Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

An in-depth analysis of a company's financial statements, focusing on comprehensive income and cash flows from operating, investing, and financing activities. It includes sections on profit for the year, other comprehensive income, cash flows from operating activities, and cash flows from investing activities. The document also covers topics such as interest and fees received, interest and commission paid, loans and advances, and impairment allowances.

Typology: Study notes

1 / 43

This page cannot be seen from the preview

Don't miss anything!

Assets Cash and cash equivalent^ Note 4.1^ Current Year^ Previous Year^ Current Year^ Previous Year Due from Nepal Rastra Bank Placement with Bank and Financial Institutions Derivative financial instruments (^) 4.24.34. Other trading assets Loan and advances to B/FIs Loans and advances to customers 4.54.64. Investment securities Current tax assets Investment in susidiaries (^) 4.104.84. Investment in associates Investment property Property and equipment 4.114.124. Goodwill and Intangible assets Deferred tax assets Other assets 4.144.154. Total Assets Note Current Year Previous Year Current Year Previous Year Liabilities Due to Bank and Financial Instituions Due to Nepal Rastra Bank 4.174. Derivative financial instruments Deposits from customers Borrowing 4.194.204. Current Tax Liabilities Provisions Deferred tax liabilities 4.224.154. Other liabilities Debt securities issued Subordinated Liabilities 4.234.244. Total liabilities Equity Share capital (^) 4. Share premium Retained earnings Reserves 4. Total equity attributable to equity holders Non-controlling interest Total equity Total liabilities and equity Contingent liabilities and commitment Net assets value per share 4.

