Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Heterogeneous Panels, Capital Asset Pricing Model, Parameter Heterogeneity, Fixed Effects Approach, Time Series, Pooling, Estimating the RPM, Price Elasticities are points which describes this lecture importance in Econometric Analysis of Panel Data course.

Typology: Slides

1 / 41

This page cannot be seen from the preview

Don't miss anything!

11. Parameter Heterogeneity – “Heterogeneous Panels”

Agenda

Classical Bayesian

Cross Country Growth Convergence

i,t i,t i,t i,t^1 i,t i,t i,t-1 i,t- i,t 1 i i,t 1 i,t i i,t 1

A index of technology K capital stock = I + (1- )K I s Y Investment Savings L labor (1 n )L

α −α

− − −

= δ = = = = = +

Solow - Swan Growth Model

Equilibrium Model for Steady i,t i i i i,t 1 i,t i i i i i i

logY t log Y (1- )g , g =technological growth rate "convergence" parameter; 1- = rate of convergence to steady state Cross country comparisons of convergence rat

= μ + θ + λ (^) − + ε θ = λ λ = λ

State Income

es are the focus of study.

Heterogeneous Production Model

Health i,t (^) i iHEXP i,t (^) i EDUCi,t i,t i country, t=year Health = health care outcome, e.g., life expectancy HEXP = health care expenditure EDUC = education Parameter heterogeneity: Discrete? Aids domin

ated vs. QOL dominated Continuous? Cross cultural heterogeneity World Health Organization, "The 2000 World Health Report"

Parameter Heterogeneity

it it i i i X i i i i

y

E[ | ] zero or nonzero - to be defined

E [E[ | ]] =

Var[ | ] to be defined, constant or variable

= ′ + ε = +

it i i

Generalize to Random Parameters x β

β β u

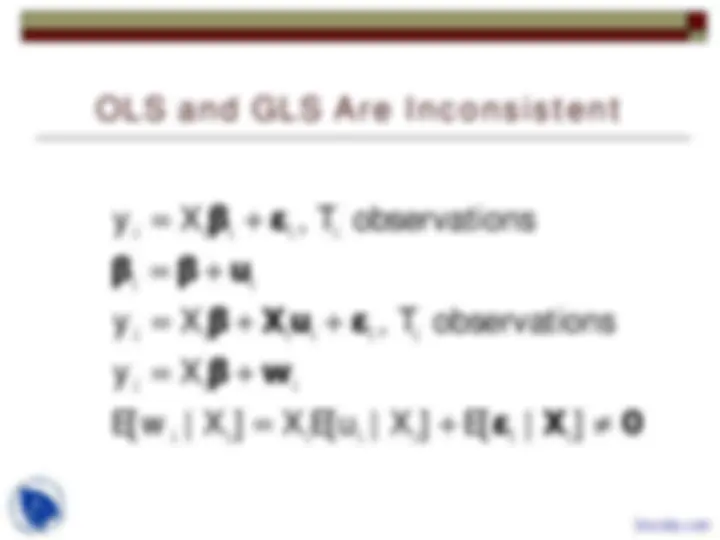

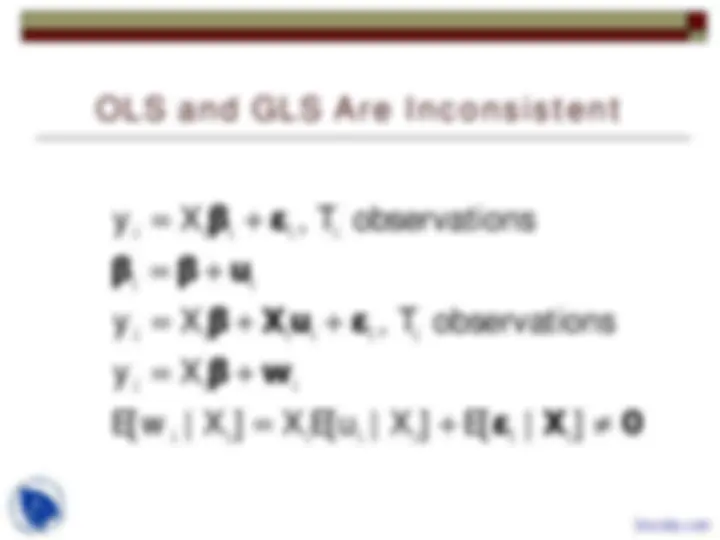

u X u X 0 u X

"The Pooling Problem : " What is the consequence

of estimating under the erroneous assumption of constant parameters. (Theil, 1960, "The Aggregation

