Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

The concept of time value of money and how interest rates affect the value of money over time. It also provides important notations to be known and seven interest rate formulas, including single-payment compound amount, single-payment present worth amount, equal-payment series compound amount, equal-payment series sinking fund, equal-payment series present worth amount, equal-payment series capital recovery amount, and uniform gradient series annual equivalent amount. Each formula is explained with examples and cash flow diagrams. Finally, the document includes a table with initial outlay, annual revenue, and life for three different technologies.

Typology: Schemes and Mind Maps

1 / 23

This page cannot be seen from the preview

Don't miss anything!

Simple interest rate is the interest is calculated, based on the initial deposit for every interest period. Compound interest rate is the interest for the current period is computed based on the amount (principal plus interest up to the end of the previous period i.e., interest on interest) at the beginning of the current period. Interest rate

Important Notations to be Known P = principal amount; n = No. of interest periods; i = interest rate (It may be compounded monthly, quarterly, semi-annually or annually); F = future amount at the end of year n; A = equal amount deposited at the end of every interest period; G = uniform amount which will be added/ subtracted period after period to/ from the amount of deposit A1 at the end of period 1.

Single-Payment Compound Amount

EXAMPLE-1: A person deposits a sum of Rs. 20,000 at the interest rate of 18% compounded annually for 10 years. Find the maturity value after 10 years.

EXAMPLE-2: A person wishes to have a future sum of Rs. 1,00,000 for his son’s education after 10 years from now. What is the single-payment that he should deposit now so that he gets the desired amount after 10 years? The bank gives 15% interest rate compounded annually.

Equal-Payment Series Compound Amount

Equal-Payment Series Sinking Fund

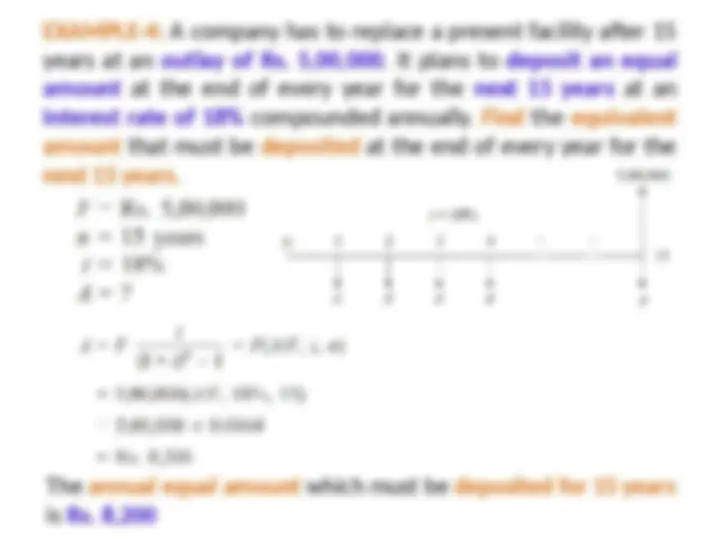

EXAMPLE-4: A company has to replace a present facility after 15 years at an outlay of Rs. 5,00,000. It plans to deposit an equal amount at the end of every year for the next 15 years at an interest rate of 18% compounded annually. Find the equivalent amount that must be deposited at the end of every year for the next 15 years. The annual equal amount which must be deposited for 15 years is Rs. 8,

EXAMPLE-5: A company wants to set up a reserve which will help the company to have an annual equivalent amount of Rs. 10,00,000 for the next 20 years towards its employees welfare measures. The reserve is assumed to grow at the rate of 15% annually. Find the single-payment that must be made now as the reserve amount. The amount of reserve which must be set-up now is equal to Rs. 62,59,300.

Equal-Payment Series Capital Recovery Amount

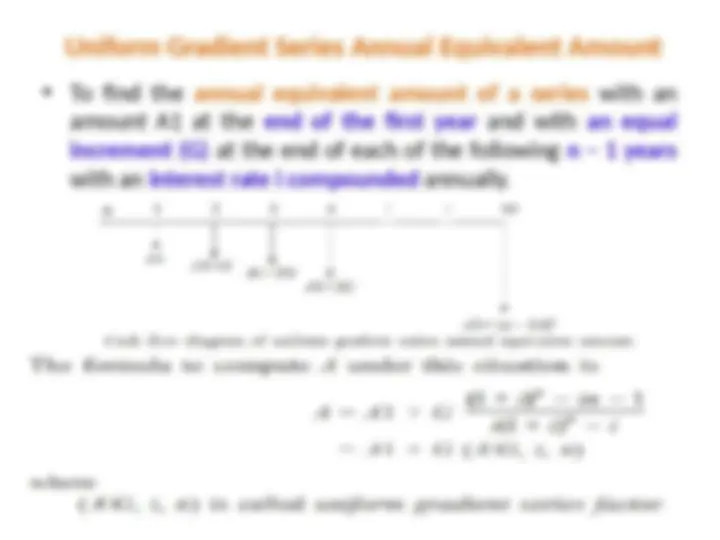

Uniform Gradient Series Annual Equivalent Amount

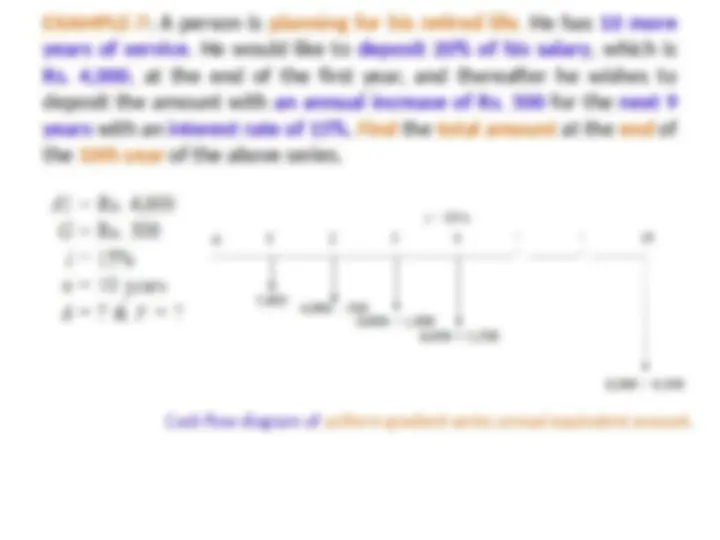

EXAMPLE-7: A person is planning for his retired life. He has 10 more years of service. He would like to deposit 20% of his salary, which is Rs. 4,000, at the end of the first year, and thereafter he wishes to deposit the amount with an annual increase of Rs. 500 for the next 9 years with an interest rate of 15%. Find the total amount at the end of the 10th year of the above series. Cash flow diagram of uniform gradient series annual equivalent amount.