Group Bank

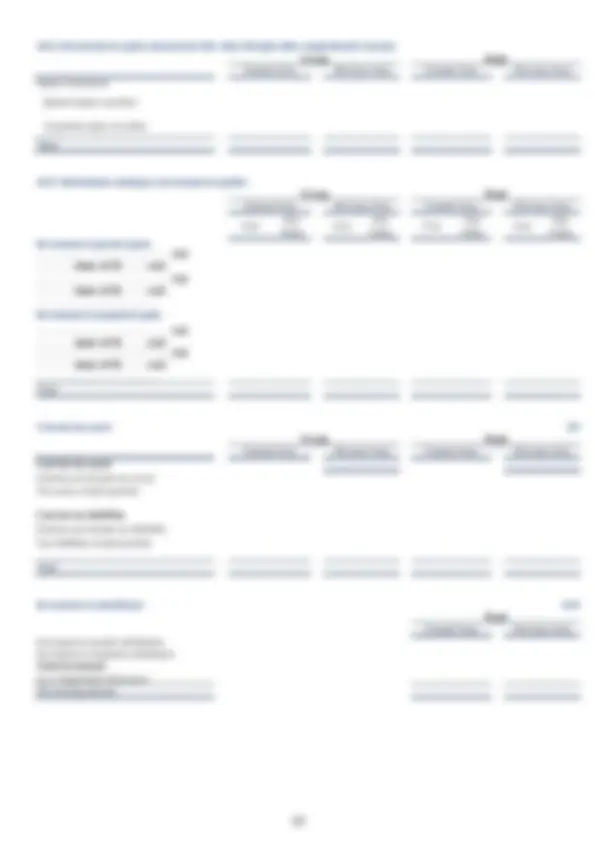

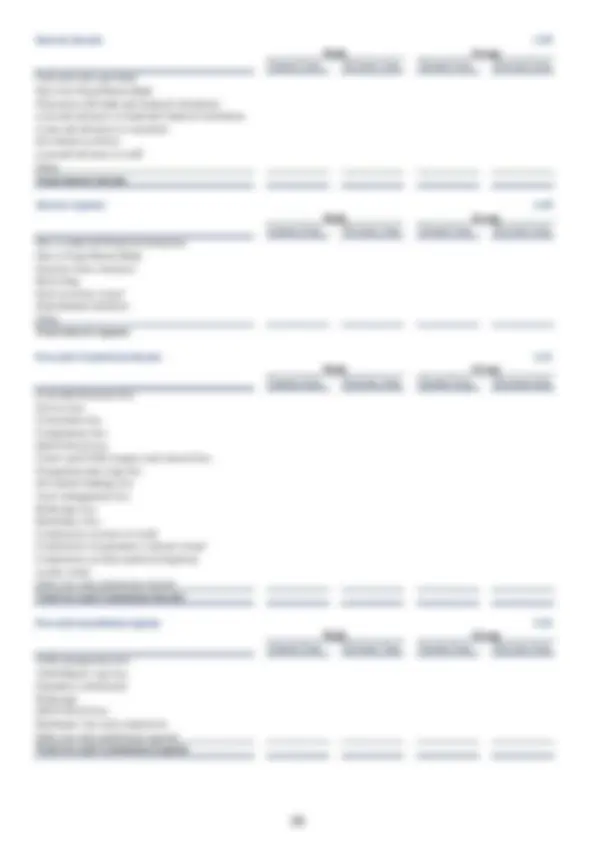

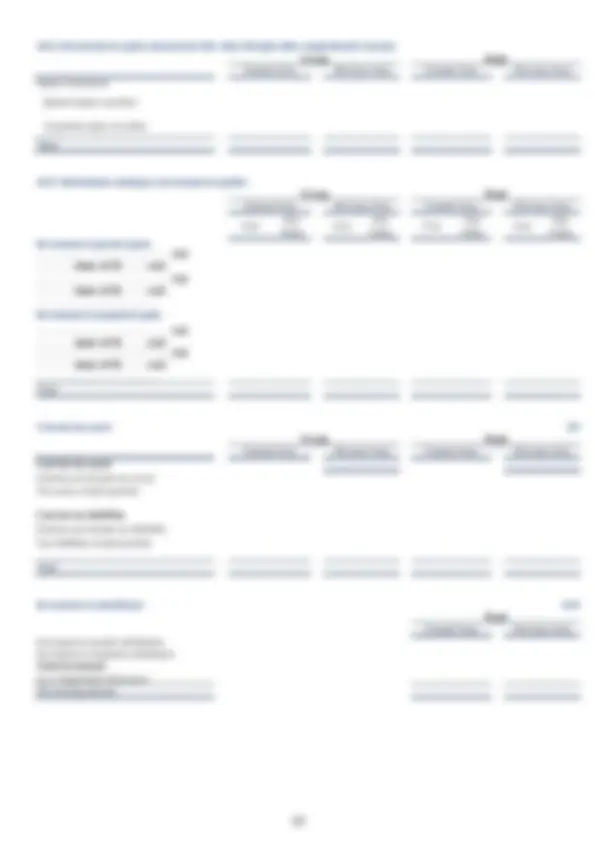

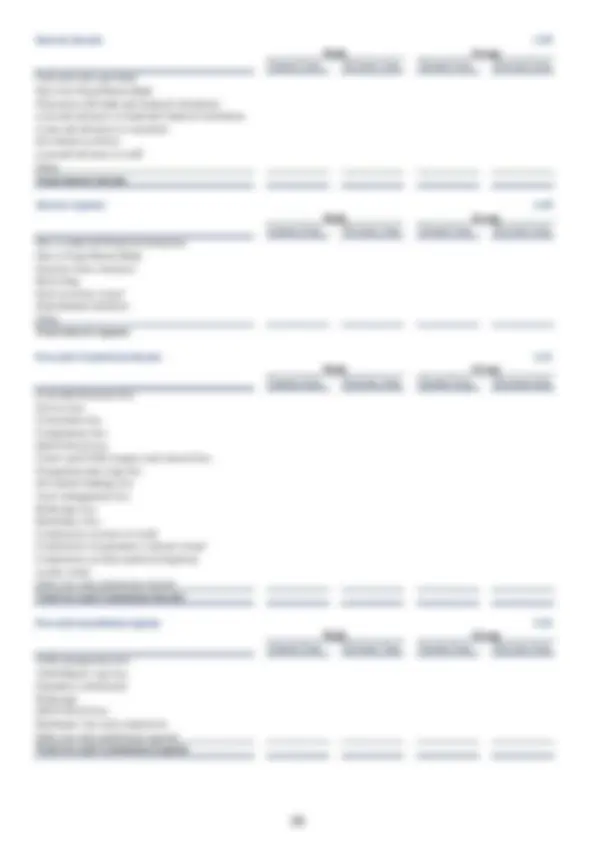

Other comprehensive income, net of income tax Fair value reserve (Investment in equity instrument):^ Note^ Current Year^ Previous Year^ Current Year^ Previous Year Net gain (loss) on revalution^ Net change in fair value^ Net amount transferred to profit or loss Cash flow hedges: Effective portion of changes in fair value Net Amount reclassified to profit or loss Net actuarial gain/loss on defined benefit plans Income Tax relating to all components of Other Comprehensive Income Other comprehensive income for the period, net of income tax Total comprehensive income for the period Total comprehensive income attributable to:

Total comprehensive income for the period^ Equity holders of the Bank^ Non-controlling interest

