Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

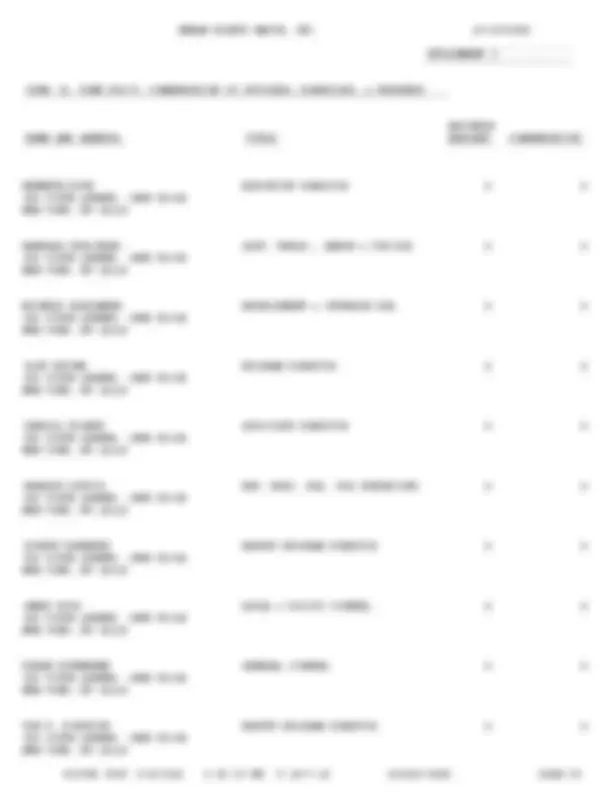

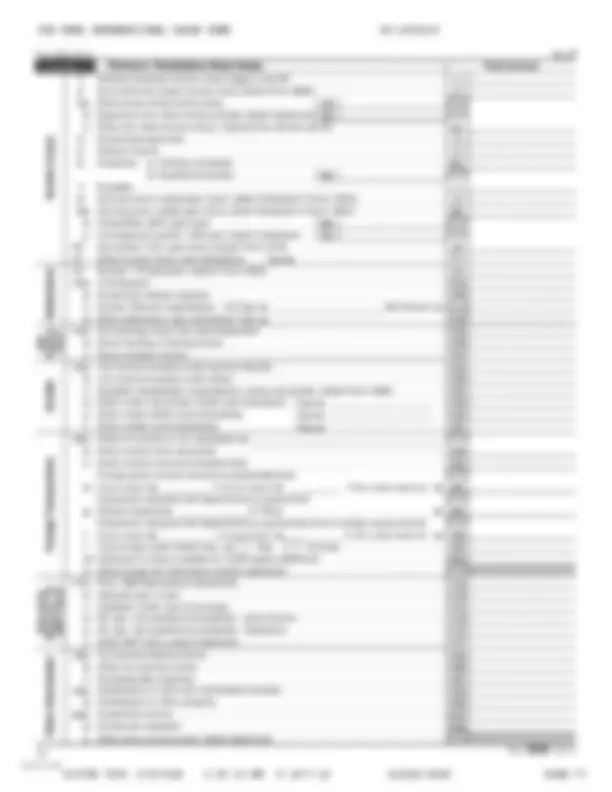

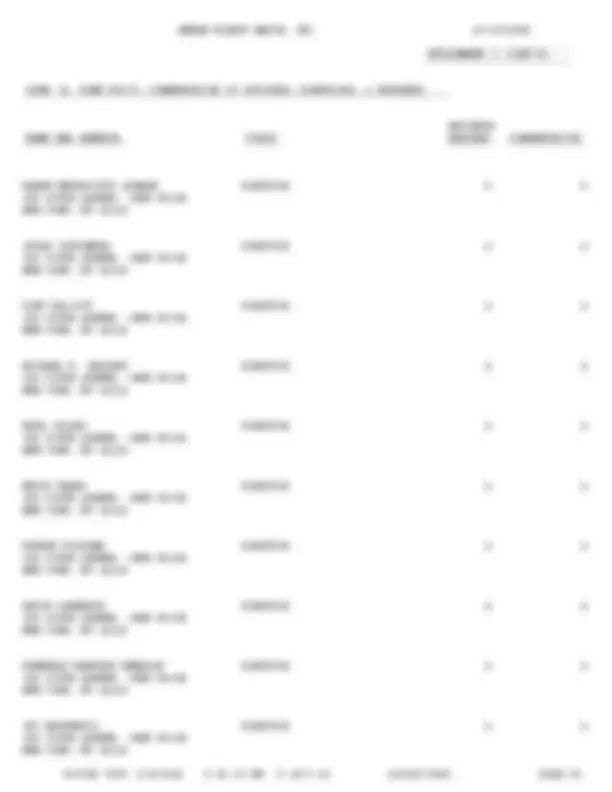

Instructions for corporations and partnerships on how to request an extension of time to file their income tax returns using Form 990-T. It includes information on which form to use, how to complete Part I for those requesting an automatic 6-month extension, and how to complete Part II for all other corporations, partnerships, REMICs, and trusts. The document also outlines the required schedules and forms to be attached, such as Schedule F for interest, annuities, royalties, and rents from controlled organizations, Schedule K for compensation of officers, directors, and trustees, and Schedule J for advertising income.