Problem") (Maddala, 1970s - 1990s, "The Pooling

Problem")

Fixed Effects

(Hildreth, Houck, Hsiao, Swamy)

it it i i i i i i i i i i i X i i X i i i

y , each observation , T observations

Assume (temporarily) T > K. E[ | ] =g( ) (conditional mean) P[ | ] =( -E[ ]) (projection) E [E[ | ]] = E [P[ | ]] = Var[ |

= ′ + ε = + = +

it i i i i i

x β y X β ε β β u

u X X u X X X θ u X u X 0 u X i ] = Γ constant but nonzero

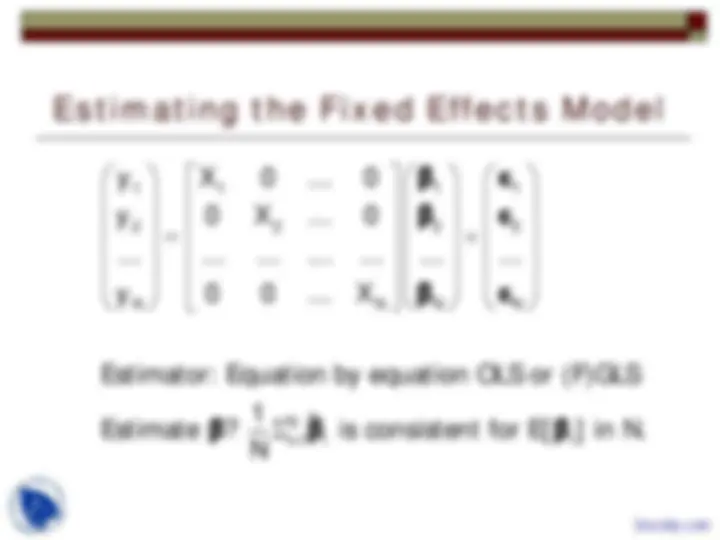

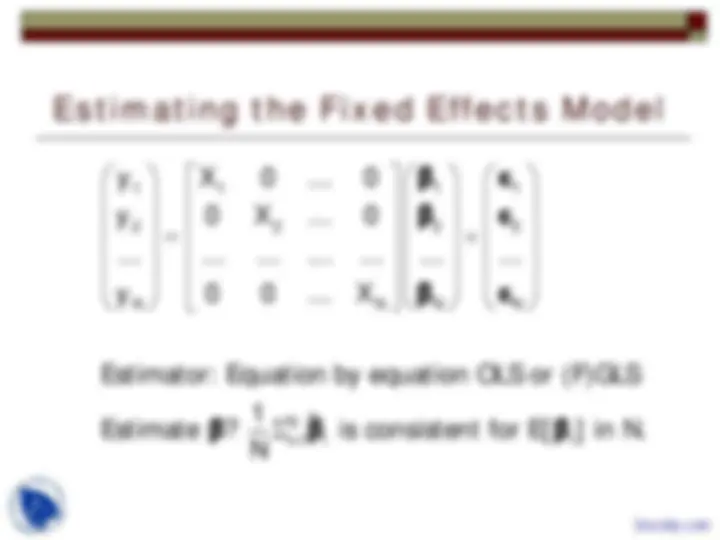

Estimating the Fixed Effects Model

N i 1

Estimator: Equation by equation OLS or (F)GLS (^1) ˆ Estimate? is consistent N =

(^) (^) = (^) + (^) (^) ^

Σ

1 1 1 1 2 2 2 2

N N N N

i

y X 0 ... 0 β ε y 0 X ... 0 β ε ... ... ... ... ... ... ... y 0 0 ... X β ε

β β for E[ βi ] in N.