Group Bank

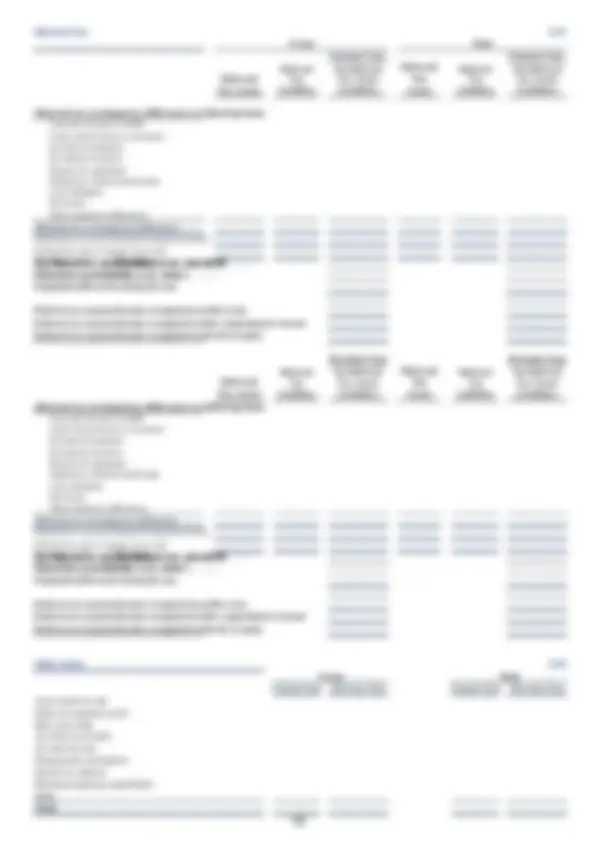

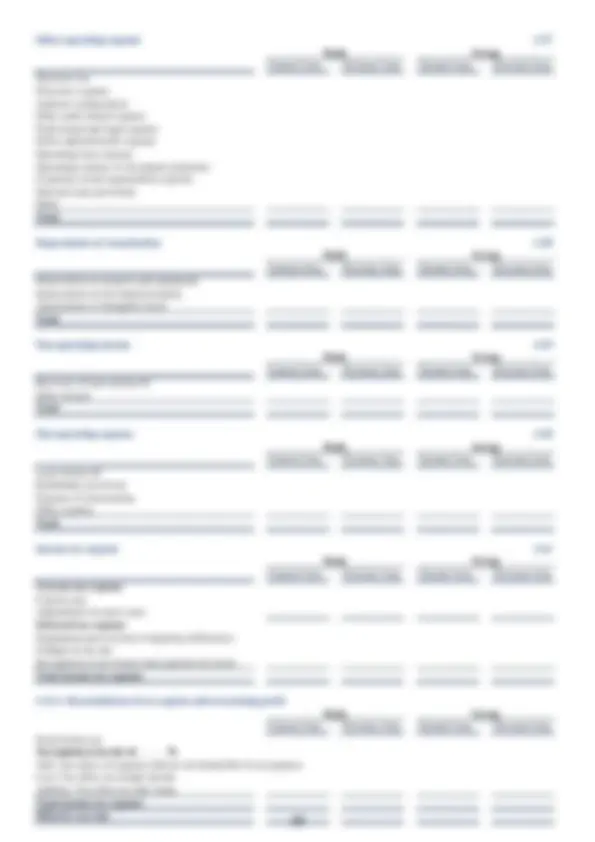

Consolidated Statement of changes in equity For the year ended ……..Asar 20…… Balance at Sawan 1, 20…. Adjustment/Restatement Capital^ Share premium^ Share^ Generalreserve equalisation^ Exchangereserve^ Regulatoryreserve^ Fair valuereserve^ Revaluationreserve^ Retainedearning reserve^ Other^ Total Adjusted/Restated balance at Sawan 1, 20….. Comprehensive income for the year Profit for the year Other comprehensive income, net of tax Remeasurements of defined benfit liability (assets) Fair value reserve (Investment in equity instrument): Net change in fair value Net amount transferred to profit or loss Net gain (loss) on revalution Cash flow hedges: Effective portion of changes in fair value Net Amount reclassified to profit or loss Total comprehensive income for the year Transfer to reserve during the year Transfer from reserve during the year Transactions with owners, directly recognised in equity Right share issued Share based payments Dividends to equity holders Bonus shares issued Balance at Asar end 20…..^ Total contributions by and distributions^ Cash dividend paid Balance at Sawan 1, 20…… Adjustment/Restatement Adjusted/Restated balance at Sawan 1, 20….. Comprehensive income for the year Profit for the year Other comprehensive income, net of tax Remeasurements of defined benfit liability (assets) Fair value reserve (Investment in equity instrument): Net gain (loss) on revalution Cash flow hedges:^ Net change in fair value^ Net amount transferred to profit or loss Total comprehensive income for the year Transfer to reserve during the year^ Effective portion of changes in fair value^ Net Amount reclassified to profit or loss Transfer from reserve during the year Transactions with owners, directly recognised in equity Right share issued Share based payments Dividends to equity holders Total contributions by and distributions Bonus shares issued Cash dividend paid Balance at Asar end 20…..

Attributable to equity holders of the Bank^ Group (^) Non-controllinginterest equity Total

