Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

An in-depth understanding of financial ratio analysis, focusing on the importance of making absolute figures relative and calculating return on capital employed (roce). It covers the key steps of financial ratio analysis, various profitability ratios, and their significance in evaluating a company's financial health.

Typology: Lecture notes

1 / 61

This page cannot be seen from the preview

Don't miss anything!

2

4

Core Ratios

**1. RETURN ON EQUITY (ROE) aka RETURN ON ORDINARY SHAREHOLDERS FUNDS

And thus the performance has declined overall…

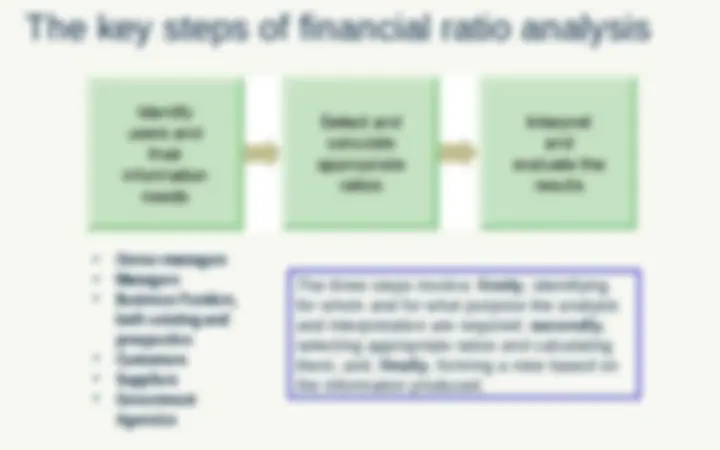

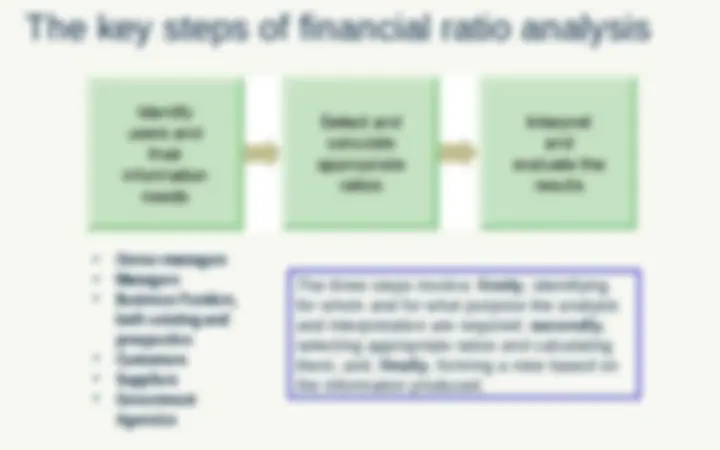

The key steps of financial ratio analysis The three steps involve: firstly , identifying for whom and for what purpose the analysis and interpretation are required; secondly , selecting appropriate ratios and calculating them; and, finally , forming a view based on the information produced.

