobservational to estimate causal effects

o^ confounding effects (omitted factors) o^ simultaneous causality o^ “correlation does not imply causation”

In this course you will:

Learn methods for estimating causal effects usingobservational data ^ Learn some tools that can be used for other purposes; forexample, forecasting using time series data; ^ Focus on applications – theory is used only as needed tounderstand the whys of the methods; ^ Learn to evaluate the regression analysis of others – thismeans you will be able to read/understand empiricaleconomics papers in other econ courses; ^ Get some hands-on experience with regression analysis inyour problem sets.

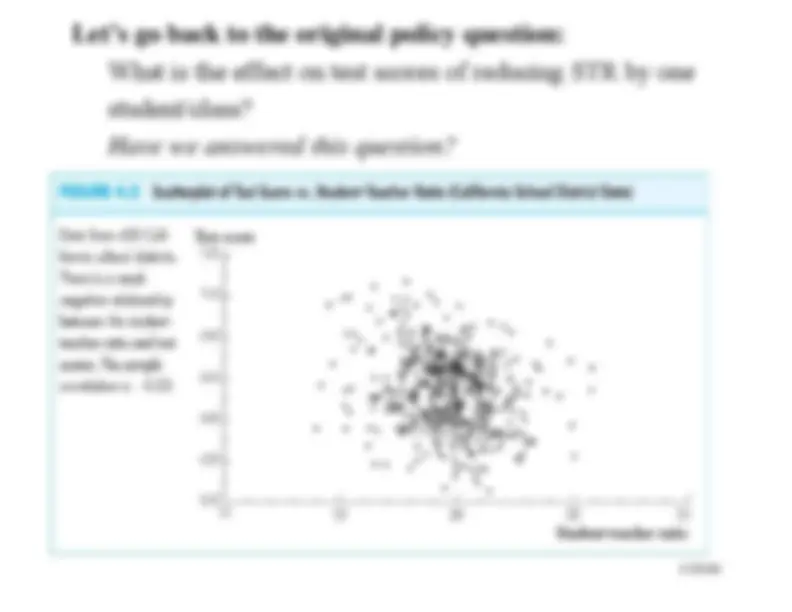

The California Test Score Data Set

All K-6 and K-8 California school districts (

n^

Variables:

th 5 P P grade test scores (Stanford-9 achievement test, combined math and reading), district average ^ Student-teacher ratio (STR) = no. of students in thedistrict divided by no. full-time equivalent teachers