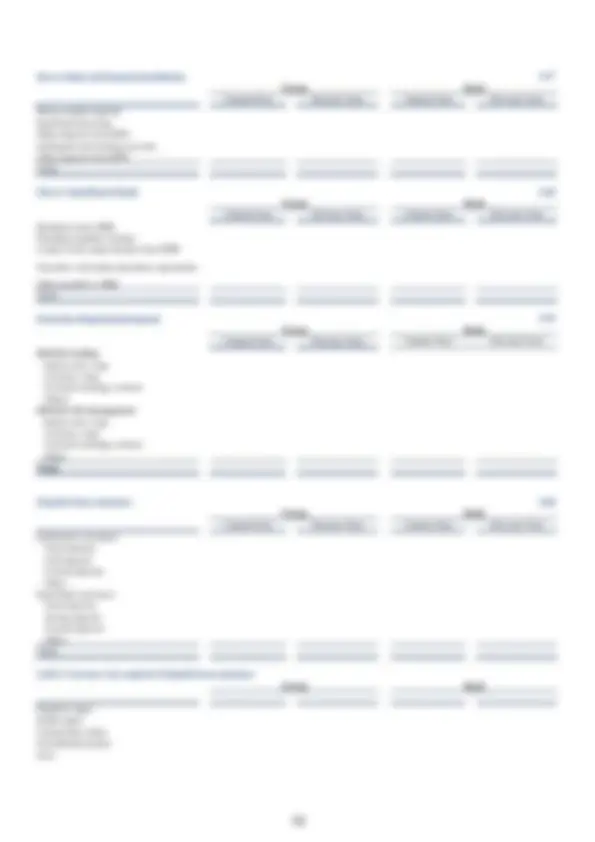

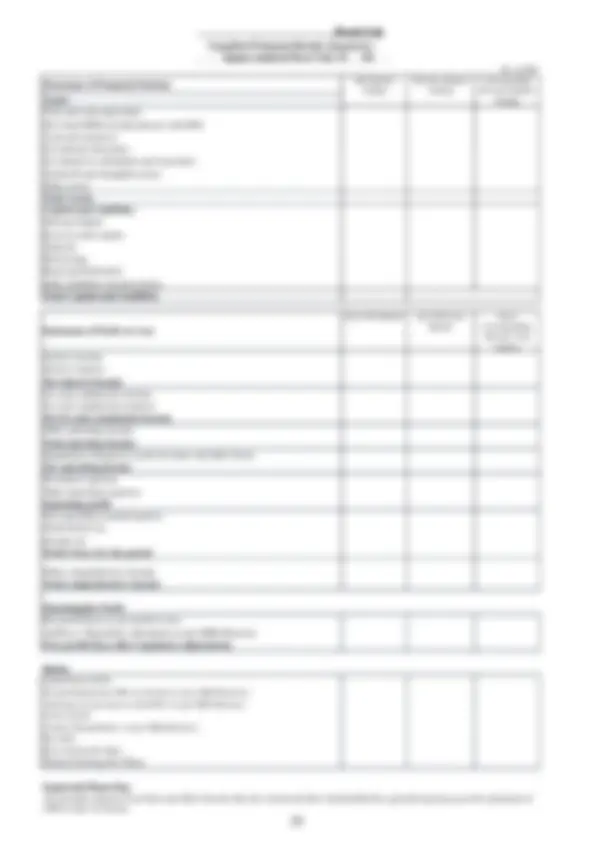

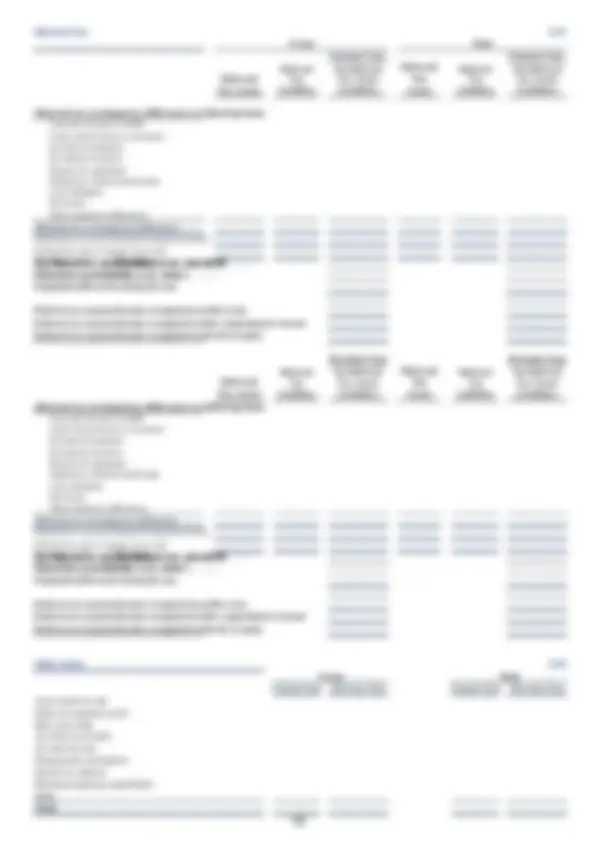

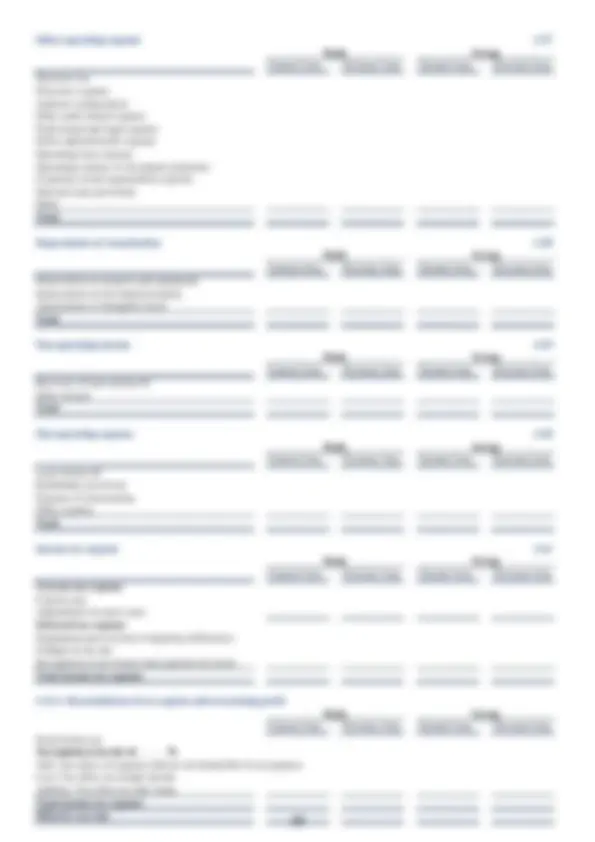

Consolidated Statement of cash flows For the year ended …….. Asar 20…….

CASH FLOWS FROM OPERATING ACTIVITIES Interest received^ Current Year^ Previous Year^ Current Year^ Previous Year Fees and other income received Divided received Receipts from other operating activities Interest paid Commission and fees paid Cash payment to employees Other expense paid Operating cash flows before changes in operating assets and liabilities (Increase)/Decrease in operating assets Due from Nepal Rastra Bank Placement with bank and financial institutions Other trading assets Loan and advances to bank and financial institutions Loans and advances to customers Other assets Increase/(Decrease) in operating liabilities Due to bank and financial institutions Due to Nepal Rastra Bank Deposit from customers Borrowings Other liabilities Net cash flow from operating activities before tax paid Income taxes paid Net cash flow from operating activities CASH FLOWS FROM INVESTING ACTIVITIES Purchase of investment securities Receipts from sale of investment securities Purchase of property and equipment Receipt from the sale of property and equipment Purchase of intangible assets Receipt from the sale of intangible assets Purchase of investment properties Receipt from the sale of investment properties Interest received Dividend received Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES Receipt from issue of debt securities Repayment of debt securities Receipt from issue of subordinated liabilities Repayment of subordinated liabilities Receipt from issue of shares Dividends paid Interest paid Other receipt/payment Net cash from financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at Sawan 1, 20……. Effect of exchange rate fluctuations on cash and cash equivalents held Cash and cash equivalents at Asar end 20…..

