Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Generally India’s assessment routine depended vigorously on roundabout charges. Income from aberrant duties was the significant wellspring of expense income till assessment changes were attempted amid nineties. The significant contention set forth for substantial dependence on circuitous duties was that the India’s dominant part of populace was poor and along these lines extending base of direct expenses had characteristics impediments.

Typology: Assignments

Uploaded on 02/25/2021

2 documents

1 / 26

This page cannot be seen from the preview

Don't miss anything!

SuBMITTEd TO: PROF SAYANTI BANERJEE SECTION: MC SAGNIk AChARYA (

BATCh: 2019- SuBMITTEd TO: SuBMITTEd BY: SAYANTI BANERJEE AIShWARYE GIRI ( kuNAL BIJLANI AkASh dEEP SINhA RIShABh GROVER ROhAN PARASRAMkA SECTION: MC SAGNIk AChARYA (

SuBMITTEd BY: AIShWARYE GIRI (19001) NAL BIJLANI (19022) AkASh dEEP SINhA (19062) RIShABh GROVER (19096) ROhAN PARASRAMkA (19098) SECTION: MC SAGNIk AChARYA (19101)

System Sale within the state

and CGST

Excise/Sales Tax Under the new system, a transaction of sale within the state shall have two taxes: SGST, which goes to the State, and CGST which goes to the Centre Sale outside the state

Excise/Sales Tax Under the new system, a transaction of sale from one state to another shall have only one type of tax, the IGST, which goes to the Centre IMPACT ON WHOLESALERS & RETAILERS Under the current indirect tax regime, wholesalers and retailers usually escape the tax liability as there is no mechanism by which their actual purchase and sale can be traced. Most of their transactions are done in black, meaning no invoice is issued to the buyer, and eventually no entry is posted in the books for such sales. These taxpayers usually leverage the tax liability evaded and undercut the market to gain in volume. Their margin of profit remains as low as 1 percent. Since under the GST regime, every invoice pertaining to taxable supply has to be uploaded on GSTN’s common portal and has to be accepted by the buyer, wholesalers and retailers will now be unable to escape their tax liability. The only possibility for tax evasion would arise if the entire supply chain is outside the tax network and did not file a return under GST law, which is very unlikely. Objective of the Study: The main objective of this research is to understand the impact of GST on retailers operating in FMCG sector. Scope of the Study: This research has been conducted to get an idea of how GST has affected Retailers. This study will help FMCG companies to understand the problems & need of retailers in GST taxation system.

Statistical tool: The raw data is carefully collected with classified information which can be edited and tabulated for analysis. The analysis tables & pie chart were prepared, analyzed and interpretation was done on the basis of percentage. Research Design: Sampling Size 50 Sampling Area Central Market, Saket Sampling Method Simple Random Sampling Sampling Respondent Shopkeeper, Businessman, Student Sampling Tools Tabulation & percentage analysis Collection of Data: The required data for the study was collected from primary data. The primary data were collected through questionnaire, in which we have asked the perceptions of the retailers on impact of GST. This mainly depends upon the primary data which have been collected from 50 respondents during the month of March-April. The consumers are classified on the basis of occupation, age group, gender. Analysis: There is awareness about GST among retailers but there is no clarity around the rules. Most of the retailers still need to upgrade their IT infrastructure for successful implementation of GST. Tax bracket decided by the government have left some retailers dissatisfied. Demonetization affected retailers. Now, GST also had a impact over retailers.

Classification of Respondents on the basis of their perception “Awareness about GST”: S No. Response No. Of Respondents Percentage (%) 1 Yes 30 60 2 No 20 40 3 May be - - Total 50 100 Interpretation: Above chart shows that majority of the respondent’s that is 60% are well known about GST and 40% are not aware of the GST. So, it is concluded that about 60% of the retailers have the awareness about GST. Classification of Respondents on the basis of their perception “how many are clear about the rules”: S No. Response No. of Respondents Percentage (%) 1 Yes 12 24 2 No 18 36 3 May Be 20 40 60 40 0 Response Yes No May BE

Total 50 60 Interpretation: Above chart shows that majority of the respondents that is 40% comes under MAY BE category because they are confused which rules are going to be recommended. 24% know the rules of the GST and about 36% are not aware about the rules. So it is concluded that 40% of retailers are confused about the rules which is going to be implemented in GST. Classification of Respondents On the Basis of Age: S No. Age Group No. of Respondents Percentage (%) 1 Below 25 5 10 2 25-35 16 32 3 35-50 18 36 4 Above 50^11 Total 50 100 24 36 40 Response Yes No May Be