Partial Fixed Effects Model

i i

Ni 1 1 Ni 1 (^) i 1 (^1) i

Some individual specific parameters

= −^ = − −

i i i i

i iD^ i i iD^ i iD i i i i i i i

y D α X β ε

β X M X X M y M D D D D

α D D D y X β

it i0 i1 it

it i0 it

e trends, y t ; Detrend individual data, then OLS E.g., Individual specific constant terms, y ; Individual group mean deviations, then OLS

= α + α + ′ + ε

= α + ′ + ε

it

it

x β

x β

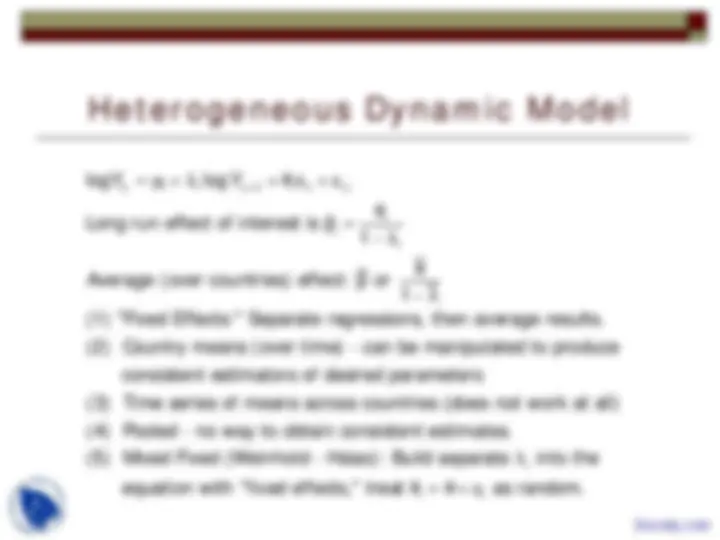

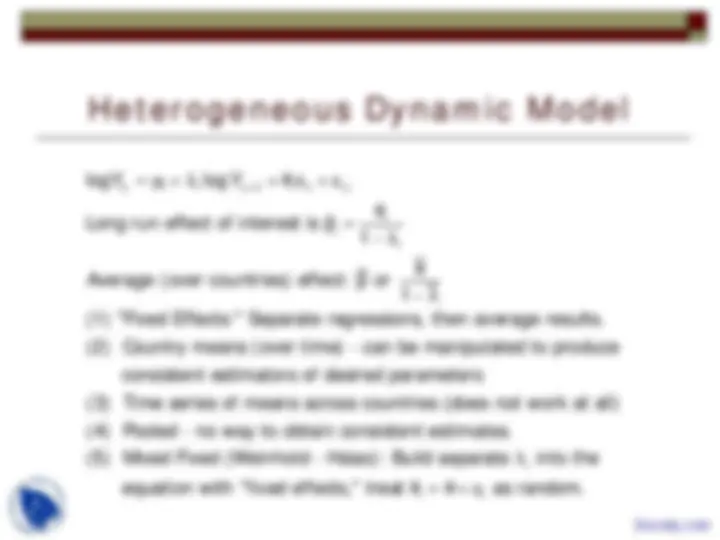

Heterogeneous Dynamic Model

i,t i i i,t 1 i it i,t i i i

logY log Y x

Long run effect of interest is (^1)

Average (over countries) effect: or 1

(1) "Fixed Effects:" Separate regressions, then average results. (2) Country means (o

= μ + λ (^) − + θ + ε β = θ − λ β θ − λ

ver time) - can be manipulated to produce consistent estimators of desired parameters (3) Time series of means across countries (does not work at all) (4) Pooled - no way to obtain consistent est

i i i

imates. (5) Mixed Fixed (Weinhold - Hsiao): Build separate into the equation with "fixed effects," treat u as random.

λ θ = θ +

“Fixed Effects” Approach

i,t i i i,t 1 i it i,t i i i i i i Ni 1 (^) i Ni 1 i i Ni 1 i Ni 1

−

= =

i N i=1 i

× (^) ∑

Country Means (cont.)

i i i i, 1 i i i i i i T i i i i i i (^) i i (^) T i ii i i i i (^0) i i i i 0 0 i i i i

logY log Y x (logY (y) / T ) x

1 1 x^1 (y) / T 1 (1) Let = /(1 ), expect to be random = /(1 ) and to be random (2) Lev

= μ + λ (^) − + θ + ε = μ + λ − ∆ + θ + ε = μ^ + θ^ − λ^ ∆ + ε − λ − λ − λ − λ δ = μ − λ δ − δ β θ − λ β − β i i T i i i^0

el variable x should be uncorrelated with change (logY (y) / T ).