Typology: Study Guides, Projects, Research

1 / 29

This page cannot be seen from the preview

Don't miss anything!

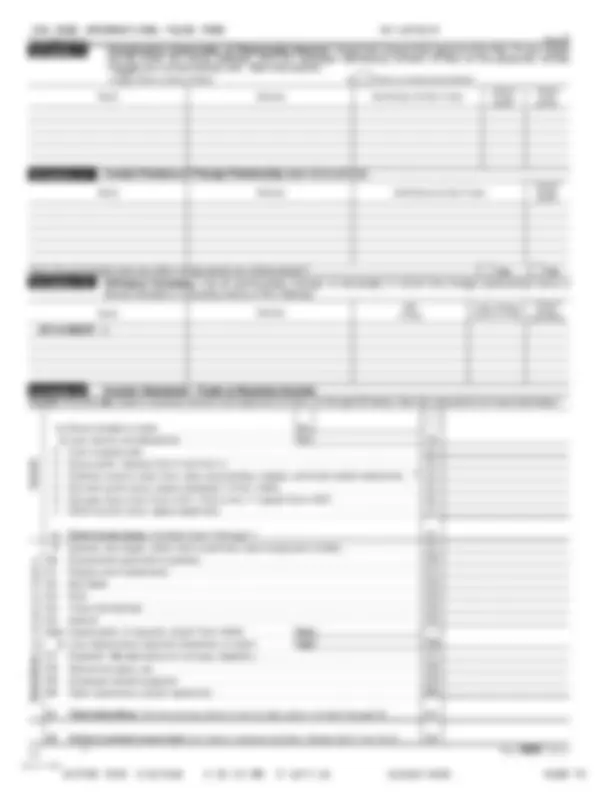

For calendar year 2014 or other tax year beginning , 2014, and ending , 20.

Internal Revenue Service Open to Public Inspection for501(c)(3) Organizations Only

D Employer identification number (Employees' trust, see instructions.) A Check box if^ Name of organization (^ Check box if name changed and see instructions.) address changed B Exempt under section Print or Type

501( )( )^ Number, street, and room or suite no. If a P.O. box, see instructions. E Unrelated business activity codes 408(e) 220(e) (See instructions.) 408A 530(a) 529(a) City or town, state or province, country, and ZIP or foreign postal code C Book value of all assets at end of year

Part I Unrelated Trade or Business Income^ (A) Income^ (B) Expenses^ (C) Net 1 2 3 4 5 6 7 8 9

10 11 12 13

a b

a b c

Gross receipts or sales Less returns and allowances Cost of goods sold (Schedule A, line 7) Gross profit. Subtract line 2 from line 1c Capital gain net income (attach Schedule D) Net gain (loss) (Form 4797, Part II, line 17) (attach Form 4797) Capital loss deduction for trusts Income (loss) from partnerships and S corporations (attach statement) Rent income (Schedule C) Unrelated debt-financed income (Schedule E)

2 3 4a 4b 4c 5 6 7 8 9 10 11 12 13

Interest, annuities, royalties, and rents from controlled organizations (Schedule F) Investment income of a section 501(c)(7), (9), or (17) organization (Schedule G) Exploited exempt activity income (Schedule I) Advertising income (Schedule J) Other income (See instructions; attach schedule) Total. Combine lines 3 through 12

Part II Deductions Not Taken Elsewhere (See instructions for limitations on deductions.) (Except for contributions, deductions must be directly connected with the unrelated business income.) 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34

Compensation of officers, directors, and trustees (Schedule K) Salaries and wages Repairs and maintenance Bad debts Interest (attach schedule) Taxes and licenses Charitable contributions (See instructions for limitation rules) Depreciation (attach Form 4562) Less depreciation claimed on Schedule A and elsewhere on return Depletion Contributions to deferred compensation plans Employee benefit programs Excess exempt expenses (Schedule I) Excess readership costs (Schedule J) Other deductions (attach schedule) Total deductions. Add lines 14 through 28

14 15 16 17 18 19 20

22b 23 24 25 26 27 28 29 30 31 32 33

34

21 22a

Unrelated business taxable income before net operating loss deduction. Subtract line 29 from line 13 Net operating loss deduction (limited to the amount on line 30) Unrelated business taxable income before specific deduction. Subtract line 31 from line 30 Specific deduction (Generally $1,000, but see line 33 instructions for exceptions)

Unrelated business taxable income. Subtract line 33 from line 32. If line 33 is greater than line 32,

JSA For Paperwork Reduction Act Notice, see instructions. (^) Form 990-T (2014) 4X2740 2.

