Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

This lecture is part of lecture series for Engineering Economics course at M. J. P. Rohilkhand University. It was delivered by Dr. Badrinath Singh to cover following points: Supply, Demand, Markets, Work, Forces, Perfect, Competition, Monopoly, Quantity, Law, Curve

Typology: Slides

1 / 9

This page cannot be seen from the preview

Don't miss anything!

Cost-Dominated cash flow analysis

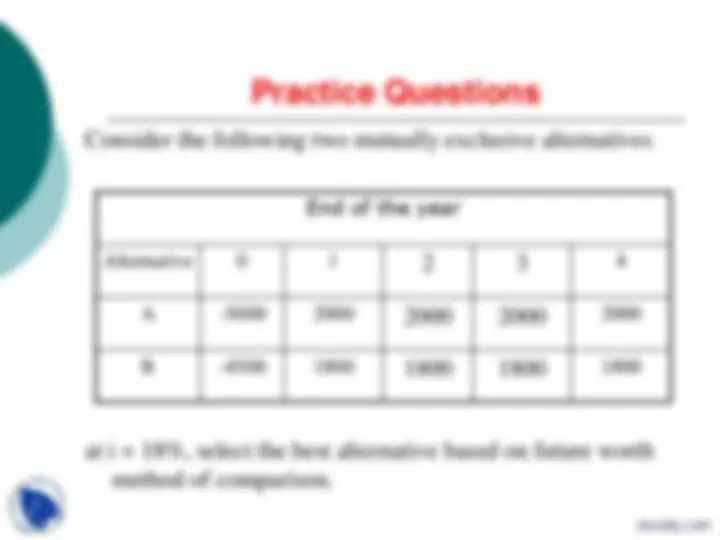

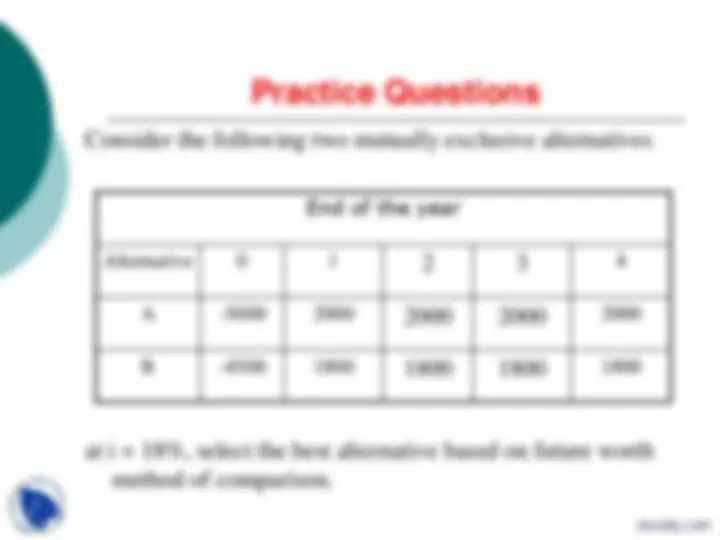

Consider the following two mutually exclusive alternatives

at i = 18%, select the best alternative based on future worth

method of comparison.