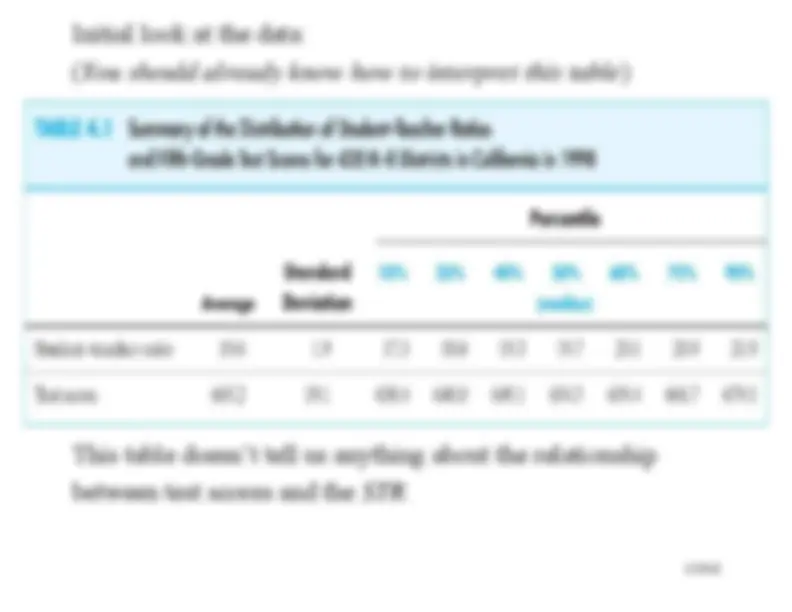

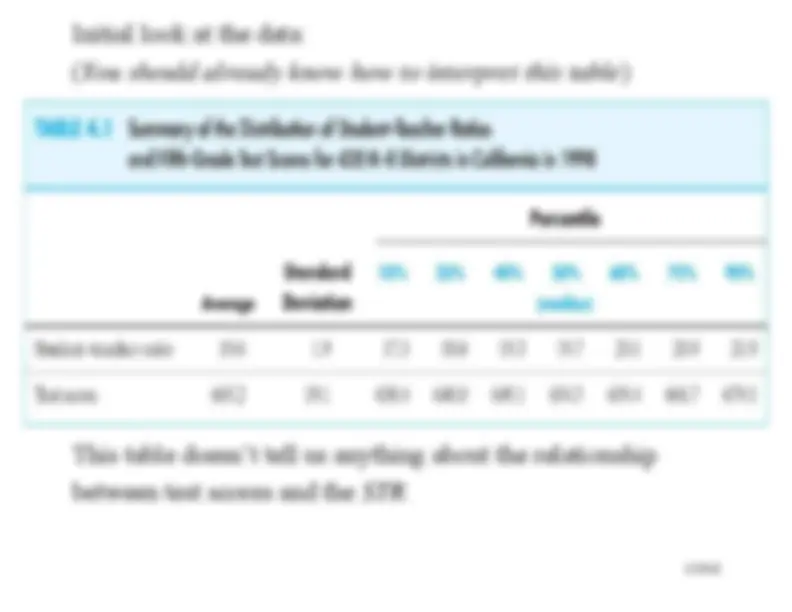

Initial look at the data:( You should already know how to interpret this table

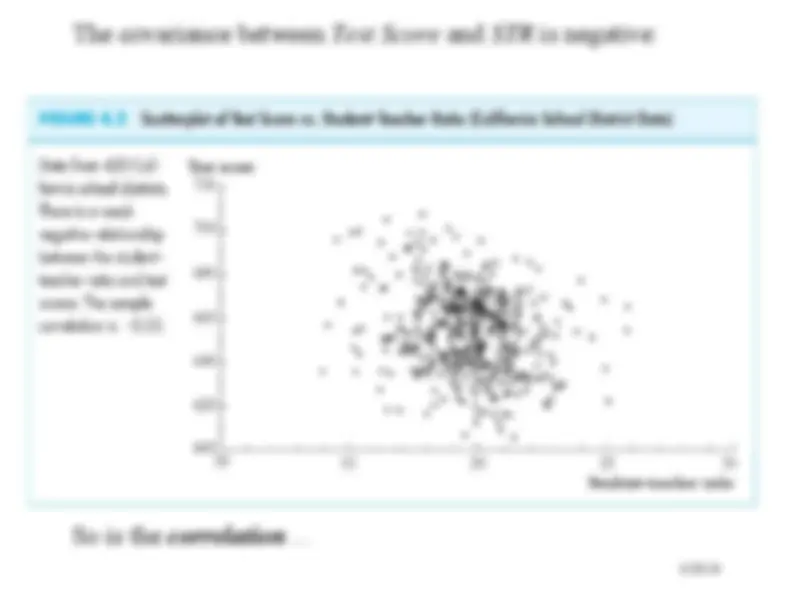

This table doesn’t tell us anything about the relationshipbetween test scores and the