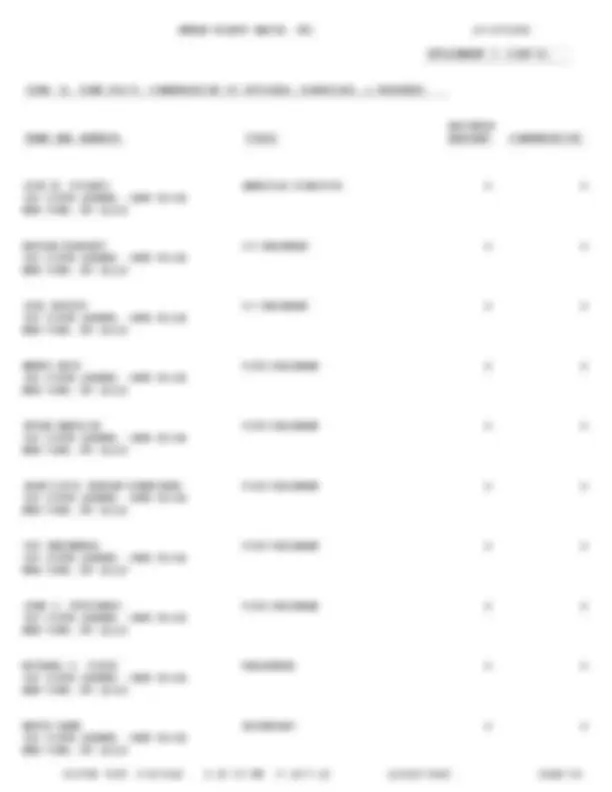

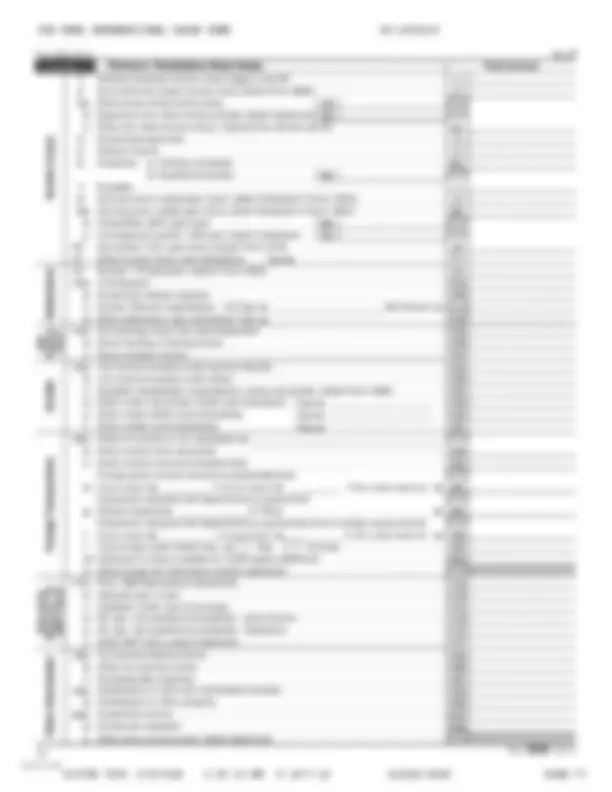

Form 990-T (2014) Page 3 Schedule C - Rent Income (From Real Property and Personal Property Leased With Real Property) (see instructions)

1. Description of property

(1) (2) (3) (4)

2. Rent received or accrued (a) From personal property (if the percentage of rent for personal property is more than 10% but not more than 50%)

(b) From real and personal property (if the percentage of rent for personal property exceeds 50% or if the rent is based on profit or income)

3(a) Deductions directly connected with the income in columns 2(a) and 2(b) (attach schedule)

(1) (2) (3) (4) Total Total (b) Total deductions. Enter here and on page 1, Part I, line 6, column (B)

(c) Total income. Add totals of columns 2(a) and 2(b). Enter

Schedule E - Unrelated Debt-Financed Income (see instructions)

3. Deductions directly connected with or allocable to allocable to debt-financed 2.^ Gross income from or debt-financed property property 1. Description of debt-financed property (^) (a) Straight line depreciation (attach schedule)

(b) Other deductions (attach schedule) (1) (2) (3) (4)

4. Amount of average acquisition debt on or allocable to debt-financed property (attach schedule) 5. Average adjusted basis of or allocable to debt-financed property (attach schedule) 6. Column 4 divided by column 5 8. Allocable deductions (column 6 x total of columns 3(a) and 3(b)) 7. Gross income reportable (column 2 x column 6)

(1) (2) (3) (4)

% % % % Enter here and on page 1, Part I, line 7, column (A).

Enter here and on page 1, Part I, line 7, column (B).

Schedule F - Interest, Annuities, Royalties, and Rents From Controlled Organizations (see instructions) Exempt Controlled Organizations

1. Name of controlled organization 2. Employer identification number 5. Part of column 4 that is included in the controlling organization's gross income 6. Deductions directly connected with income in column 5 3. Net unrelated income (loss) (see instructions) 4. Total of specified payments made

(1) (2) (3) (4) Nonexempt Controlled Organizations

10. Part of column 9 that is included in the controlling organization's gross income 11. Deductions directly connected with income in column 10 8. Net unrelated income (loss) (see instructions) 9. Total of specified 7. Taxable Income payments made

(1) (2) (3) (4) Add columns 5 and 10. Enter here and on page 1, Part I, line 8, column (A).