Interpretation: From the above table and figure it is clear that majority of respondents are Married that is 70% and rest of the 30% are Unmarried. Therefore according to this observation maximum respondents are married. Classification of Respondents on the basis of gender: S No. Gender No. of Respondents Percentage (%) 1 Male 40 80 2 Female 10 20 Total 50 100 70 30 Response Married Unmarried

Interpretation: From the above table and figure it is shown that majority of respondents are Males 80% and Females are 20%. Thus it can be concluded Males are shown in high interest in business activities. Classification of Respondents on the basis of their perception “Is GST a good tax reform for India”? S No. Response No. of Respondents Percentage (%) 1 Strongly Agree 28 56 2 Agree 15 30 3 Neutral 6 12 4 Disagree 1 2 5 Strongly Disagree^ -^ - Total 50 100 80 20 Response Male Female

Interpretation: Above chart shown that majority of the respondents are disagree i.e. 34% and 28% are neutral from the above statements. But 20% of the respondents agree that legal formalities has increased because now they have to make bill and have a proof of everything they had to keep with them. But 34% of respondents disagreed with this statement. Classification of Respondents on the basis of their perception “Has GST increased the tax burden”? S No. Response 1 Strongly Agree 2 Agree 3 Neutral 4 Disagree 5 Strongly Disagree Above chart shown that majority of the respondents are disagree i.e. 34% and 28% rom the above statements. But 20% of the respondents agree that legal formalities has increased because now they have to make bill and have a proof of everything they had to keep with them. But 34% of respondents disagreed with this on of Respondents on the basis of their perception “Has GST increased the tax burden”? Response No. of Respondents Percentage (%) Strongly Agree 12 19 13 6 Strongly Disagree 0 50 Above chart shown that majority of the respondents are disagree i.e. 34% and 28% rom the above statements. But 20% of the respondents agree that legal formalities has increased because now they have to make bill and have a proof of everything they had to keep with them. But 34% of respondents disagreed with this on of Respondents on the basis of their perception “Has GST Percentage (%) 24 38 26 12 0 100

Interpretation: Above chart shows that maximum majority of respondents represents that there is an increase in tax burden on them so 38% are agreed and 24% are strongly agreed with this statement and also 26% are neutral but even 12% are disagreed for th statement. Hence, it is concluded that maximum respondents think that tax burdened has increased. Classification of respondents on the basis of their perception “Did govt. impose the GST without any Proper Preparation”? S No. Response 1 Strongly Agree 2 Agree 3 Neutral 4 Disagree 5 Strongly Disagree Above chart shows that maximum majority of respondents represents that there is an increase in tax burden on them so 38% are agreed and 24% are strongly agreed with this statement and also 26% are neutral but even 12% are disagreed for th statement. Hence, it is concluded that maximum respondents think that tax Classification of respondents on the basis of their perception “Did govt. impose the GST without any Proper Preparation”? Response No. of Respondents Percentage Strongly Agree 6 12 22 8 Strongly Disagree 2 50 Above chart shows that maximum majority of respondents represents that there is an increase in tax burden on them so 38% are agreed and 24% are strongly agreed with this statement and also 26% are neutral but even 12% are disagreed for this statement. Hence, it is concluded that maximum respondents think that tax Classification of respondents on the basis of their perception “Did govt. Percentage (%) 12 24 44 16 4 100

Interpretation: Above chart show that majority of the respondents i.e. 68% are positive and 28% are Negative and above statement depicts that there is an impact on purchasing power Because of GST and 4% of the respondents think that there is no impact. But majority Of the retailer's perception is that after GST implementation there is a big impact on the purchasing power of the customer's. Classification of Respondents On the basis of their perception "GST Impacted your income": S.NO Responses N.O of respondents

1 Increase 16 32 2 decrease 26 52 3 No change 8 16 total 50 100 Interpretation: Above chart depicts that there is about 52% decrease in the income of the retailers And 32% increase in the income of some retailers and 16% of the retailers have no Change in their income at the time of GST implementation and it is concluded that N.O of respondents 1 Increase 2 decrease 3 No change