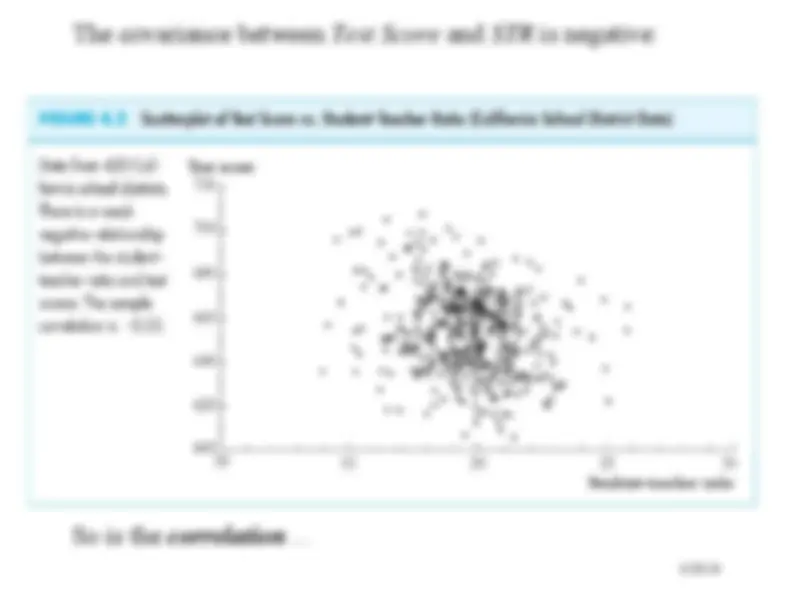

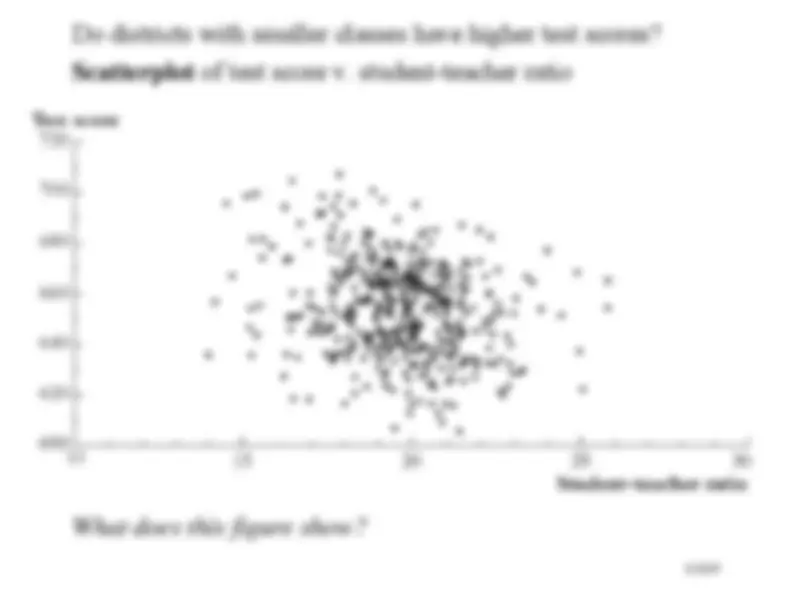

We need to get some numerical evidence on whether districtswith low STRs have higher test scores – but how?

Compare average test scores in districts with low STRsto those with high STRs (“

estimation

Test the “null” hypothesis that the mean test scores inthe two types of districts are the same, against the“alternative” hypothesis that they differ (“

hypothesis

testing

Estimate an interval for the difference in the mean testscores, high v. low STR districts (“

confidence

interval

Initial data analysis:

Compare districts with “small” (STR <

ClassSize

Average score

Standard deviation (

s B^ Y

n

Small

Large

Estimation

of

= difference between group means

Test the hypothesis

that

Construct a

confidence interval

for

2. Hypothesis testing Difference-in-means test: compute the

t -statistic,

2

2

s^

l s^

l s^

l^

s^

l

s^

s^

s^

l

n^

n

Y^

t^

(remember this?)

where

Y^ – s

Y^ ) is the “standard error” of l

Y^ – s

Y^ , the l

subscripts

s^

and

l^

refer to “small” and “large” STR districts,

and

2

2

1

1

n^ s

s^

i^

s

i s

s^

n^

(etc.)

Compute the difference-of-means

t -statistic:

Size

s B^ Y

B

n

small

large

2

2

2

2

238

182

s^

l s^

l s^

l s^

s n^

n

Y^

t^

|t| > 1.96, so reject (at the 5% significance level) the nullhypothesis that the two means are the same.

What comes next…

The mechanics of estimation, hypothesis testing, andconfidence intervals should be familiar ^ These concepts extend directly to regression and itsvariants ^ Before turning to regression, however, we will reviewsome of the underlying theory of estimation, hypothesistesting, and confidence intervals:

Why do these procedures work, and why use theserather than others? ^ We will review the intellectual foundations of statisticsand econometrics

Review of Statistical Theory

The probability framework for statistical inference

Estimation

Testing

Confidence Intervals The probability framework for statistical inference (a)

Population, random variable, and distribution (b)

Moments of a distribution (mean, variance, standarddeviation, covariance, correlation) (c)

Conditional distributions and conditional means (d)

Distribution of a sample of data drawn randomly from apopulation:

B n B

Population distribution of Y

The probabilities of different values of

that occur in the

population, for ex. Pr[

= 650] (when

is discrete)

or: The probabilities of sets of these values, for ex. Pr[640 ^

660] (when

is continuous).

(b) Moments of a population distribution: mean, variance,

standard deviation, covariance, correlation mean

= expected value (expectation) of

B = long-run average value of

over repeated

realizations of

variance

P

(^2) Y

= measure of the squared spread of the

distribution

standard deviation

variance =

B