Group Bank

……………………………………………….Notes to the consolidated financial statements Bank Ltd. 1 Reporting entity^ for the year ended ……Asar…….. G sheneall raallso a nind baccludekg trhounde pri (^) nIcnifpoarlm aactitionviti ofes Bandank l (^) oorca Fitionna nofci athel I nsheadtitu toionffice an ofd itthes s ubrepsiodritaingry. enThtitisy. (^2) 2.1 (^) B St a a si te s m of ent P re of p co ar m at p io li n ance 2.2 2.3 RFuncepotritoninga (^) lpe anrd piodr andesen atapptiorovn cual (^) rofrency financial statements 2.4 2.5 UCsehan ofg (^) esE sitnim Aactcoues, anstisngum poptilonsicies and judgments 2.6 2.7 NNeew st aSndatandrdsar (^) dsin andissue in butterp nroteta ytieton e ffnotec tadaivepted 2.8 Discounting (^3) 3.1 (^) S B ig asi n s if of ica M nt e A asu cc r o e un ment ting Policies 3.2 B a. Busasis ofine csonss coomlidbainationtion b. non c c. Subsiodniatrrioeslling interest (NCI) d. Loss e. Spec (^) ioafl PCuornpotrosle Entity (SPE) 3.3 fC.^ aTsrh andansac cationsh eq^ elimuiivnaaltieonnt^ on^ consolidation 3.4 Fin Recoangcniaitli (^) onassets and financial liabilities C Mleasassiufricematienton D Dee-terecormignnaititioonn of fair value 3.5 ITmradpaiirngm entassets 3.6 3.7 DProperivearttyiv and Eqes assets and derivative liabilitiesuipment 3.8 Goodwill Intangible assets

Cash and cash equivalent Cash in hand Balances with B/FIs Money at call and short notice Other Total Due from Nepal Rastra Bank Statutory balances with NRB Securities purchased under resale agreement Other deposit and receivable from NRB Total

Placement with domestic B/FIs Placement with foreign B/FIs Less: Allowances for impairment Total Derivative financial instruments Held for trading Interest rate swap Currency swap Held for risk management^ Forward exchange contract^ Others Interest rate swap Currency swap Forward exchange contract Total^ Other Other trading assets Teasury bills Government bonds NRB Bonds Domestic Corporate bonds Equities Other Total Pledged Non-pledged Loan and advances to B/FIs Loans to microfinance institutions Other Less: Allowances for impairment Total

Previous Year

Previous Year

Current Year^ Group

Current Year

Group

Group

Current Year Previous Year

Current Year

Previous Year

Previous Year

Current Year

Current Year^ Group Previous Year Current Year^ Bank Previous Year^ 4.

Current Year Previous Year

Current Year^ Bank Previous Year^ 4.

Current Year^ Bank Previous Year^ 4.

Current Year Previous Year^ 4.

Group Bank^ 4.

Group (^) Current Year Bank Previous Year^ 4.