Add columns 6 and 11. Enter here and on page 1, Part I, line 8, column (B).

JSA Form^ 990-T^ (2014) 4X2742 2.

Form 990-T (2014) Page 4 Schedule G -^ Investment Income of a Section 501(c)(7), (9), or (17) Organization^ (see instructions)

3. Deductions directly connected (attach schedule) 5. Total deductions and set-asides (col. 3 plus col. 4) 4. Set-asides 1. Description of income 2. Amount of income (attach schedule) (1) (2) (3) (4) Enter here and on page 1, Part I, line 9, colum

Enter here and on page 1, n (A). Part I, line 9, column (B).

Schedule I - Exploited Exempt Activity Income, Other Than Advertising Income (see instructions)

4. Net income (loss) from unrelated trade or business (column 2 minus column 3). If a gain, compute cols. 5 through 7. 3. Expenses directly connected with production of unrelated business income 7. Excess exempt expenses (column 6 minus column 5, but not more than column 4). 2. Gross unrelated business income from trade or business 5. Gross income from activity that is not unrelated business income 6. Expenses attributable to 1. Description of exploited activity column 5

(1) (2) (3) (4) Enter here and on page 1, Part I, line 10, col. (A).

Enter here and on page 1, Part I, line 10, col. (B).

Enter here and on page 1, Part II, line 26.

Schedule J - Advertising Income (see instructions) Part I Income From Periodicals Reported on a Consolidated Basis

7. Excess readership costs (column 6 minus column 5, but not more than column 4). 4. Advertising gain or (loss) (col. 2 minus col. 3). If a gain, compute cols. 5 through 7. 2. Gross advertising income 3. Direct advertising costs 5. Circulation income 6. Readership 1. Name of periodical costs

(1) (2) (3) (4)

Part II Income From Periodicals Reported on a Separate Basis (For each periodical listed in Part II, fill in columns 2 through 7 on a line-by-line basis.)

7. Excess readership costs (column 6 minus column 5, but not more than column 4). 4. Advertising gain or (loss) (col. 2 minus col. 3). If a gain, compute cols. 5 through 7. 2. Gross advertising income 3. Direct advertising costs 5. Circulation income 6. Readership 1. Name of periodical costs

(1) (2) (3) (4)

Enter here and on page 1, Part I, line 11, col. (A).

Enter here and on page 1, Part I, line 11, col. (B).

Enter here and on page 1, Part II, line 27.

Schedule K - Compensation of Officers, Directors, and Trustees (see instructions)

3. Percent of time devoted to business 4. Compensation attributable to 1. Name 2. Title unrelated business

(1) (^) % (2) (^) % (3) (^) % (4) (^) %

JSA Form^ 990-T^ (2014) 4X2743 2.