Liquidity – concerned with the ability to meet short-term obligations

10 From a statement of cash flows

11

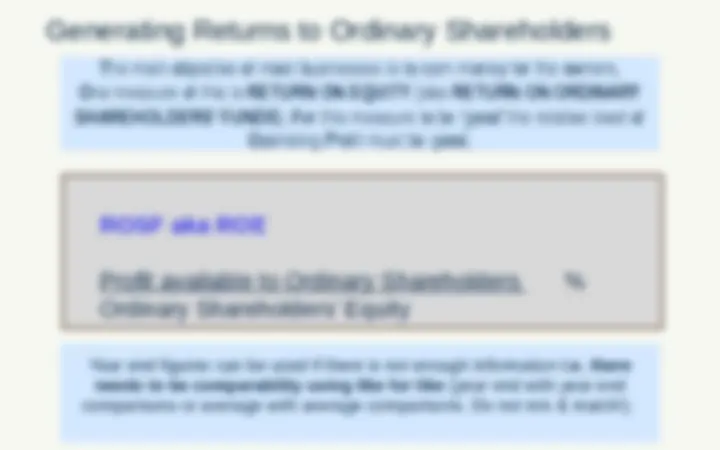

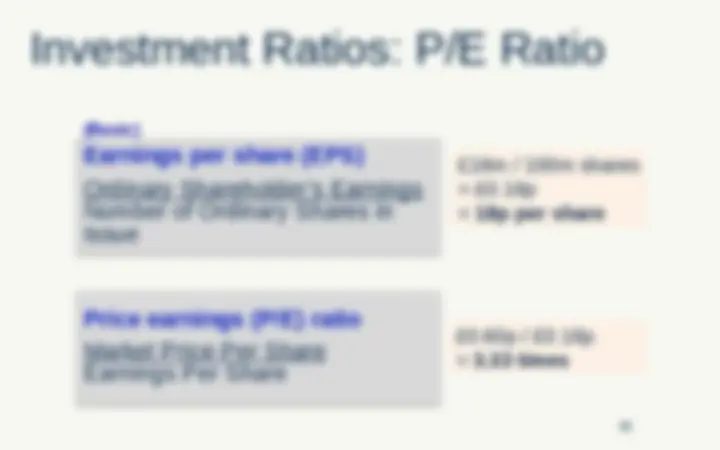

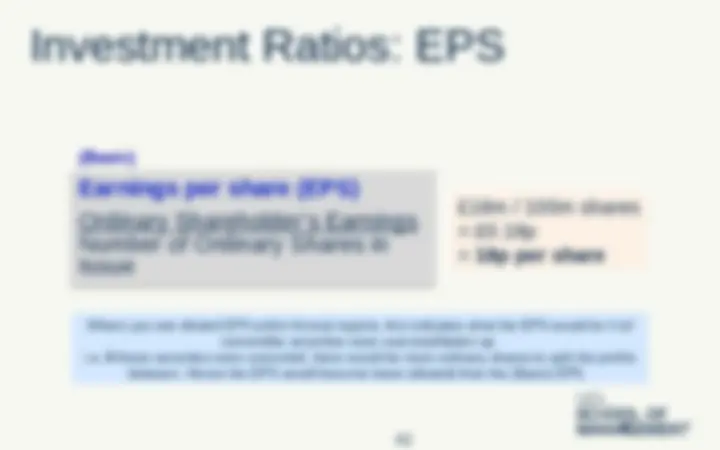

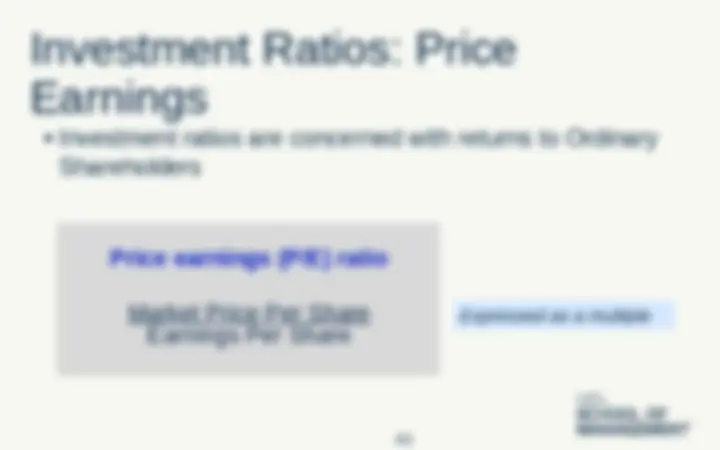

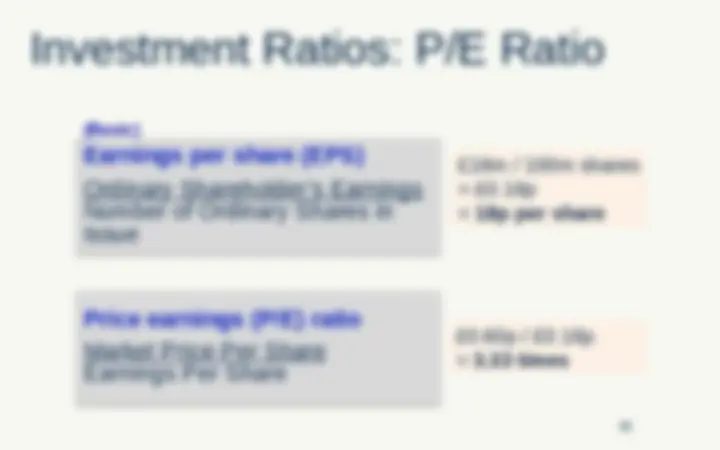

Generating Returns to Ordinary Shareholders

Year end figures can be used if there is not enough information i.e. there needs to be comparability using like for like (year end with year end comparisons or average with average comparisons. Do not mix & match!). ROSF aka ROE Profit available to Ordinary Shareholders % Ordinary Shareholders’ Equity

Profitability Ratios: Return on Equity (ROE)

Year end figures can be used if there is not enough information i.e. there needs to be comparability using like for like (year end with year end comparisons or average with average comparisons. Do not mix & match!). ROSF aka ROE Profit available to Ordinary Shareholders Ordinary Shareholders’ Equity £18m £63m = 28.57%

These Ratios may be compared with targets for the year, with competitors’, and with industry averages, and when older than one year, with those of previous years

(Net Asset Turnover) ... SALES TA - CL Expressed as a factor £23m (NCL Loan £50m

- Current Liabilities £7m figure of £113m is the same as the Total Capital Employed figure of £113m Profitability Ratios: Return on Capital Employed Expressed as a %

Asset Turn and Operating Profit Margin are the drivers of the ROCE ratio Operating Profit % 15.33% Net Asset Turn 1.33 times ROCE 20.39% Allow for rounding!

=