End of the year

Alternative 0 1 2 3 4

A -5000 2000 2000 2000 2000

B -4500 1800 1800 1800 1800

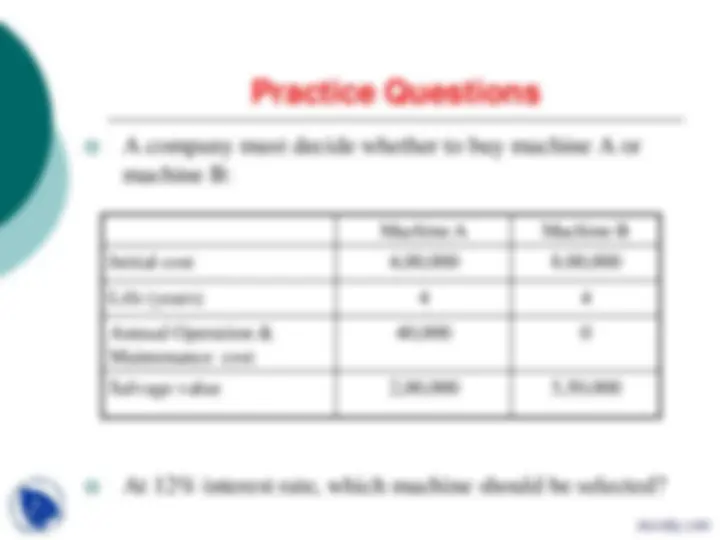

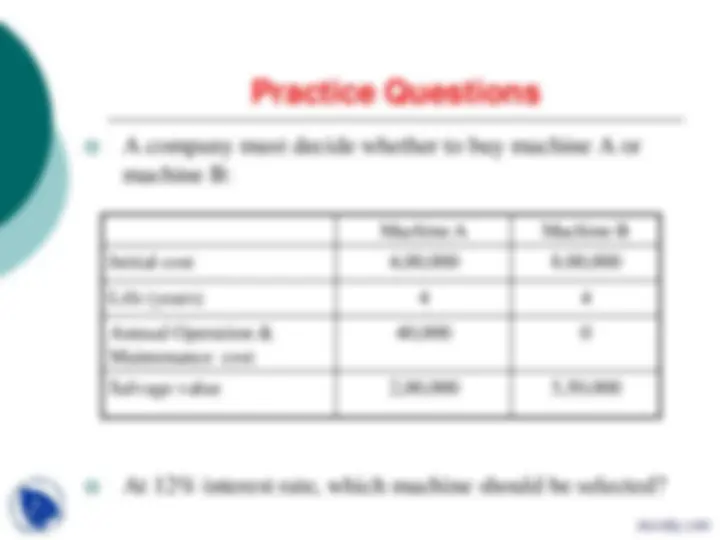

The cash flows of two mutually exclusive alternatives are

given as: all figures in (000)

Select the best alternative based on future worth method

at i = 8%

Option A

Option B

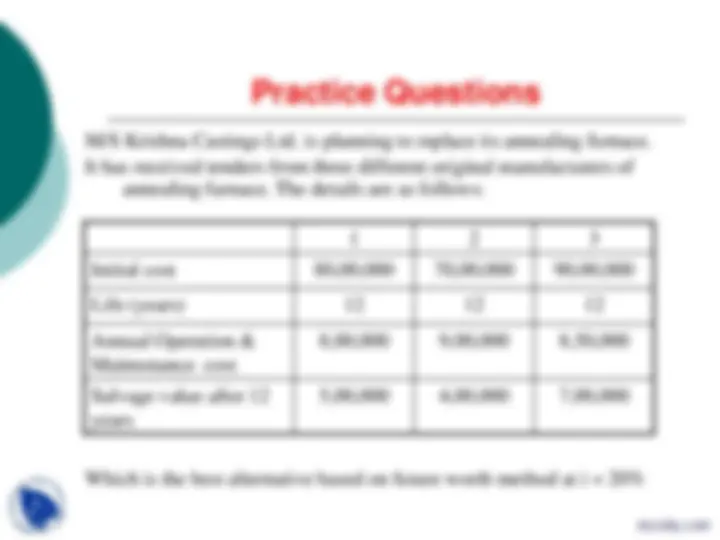

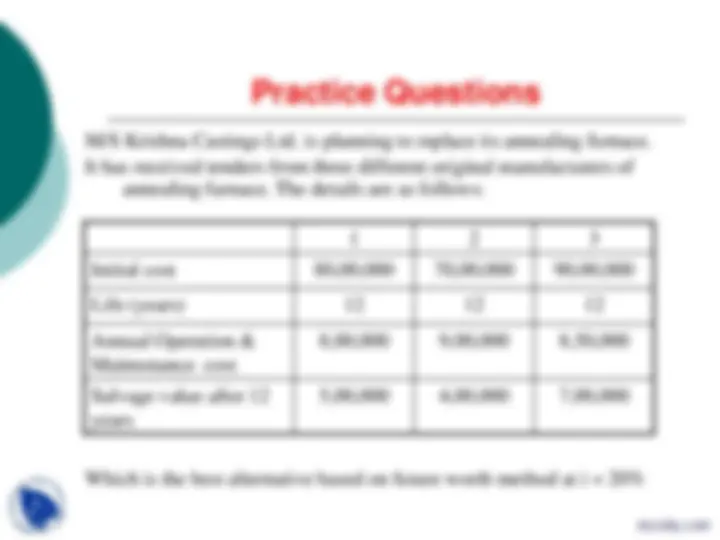

M/S Krishna Castings Ltd. is planning to replace its annealing furnace.

It has received tenders from three different original manufacturers of annealing furnace. The details are as follows:

Which is the best alternative based on future worth method at i = 20%

Initial cost 80,00,000 70,00,000 90,00, Life (years) 12 12 12 Annual Operation & Maintenance cost

Salvage value after 12 years