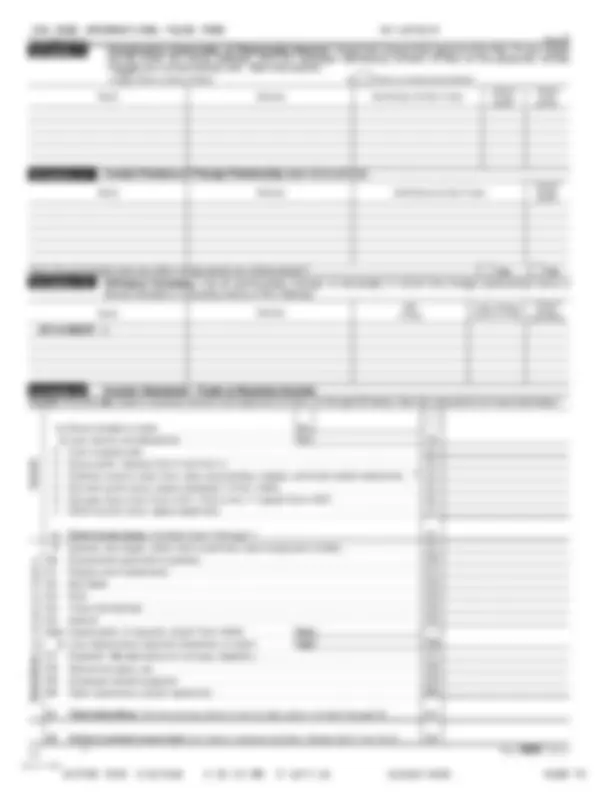

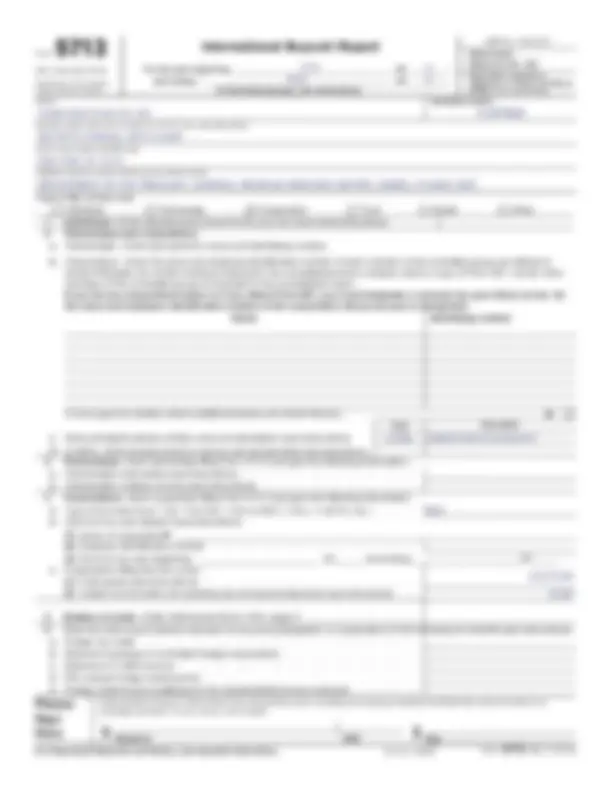

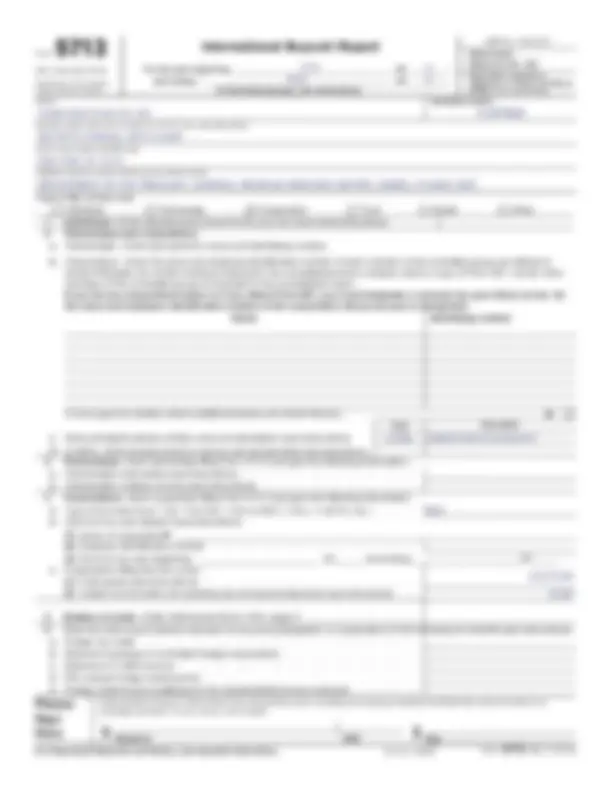

(Rev. December 2014) (^) Attachment Sequence No. 69 Department of the Treasury

Name of shareholder Identifying number (see instructions)

Number, street, and room or suite no. (If a P.O. box, see instructions.) Shareholder tax year: calendar year or other tax year beginning and ending. City or town, state, and ZIP code or country

Check type of shareholder filing the return: Individual Corporation Partnership S Corporation Nongrantor Trust Estate Name of passive foreign investment company (PFIC) or qualified electing fund (QEF) Employer identification number (if any)

Address (Enter number, street, city or town, and country.) Reference ID number (see instructions)

Tax year of PFIC or QEF: calendar year or other tax year beginning and ending. Part I Summary of Annual Information (See instructions.) Provide the following information with respect to all shares of the PFIC held by the shareholder:

1 Description of each class of shares held by the shareholder: Check if shares jointly owned with spouse.

2 Date shares acquired during the taxable year, if applicable:

3 Number of shares held at the end of the taxable year:

4 Value of shares held at the end of the taxable year (check the appropriate box, if applicable): (a) $0-50,000 (b) $50,001-100,000 (c) $100,001-150,000 (d) $150,001-200, (e) If more than $200,000, list value:

Type of PFIC and amount of any excess distribution or gain treated as an excess distribution under section 1291, inclusion under section 1293, or inclusion or deduction under section 1296:

5

(a) (^) Section 1291 $ (b) Section 1293 (Qualified Electing Fund) $ (c) Section 1296 (Mark to Market) (^) $

Part II Elections (See instructions.) A Election To Treat the PFIC as a QEF. I, a shareholder of a PFIC, elect to treat the PFIC as a QEF. Complete lines 6a through 7c of Part III. B Election To Extend Time For Payment of Tax. I, a shareholder of a QEF, elect to extend the time for payment of tax on the undistributed earnings and profits of the QEF until this election is terminated. Complete lines 8a through 9c of Part III to calculate the tax that may be deferred. Note: If any portion of line 6a or line 7a of Part III is includible under section 951, you may not make this election. Also, see sections 1294(c) and 1294(f) and the related regulations for events that terminate this election.