52% of the respondents had lost their income because at that time prices of goods are very high due to high GST rates. Classification of Respondents On the basis of their perception "Satisfied With the tax bracket decided by the government": S.NO Response Respondents % 1 Yes 38 76 2 NO 12 24 Total 50 100 Interpretation: Above chart shows that majority of the respondents’ that is 76% are saying yes and 24% Arc saying No from the above statement. Hence, it is concluded that majority of the Respondents are satisfied with the tax bracket which shows that results are positive. Yes NO

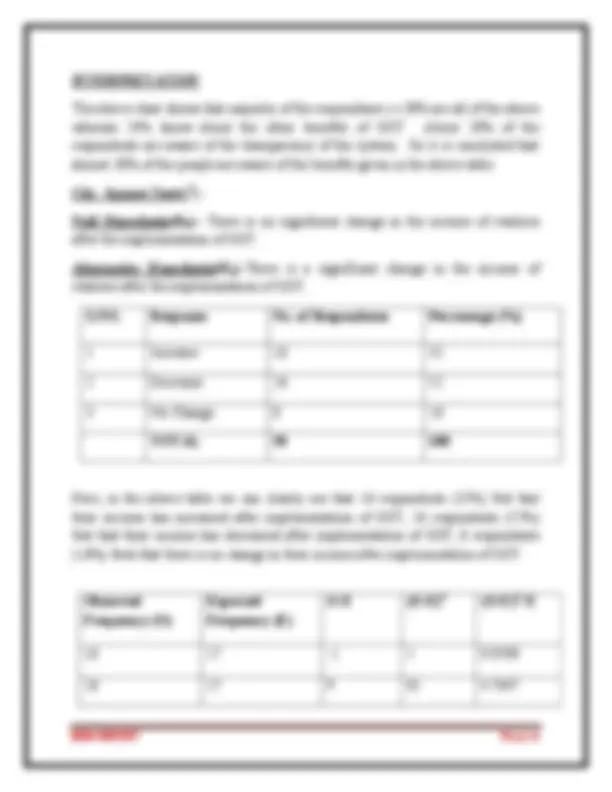

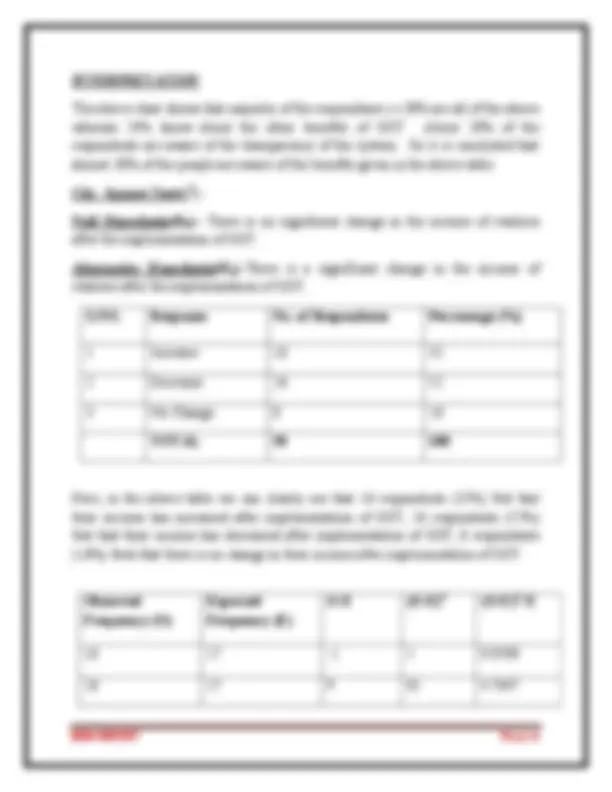

The above chart shows that majority of the respondents i.e.30% are all of the above whereas 24% know about the other benefits of GST. About 20% of the respondents are aware of the transparency of the system. So it is concluded that almost 30% of the people are aware of the benefits given in the above table. Chi - Square Test(χ 2 ) : Null Hypothesis(H 0 )– There is no significant change in the income of retailers after the implementation of GST. Alternative Hypothesis(Ha)–There is a significant change in the income of retailers after the implementation of GST. S.NO. Response No. of Respondents Percentage (%) 1 Increase 16 32 2 Decrease 26 52 3 No Change 8 16 TOTAL 50 100 Here, in the above table we can clearly see that 16 respondents (32%) feel that their income has increased after implementation of GST, 26 respondents (52%) feel that their income has decreased after implementation of GST, 8 respondents (16%) feels that there is no change in their income after implementation of GST. Observed Frequency (O) Expected Frequency (E)

2 (O-E) 2 / E 16 17 -1 1 0. 26 17 9 81 4.