Placements with Bank and Financial Instituitions

Bank

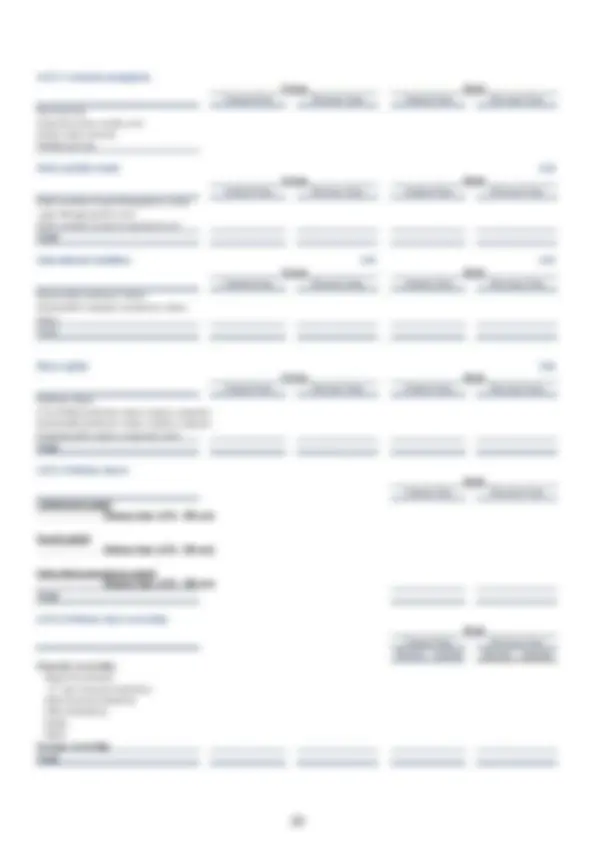

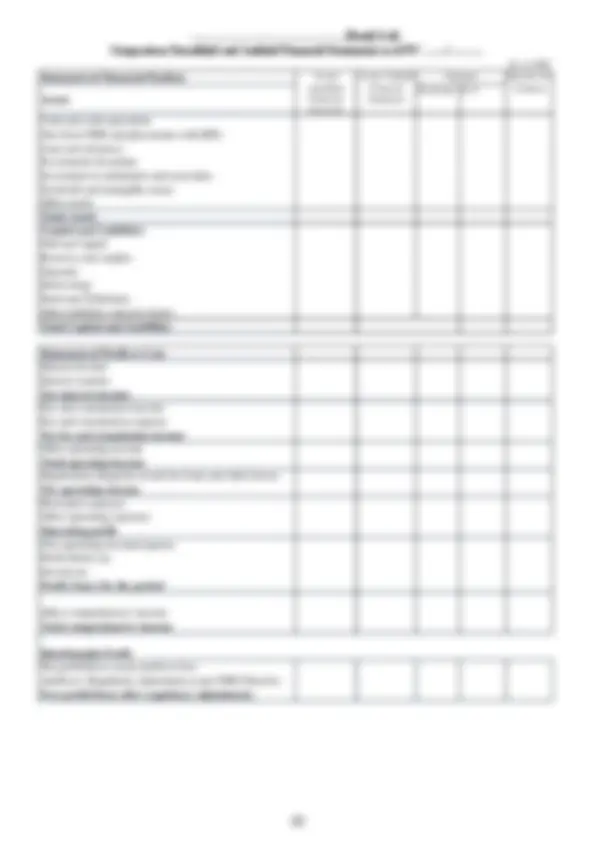

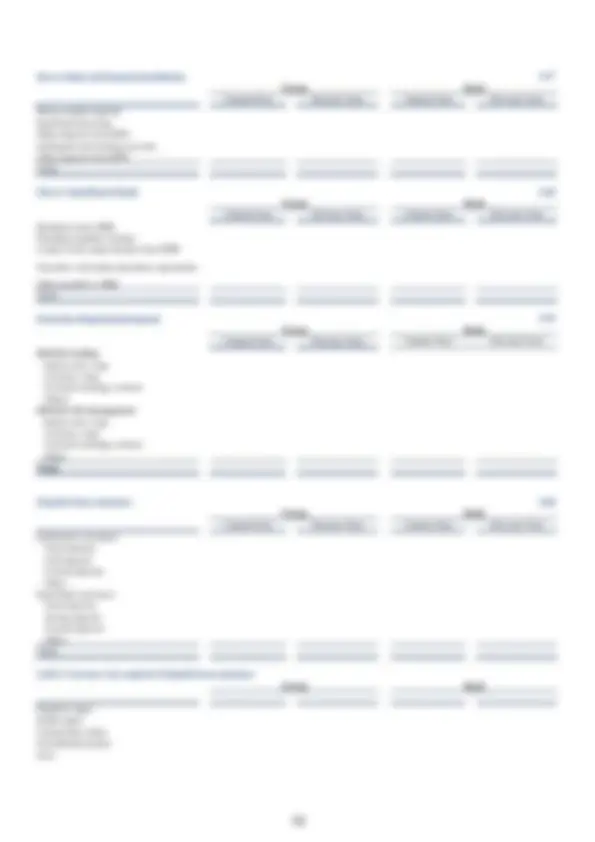

4.6.1: Allowances for impairment Balance at Sawan 1 Impairment loss for the year: Charge for the year Amount written off Balance at Asar end^ Recoveries/reversal Loans and advances to customers Loan and advances measured at amortizedcost Less: Impairment allowances Collective impairment Individual impairment Net amount Loan and advances measured at FVTPL Total

Product Term loans Overdraft Trust receipt/Import loans Demand and other working capital loans Personal residential loans Real estate loans Margin lending loans Hire purchase loans Deprived sector loans Bills purchased Staff loans Interest receivable^ Other^ Sub total Grand total

Nepalese rupee Indian rupee United State dollar Great Britain pound Euro Japenese yen Chinese yuan Other Total

Previous Year

Previous Year

Previous Year

Current Year

Current Year

Current Year

Current Year Previous Year^ 4.

Current Year Previous Year

4.7.2: Analysis of loan and advances - By Currency Current Year Previous Year

4.7.1: Analysis of loan and advances - By Product

Group Bank

Group Bank

Group Bank

Equity instruments Quoted equity securities

Total^ Unquoted equity securities

Investment in quoted equity …………………………………….Ltd.^ Cost^ ValueFair^ Cost^ ValueFair^ Cost^ ValueFair^ Cost^ ValueFair …………shares of Rs. …….each …………………………………….Ltd.…………shares of Rs. …….each ………………………………. Investment in unquoted equity …………………………………….Ltd. …………shares of Rs. …….each …………………………………….Ltd.…………shares of Rs. …….each ………………………………. Total Current tax assets Current tax assets Current year income tax assets Tax assets of prior periods Current tax liabilities Current year income tax liabilities Tax liabilities of prior periods Total Investment in subsidiaries Investment in quoted subsidiaries Investment in unquoted subsidiaries Total investment Less: Impairment allowances Net carrying amount

Previous Year

Current Year Previous Year

Current Year

Current Year Previous Year

4.8.2: Investment in equity measured at fair value through other comprehensive income Current Year Previous Year

Current Year Previous Year

Current Year Previous Year^ 4.

Current Year Previous Year^ 4.

Group Bank

Group Bank

Bank

Group

4.8.3: Information relating to investment in equities

Bank

4.10.1: Investment in quoted subsidiaries

…………………………………….Ltd.^ Cost^ ValueFair^ Cost^ ValueFair …………shares of Rs. …….each …………………………………….Ltd.…………shares of Rs. …….each ………………………………. Total

…………………………………….Ltd.…………shares of Rs. …….each^ Cost^ ValueFair^ Cost^ ValueFair …………………………………….Ltd.…………shares of Rs. …….each ………………………………. Total

…………………………………….Ltd. …………………………………….Ltd. …………………………………….Ltd. …………………………………….Ltd. …………………………….

Equity interest held by NCI (%) Profit/(loss) allocated during the year^ ...Ltd^ …Ltd.^ …Ltd^ …Ltd. Accumulated balances of NCI as on Asar end…….. Dividend paid to NCI Equity interest held by NCI (%) Profit/(loss) allocated during the year^ ...Ltd^ …Ltd.^ …Ltd^ …Ltd. Accumulated balances of NCI as on Asar end…….. Dividend paid to NCI Investment in associates Investment in quoted associates Investment in unquoted associates Total investment Less: Impairment allowances Net carrying amount

Group Previous Year

4.10.2: Investment in unquoted subsidiaries

Current Year Previous Year

Current Year

Group

Current Year Previous Year

Current Year Previous Year

4.10.3: Information relating to subsidiaries of the Bank

Current Year^ Bank Previous Year^ 4.