C Election To Mark-to-Market PFIC Stock. I, a shareholder of a PFIC, elect to mark-to-market the PFIC stock that is marketable within the meaning of section 1296(e). Complete Part IV. D Deemed Sale Election. I, a shareholder on the first day of a PFIC's first tax year as a QEF, elect to recognize gain on the deemed sale of my interest in the PFIC. Enter gain or loss on line 15f of Part V. E Deemed Dividend Election. I, a shareholder on the first day of a PFIC's first tax year as a QEF that is a controlled foreign corporation (CFC), elect to treat an amount equal to my share of the post-1986 earnings and profits of the CFC as an excess distribution. Enter this amount on line 15e of Part V. If the excess distribution is greater than zero, also complete line 16 of Part V. F Election To Recognize Gain on Deemed Sale of PFIC. I, a shareholder of a former PFIC or a PFIC to which section 1297(d) applies, elect to treat as an excess distribution the gain recognized on the deemed sale of my interest in the PFIC on the last day of its last tax year as a PFIC under section 1297(a). Enter gain on line 15f of Part V. G Deemed Dividend Election With Respect to a Section 1297(e) PFIC. I, a shareholder of a section 1297(e) PFIC, within the meaning of Regulations section 1.1297-3(a), elect to make a deemed dividend election with respect to the Section 1297(e) PFIC. My holding period in the stock of the Section 1297(e) PFIC includes the CFC qualification date, as defined in Regulations section 1.1297-3(d). Enter the excess distribution on line 15e, Part V. If the excess distribution is greater than zero, also complete line 16, Part V. H Deemed Dividend Election With Respect to a Former PFIC. I, a shareholder of a former PFIC, within the meaning of Regulations section 1.1298-3(a), elect to make a deemed dividend election with respect to the former PFIC. My holding period in the stock of the former PFIC includes the termination date, as defined in Regulations section 1.1298-3(d). Enter the excess distribution on line 15e, Part V. If the excess distribution is greater than zero, also complete line 16, Part V. JSA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Form 8621 (Rev. 12-2014) 4X1823 2.

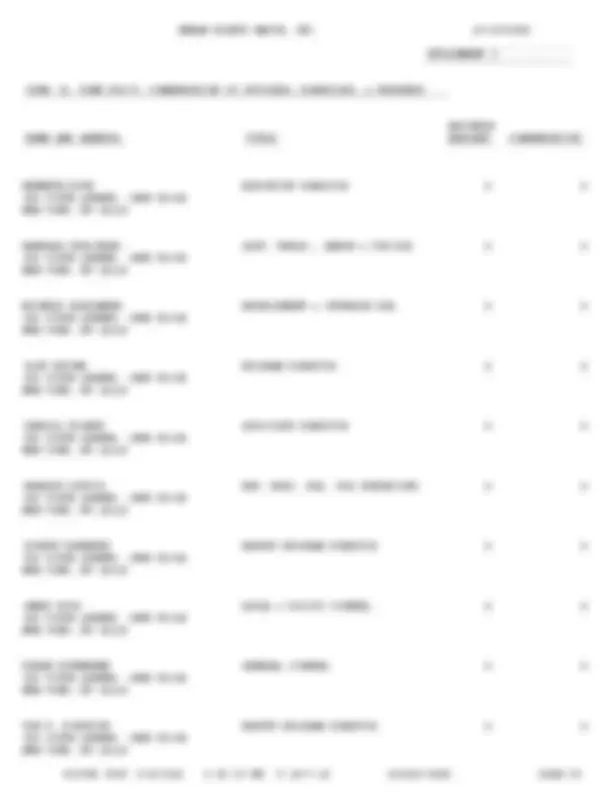

(Rev. December 2014) (^) Attachment Sequence No. 69 Department of the Treasury

Name of shareholder Identifying number (see instructions)

Number, street, and room or suite no. (If a P.O. box, see instructions.) Shareholder tax year: calendar year or other tax year beginning and ending. City or town, state, and ZIP code or country

Check type of shareholder filing the return: Individual Corporation Partnership S Corporation Nongrantor Trust Estate Name of passive foreign investment company (PFIC) or qualified electing fund (QEF) Employer identification number (if any)

Address (Enter number, street, city or town, and country.) Reference ID number (see instructions)

Tax year of PFIC or QEF: calendar year or other tax year beginning and ending. Part I Summary of Annual Information (See instructions.) Provide the following information with respect to all shares of the PFIC held by the shareholder:

1 Description of each class of shares held by the shareholder: Check if shares jointly owned with spouse.

2 Date shares acquired during the taxable year, if applicable:

3 Number of shares held at the end of the taxable year:

4 Value of shares held at the end of the taxable year (check the appropriate box, if applicable): (a) $0-50,000 (b) $50,001-100,000 (c) $100,001-150,000 (d) $150,001-200, (e) If more than $200,000, list value:

Type of PFIC and amount of any excess distribution or gain treated as an excess distribution under section 1291, inclusion under section 1293, or inclusion or deduction under section 1296:

5

(a) (^) Section 1291 $ (b) Section 1293 (Qualified Electing Fund) $ (c) Section 1296 (Mark to Market) (^) $

Part II Elections (See instructions.) A Election To Treat the PFIC as a QEF. I, a shareholder of a PFIC, elect to treat the PFIC as a QEF. Complete lines 6a through 7c of Part III. B Election To Extend Time For Payment of Tax. I, a shareholder of a QEF, elect to extend the time for payment of tax on the undistributed earnings and profits of the QEF until this election is terminated. Complete lines 8a through 9c of Part III to calculate the tax that may be deferred. Note: If any portion of line 6a or line 7a of Part III is includible under section 951, you may not make this election. Also, see sections 1294(c) and 1294(f) and the related regulations for events that terminate this election.