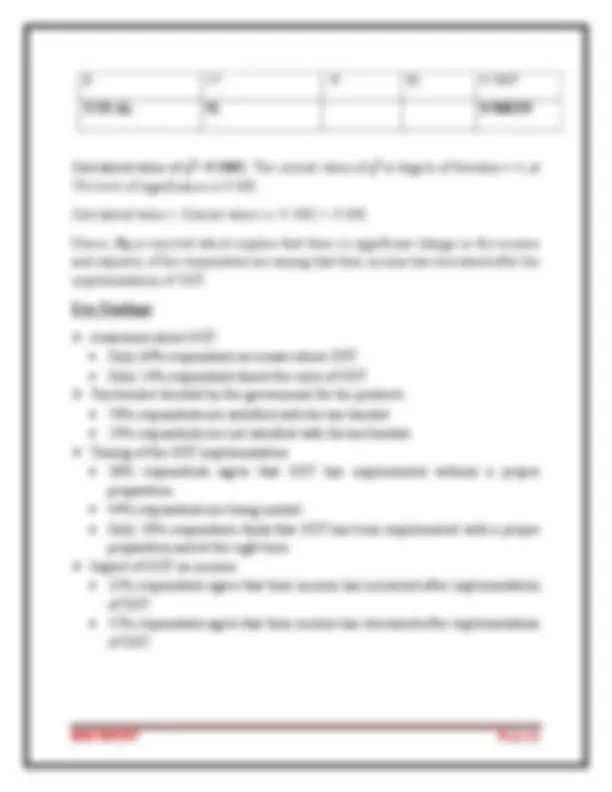

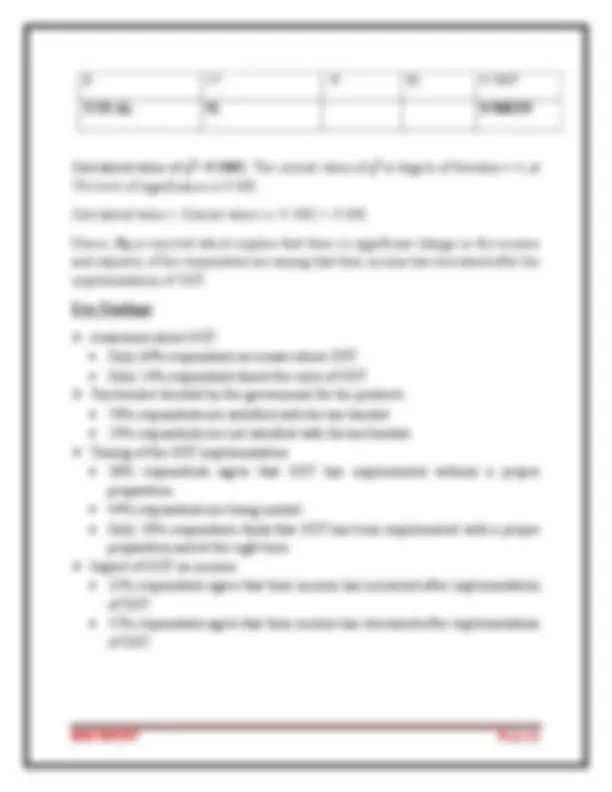

Calculated value of χ 2 = 9.5882. The critical value of χ 2 at degree of freedom = 4, at 5% level of significance is 9.488. Calculated value > Critical value i.e. 9.5882 > 9.488. Hence, H 0 is rejected which implies that there is significant change in the income and majority of the respondents are saying that their income has decreased after the implementation of GST. Key Findings: Awareness about GST Only 60% respondents are aware about GST. Only 24% respondents know the rules of GST. Tax bracket decided by the government for the products 76% respondents are satisfied with the tax bracket. 24% respondents are not satisfied with the tax bracket. Timing of the GST implementation 36% respondents agree that GST has implemented without a proper preparation. 44% respondents are being neutral. Only 20% respondents think that GST has been implemented with a proper preparation and at the right time. Impact of GST on income 32% respondents agree that their income has increased after implementation of GST. 52% respondents agree that their income has decreased after implementation of GST.