Bank

Bank

Percentage of ownership held by the Bank Current Year^ Bank Previous Year

4.10.4: Non controlling interest of the subsidiaries

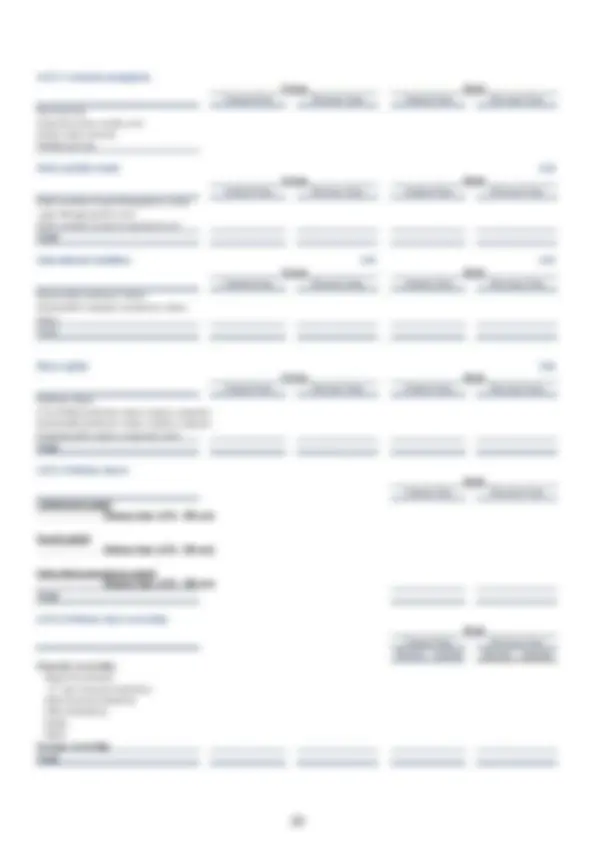

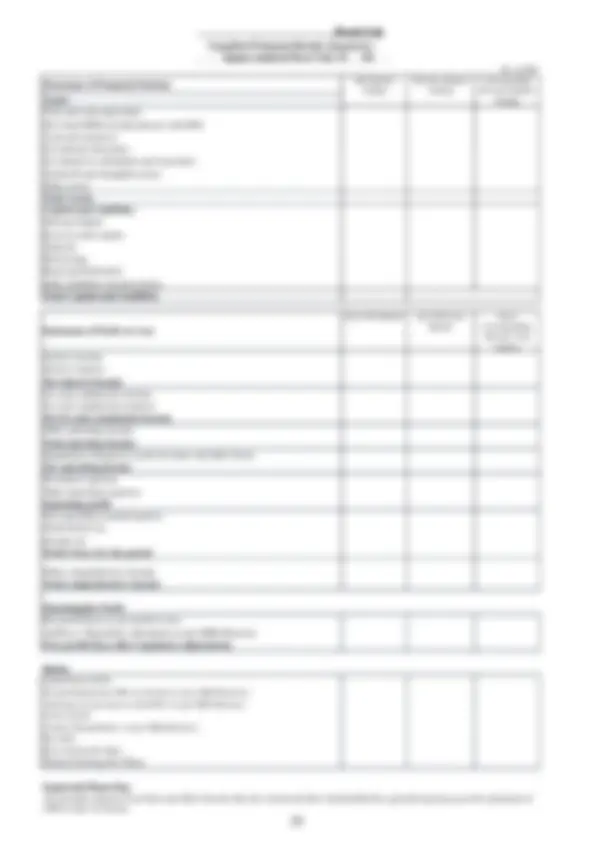

Property and Equipment 4. Cost As on Sawan 1, 20X0 Addition during the Year Disposal during the year^ Acquisition^ Capitalization Adjustment/Revaluation Balance as on Asar end 20X Addition during the Year Acquisition Capitalization Disposal during the year Adjustment/Revaluation Balance as on Asar end 20X Depreciation and Impairment As on Sawan 1, 20X0 Depreciation charge for the Year Impairment for the year Disposals Adjustment As on Asar end 20X1 Impairment for the year Depreciation charge for the Year Disposals Adjustment As on Asar end 20X Capital Work in Progress Net Book Value As on Asar end 20X0 As on Asar end 20X1 As on Asar end 20X

Cost As on Sawan 1, 20X0 Addition during the Year Disposal during the year^ Acquisition^ Capitalization Adjustment/Revaluation Balance as on Asar end 20X Addition during the Year Acquisition Capitalization Disposal during the year Adjustment/Revaluation Balance as on Asar end 20X Depreciation and Impairment As on Sawan 1, 20X0 Depreciation charge for the Year Impairment for the year Disposals Adjustment As on Asar end 20X1 Impairment for the year Depreciation charge for the Year

Particulars Land Building LeaseholdProperties^ Group Machinery^ Total Asarend 20X

Particulars Land Building LeaseholdProperties^ Computer &Accessories Vehicles BankFurniture& Fixture Machinery Equipment& Others Asar 20X2^ Total 31st^ Total AsarEnd 20X

Computer &Accessories Vehicles Furniture& Fixture Equipment& Others Total AsarEnd 20X

Disposals Adjustment As on Asar end 20X Capital Work in Progress Net Book Value As on Asar end 20X0 As on Asar end 20X1 As on Asar end 20X

Goodwill and Intangible Assets 4. Purchased Developed

Purchased Developed

Goodwill^ Software Other^ Total Asarend 20X2^ Total Asarend 20X

Disposal during the year Adjustment/Revluation

Balance as on Asar end 20X1 Addition during the Year Acquisition Capitalization

Cost^ Particulars As on Sawan 1, 20X0 Addition during the Year Disposal during the year Adjustment/Revaluation^ Acquisition^ Capitalization