C Election To Mark-to-Market PFIC Stock. I, a shareholder of a PFIC, elect to mark-to-market the PFIC stock that is marketable within the meaning of section 1296(e). Complete Part IV. D Deemed Sale Election. I, a shareholder on the first day of a PFIC's first tax year as a QEF, elect to recognize gain on the deemed sale of my interest in the PFIC. Enter gain or loss on line 15f of Part V. E Deemed Dividend Election. I, a shareholder on the first day of a PFIC's first tax year as a QEF that is a controlled foreign corporation (CFC), elect to treat an amount equal to my share of the post-1986 earnings and profits of the CFC as an excess distribution. Enter this amount on line 15e of Part V. If the excess distribution is greater than zero, also complete line 16 of Part V. F Election To Recognize Gain on Deemed Sale of PFIC. I, a shareholder of a former PFIC or a PFIC to which section 1297(d) applies, elect to treat as an excess distribution the gain recognized on the deemed sale of my interest in the PFIC on the last day of its last tax year as a PFIC under section 1297(a). Enter gain on line 15f of Part V. G Deemed Dividend Election With Respect to a Section 1297(e) PFIC. I, a shareholder of a section 1297(e) PFIC, within the meaning of Regulations section 1.1297-3(a), elect to make a deemed dividend election with respect to the Section 1297(e) PFIC. My holding period in the stock of the Section 1297(e) PFIC includes the CFC qualification date, as defined in Regulations section 1.1297-3(d). Enter the excess distribution on line 15e, Part V. If the excess distribution is greater than zero, also complete line 16, Part V. H Deemed Dividend Election With Respect to a Former PFIC. I, a shareholder of a former PFIC, within the meaning of Regulations section 1.1298-3(a), elect to make a deemed dividend election with respect to the former PFIC. My holding period in the stock of the former PFIC includes the termination date, as defined in Regulations section 1.1298-3(d). Enter the excess distribution on line 15e, Part V. If the excess distribution is greater than zero, also complete line 16, Part V. JSA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Form 8621 (Rev. 12-2014) 4X1823 2.