Regression of logY on 1, x should give consistent estimates of and.

δ β

Time Series

t Ni 1 i,t Ni 1 (^) i i,t 1 Ni 1 (^) i i,t Ni 1 i,t Ni 1 i i i Ni 1 (^) i i,t 1 1,t Ni 1 i i,t 1

= = − = = = = − − = −

Ni 1 i i,t

t (^) 1,t t t Ni 1 i i,t 1

= − = −

Mixed/Fixed Approach

N i,t i i 1 i i,t i,t 1 i i,t i,t i,t i i i

log y d log y x

d = country specific dummy variable. Treat and as random, is a 'fixed effect.' This model can be fit consistently by OLS.

= μ + Σ (^) = λ (^) − + θ + ε

μ θ λ

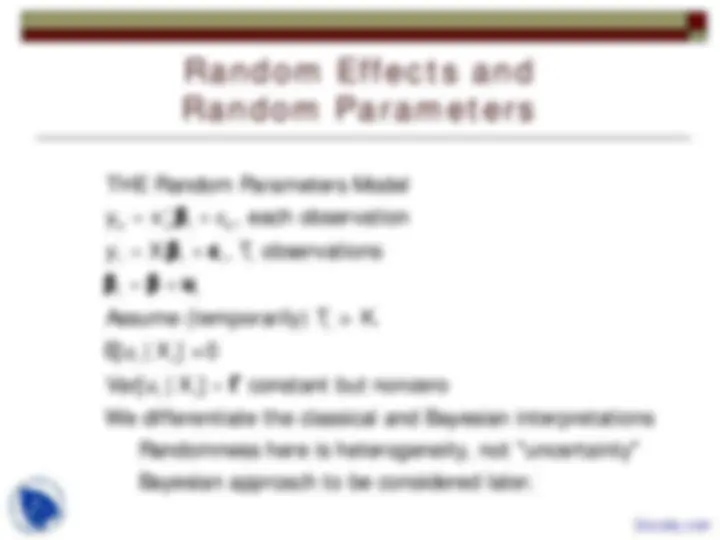

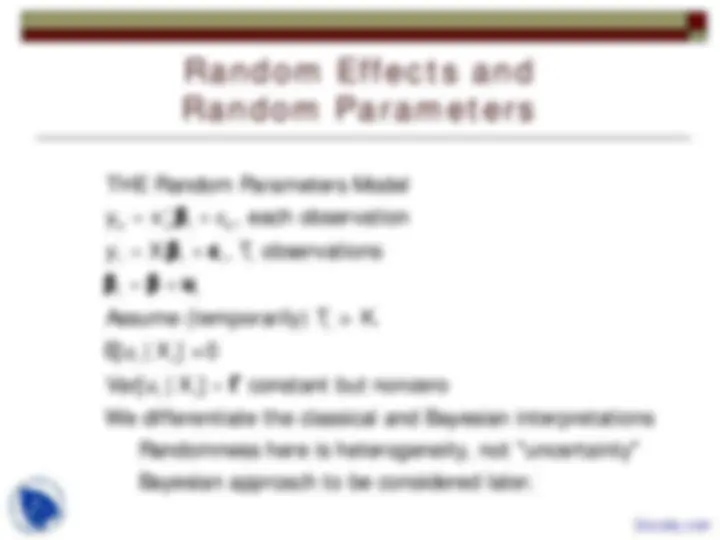

Random Effects and Random Parameters

it it i i i i i i i i

Random Parameters Model y , each observation , T observations

Assume (temporarily) T > K.

E[ | ] =

Var[ | ] constant but nonzero We differentiate the classical and

= ′ + ε = + = +

=

it i i i i i

THE x β y X β ε

β β u

u X 0 u X Γ Bayesian interpretations Randomness here is heterogeneity, not "uncertainty" Bayesian approach to be considered later.