Net Book Value

As on Asar end 20X1^ Adjustment Disposals Adjustment Capital Work in Progress

As on Sawan 1, 20X0 Amortization charge for the Year Impairment for the year Disposals

Amortization and Impairment

Amortization charge for the Year Impairment for the year

Cost As on Sawan 1, 20X0 Addition during the Year Acquisition Capitalization

Particulars (^) Goodwill^ Bank^ Software Other Total Asarend 20X2^ Total Asarend 20X

Group

As on Asar end 20X As on Asar end 20X0 As on Asar end 20X1 As on Asar end 20X

Balance as on Asar end 20X

Disposal during the year Adjustment/Revaluation Balance as on Asar end 20X

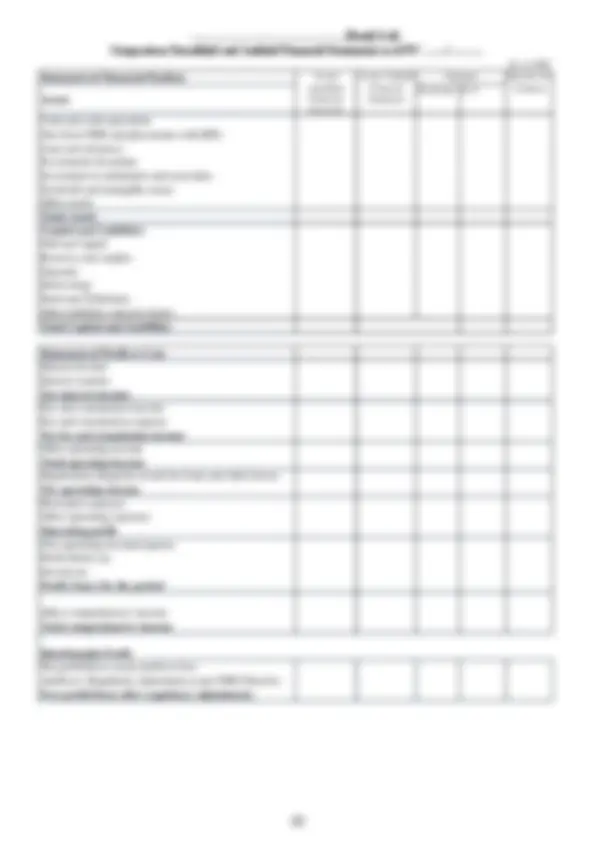

Deferred Tax (^) Current Year Current Year4. Tax Assets^ Deferred Liabilities^ DeferredTax^ Net DeferredTax Assets/(Liabilities)^ DeferredAssetsTax Liabilities^ DeferredTax^ Net DeferredTax Assets/(Liabilities) Deferred tax on temporory differences on following items Loan and Advance to B/FIs Loans and advances to customers Investment properties Investment securities Property & equipment Employees' defined benefit plan Lease liabilities Provisions Deferred tax on carry forward of unused tax losses^ Deferred tax on temporory differences^ Other temporory differences Deferred tax due to changes in tax rate Net Deferred tax asset/(liabilities) as on year end of …….. Deferred tax (asset)/liabilities as on sawan 1, …….. Origination/(Reversal) during the year Deferred tax expense/(income) recognised in profit or loss Deferred tax expense/(income) recognised in other comprehensive income Deferred tax expense/(income) recognised in directly in equity Deferred^ Previous Year^ Previous Year Deferred tax on temporory differences on following items Loan and Advance to B/FIs Tax Assets Liabilities^ DeferredTax^ Net DeferredTax Assets/(Liabilities)^ DeferredAssetsTax Liabilities^ DeferredTax^ Net DeferredTax Assets/(Liabilities) Loans and advances to customers Investment properties Investment securities Property & equipment Employees' defined benefit plan Lease liabilities Deferred tax on temporory differences^ Provisions^ Other temporory differences Deferred tax on carry forward of unused tax losses Deferred tax due to changes in tax rate Net Deferred tax asset/(liabilities) as on year end of …….. Deferred tax (asset)/liabilities as on sawan 1, …….. Origination/(Reversal) during the year Deferred tax expense/(income) recognised in profit or loss Deferred tax expense/(income) recognised in other comprehensive income Deferred tax expense/(income) recognised in directly in equity

Current Year Previous Year Current Year Previous Year^ 4.

Group Bank

Group Bank

Total

Other assets Assets held for sale Other non banking assets Bills receivable Accounts receivable Accrued income Prepayments and deposit Income tax deposit Deferred employee expenditure Other

Due to Bank and Financial Institutions Money market deposits Interbank borrowing Other deposits from BFIs Settlement and clearing accounts Other deposits from BFIs Total Due to Nepal Rastra Bank Refinance from NRB Standing Liquidity Facility Lender of last report facility from NRB Securities sold under repurchase agreements Other payable to NRB Total Derivative financial instruments Held for trading Interest rate swap Currency swap Held for risk management^ Forward exchange contract^ Others Interest rate swap Currency swap Forward exchange contract Total^ Other Deposits from customers Institutions customers: Term deposits Call deposits Individual customers:^ Current deposits^ Other Term deposits Saving deposits Current deposits Total^ Other Nepalese rupee Indian rupee United State dollar Great Britain pound Euro

Current Year Previous Year

Current Year Previous Year

Current Year Previous Year

Current Year Previous Year Current Year

Current Year Previous Year^ 4.

Previous Year^ 4.

Current Year Previous Year^ 4.

Current Year Previous Year^ 4.

Group Bank

Group Bank

Group Bank

Group Bank

4.20.1: Currency wise analysis of deposit from customers Group Bank