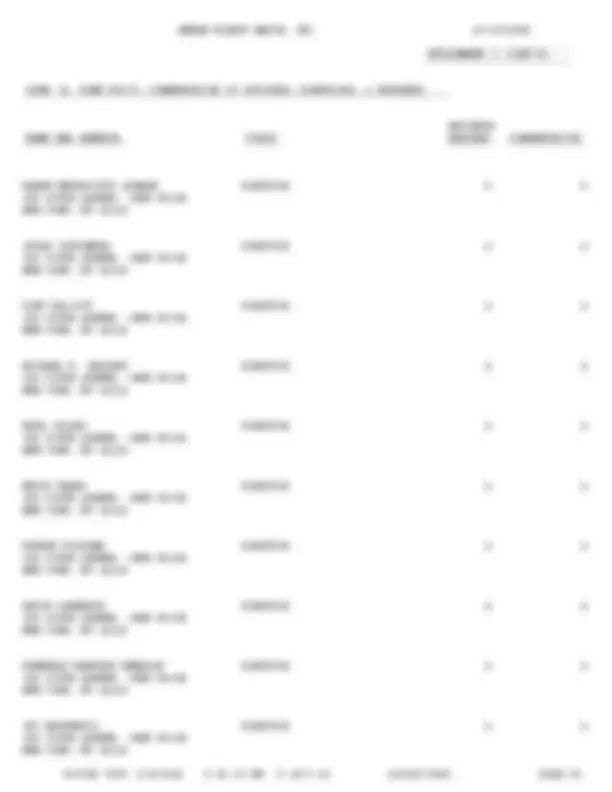

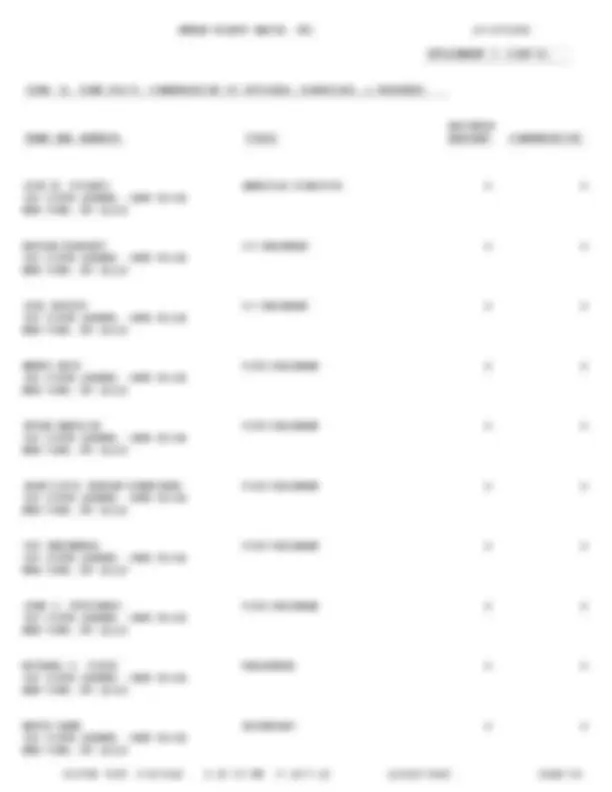

Form 8865 (2014) Page 2 Constructive Ownership of Partnership Interest. Check the boxes that apply to the filer. If you check box b, enter the name, address, and U.S. taxpayer identifying number (if any) of the person(s) whose interest you constructively own. See instructions.

Schedule A

a Owns a direct interest b Owns a constructive interest Check if foreign person

Check if direct partner

Name Address Identifying number (if any)

Check if foreign Name Address Identifying number (if any) person

Affiliation Schedule. List all partnerships (foreign or domestic) in which the foreign partnership owns a direct interest or indirectly owns a 10% interest.

Schedule A-

Total ordinary income or loss

Check if foreign partnership

EIN Name Address (if any)

Schedule B Income Statement - Trade or Business Income Caution. Include only trade or business income and expenses on lines 1a through 22 below. See the instructions for more information.

1 2 3 4 5 6 7 1a 1b

a b

Gross receipts or sales Less returns and allowances Cost of goods sold Gross profit. Subtract line 2 from line 1c Ordinary income (loss) from other partnerships, estates, and trusts (attach statement) Net farm profit (loss) (attach Schedule F (Form 1040)) Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) Other income (loss) (attach statement)

1c 2 3 4 5 6 7 8 9

10 11 12 13 14 15

16c 17 18 19 20

21

22

Income

(^9) Salaries and wages (other than to partners) (less employment credits) Guaranteed payments to partners Repairs and maintenance Bad debts Rent Taxes and licenses Interest Depreciation (if required, attach Form 4562) Less depreciation reported elsewhere on return Depletion ( Do not deduct oil and gas depletion.)

10 11 12 13 14 15 16

17 18 19 20

16a 16b

a b

Retirement plans, etc. Employee benefit programs Other deductions (attach statement)

Deductions

(see instructions for limitations)

JSA Form^^8865 (2014) 4X1911 2.

Form 8865 (2014) Page 3 Schedule K Partners' Distributive Share Items^ Total amount 1 2 3 4 5 6 7 8 9

10 11 12 13

14

15

16

17

18

19

20

Ordinary business income (loss) (page 2, line 22) Net rental real estate income (loss) (attach Form 8825) Other gross rental income (loss) Expenses from other rental activities (attach statement) Other net rental income (loss). Subtract line 3b from line 3a Guaranteed payments Interest income

1 2

3c 4 5 6a

7 8 9a

10 11 12 13a 13b 13c(2) 13d

a b c a b c a b c d a b c a b c d e f a b c d g i l m n a b c d e f a b c a b a b c 3a 3b

Dividends: a b

Ordinary dividends Qualified dividends

Royalties Net short-term capital gain (loss) (attach Schedule D (Form 1065)) Net long-term capital gain (loss) (attach Schedule D (Form 1065)) Collectibles (28%) gain (loss) Unrecaptured section 1250 gain (attach statement) Net section 1231 gain (loss) (attach Form 4797) Other income (loss) (see instructions)

9b 9c

Income (Loss)

Section 179 deduction (attach Form 4562) Contributions

Deductions Net earnings (loss) from self-employment Gross farming or fishing income Gross nonfarm income

14a 14b 14c

Self- Employ-ment Low-income housing credit (section 42(j)(5)) Low-income housing credit (other) Qualified rehabilitation expenditures (rental real estate) (attach Form 3468) Other rental real estate credits (see instructions) Other rental credits (see instructions) Other credits (see instructions)

15a 15b 15c 15d 15e 15f

Credits

Gross income from all sources Gross income sourced at partner level Foreign gross income sourced at partnership level Passive category Deductions allocated and apportioned at partner level Interest expense Deductions allocated and apportioned at partnership level to foreign source income Passive category Total foreign taxes (check one):

16b 16c

16f

16h

16k 16l 16m

Reduction in taxes available for credit (attach statement) Other foreign tax information (attach statement)

AlternativeMinimum Tax(AMT) Items

Foreign Transactions

Post-1986 depreciation adjustment Adjusted gain or loss Depletion (other than oil and gas) Oil, gas, and geothermal properties - gross income Oil, gas, and geothermal properties - deductions Other AMT items (attach statement)

17a 17b 17c 17d 17e 17f 18a 18b 18c 19a 19b 20a 20b

Tax-exempt interest income Other tax-exempt income Nondeductible expenses Distributions of cash and marketable securities Distributions of other property Investment income Investment expenses

Other Information Other items and amounts (attach statement)

JSA^ Form^^8865 (2014) 4X1913 2.