Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

An analysis of wholesale prices, cost of living indices, public debt composition, and economic development expenditures in Egypt, Iran, Jordan, Syria, and Turkey. the impact of these factors on price movements and terms of trade.

What you will learn

Typology: Slides

1 / 177

This page cannot be seen from the preview

Don't miss anything!

·---, - - -

U NITE D N ATIO N S

ECONOMIC DEVELOPMENTS

IN THE MIDDLE EAST

IN

NO I

HE I

p

1956-

FOREi;JORD

This report)Economic Developments in the Middle East) 1956-1957, forms part of the survey of the world economic situation prepared by the Secretariat of the United Nations) and is a supplement to World Economic Survey, 1957 (sales number: 58.II.C.l). It also complements the series of annual surveys prepared by the secretariats of the regional economic commissions and is a continuation of studies on the Middle East, of which the most recent is Economic Developments in the Middle East, 1955-1956 (sales number: 1957.II.C.2).

Unlike its predecessor, however, the present report is not limited to an analysis of current economic developments. As the World Economic Survey, 1957 presents a study of inflation, attention has been devoted to the economic forces in the region covered by this report which have given rise to inflationary or dis inflationary pressures over the past few years.

The period investigated extends generally from 1953 to the end of 1957. Sometimes earlier years are brought into the picture as benchmarks for observing longer trends. Statistical data for the most part are not available to the end of 1957, a fact which renders tentative a good many of the conclusions reached with respect to developments during that year, and which sometimes limits the analysis to the end of 1956. Lack of adequate data also prevented covering all countries in the region. A brief regional summary of findings is given at the beginning for the purpose of presenting a concise general picture to the reader who is not looking for a detailed account of activity country by country. This is followed by individual country reports on Egypt, Iran, Iraq, Israel, Jordan, Lebanon, Syria and Turkey.

In addition to the examination of inflationary and dis inflationary forces, the present report includes a statistical picture of economic developments in the region. Not only have the figures shown in the latest report been brought up to date, but they have been expanded in a series of thirty-two tables relating to all phases of economic activity and classified into seven groups - agriculture, industry, foreign trade, petroleum, transportation, finance and development, and miscellaneous. In order to facilitate for the reader the tracing of development trends in these various fields of economic activity, a concise verbal review of the statistical tables is given.

This report was prepared by the Bureau of Economic Affairs in the United Nations Department of Economic and Social Affairs. In general, the statistical data were either prepared directly by the Statistical Office of the United Nations or obtained from data published by that office. In addition, other official international and national sources were utilized; when such data were not available, private sources were consulted. Because of variations in methods of compiling data, information for the various countries is not always strictly comparable.

Wherever the terms "Syrian and "Egypt n^ are used, reference is to the northern and southern regions of the United Arab RepUblic. The latter terms have not been used since the study covers the period ending in 1957, while the United Arab Republic was established in 1958. For the same reason no use is made of the term "Arab Federation".

-iii-

The following symbols have been used in the tables throughout the report:

Three dots ( ••• ) indicate that data are not available or are not separately reported.

A dash (-) indicates that the amount is nil or negligible.

A blank in a table indicates that the item is not applicable.

A minus sign (-) indicates a deficit or decrease.

A full stop (.) is used to indicate decimals.

A comma (,) is used to distinguish thousands and millions.

A slash (I) indicates a crop year or financial year, e.g., 1955/56.

Use of a hyphen (-) between dates representing years, e.g., 195 0 - 1 954, signifies the full period involved, including the beginning and end years.

References to "tons" indicate metric tons, and to "dollars" United States dollars, unless otherwise stated.

The term "billion" signifies a thousand million.

Details and percentages in tables do not necessarily add to totals, because of rounding.

Information regarding rates of exchange may be found in issues of the United Nations, Monthly Bulletin of Statistics.

Certain abbreviations have been used: FAO for Food and Agriculture Organization of the United Nations; GNP for gross national product; IBRD for International Bank for Reconstruction and Development; IMF for International Monetary Fund; NATO for North Atlantic Treaty Organization; TOPRAK for State Soil Products Purchasing Agency (Turkey); UNRWA for United Nations Relief and Works Agency for Palestine Refugees in the Near East.

The designations of countries and territories and the arrangement of material in this publication should not be considered as implying any endorsement or other jUdgement by the Secretariat of the United Nations regarding the legal status of any country or territory, or of its authorities, or in respect of the delimitation of its boundaries.

-iv-

Turkey.

TABLE OF CONTENTS (continued)

06"0 •••••• e ••••••••• II. Economic background - Price movements - Availability and use of resources - Public finance, money and credit - Foreign trade and balance of payments

Statistical tables • • • • • • • • •. ••• 00G.0060 ••• e ••

-vi-

Egypt

Egypt: Ratio of ordinary budget expenditure to domestic production.

Foreign Trade: Balance of current account of goods and services Money and real wages of urban workers •

Egypt: Savings and investment

10 12

13 15 16

·.

Availability and use of resources at current prices • Indices of wholesale prices, cost of living, and foreign

Composition of Egyptian public debt at year end

7·

Iran

Iraq

15· Iraq:^ Composition^ of^ national^ product^ · · · · 32

17· Iraq:^ Actual^ revenue^ and^ expenditure^ of^ ordinary^ budget^34

19· Iraq:^ Related^ budgets^ and^ municipalities^..^ · · · · ·^ ·

. (^36)

42

-vii-

LIST OF TABLES (continued)

Syria

Syria: Public deposits,· official gold and exchange holdings and domestic public debt • • • • • • • • • • • •. • • • • •. • 92

Syria: Indices of volume of money supply and bank credit to the private sector • • • • • • • • • • • • • • • • 0 • 0 93

Turkey Turkey: Industrial orlgln of gross domestic product at factor cost and 1953 prices 0 • • • • 0 0 • • • • • 0 • • • • • • • •

Bank credit outstanding at year end (^)..... (^). ·

Bank credit outstanding and its^ distripution^0 .. ·

Balance of payments..... (^) •....... 105

98

99

Availability and use of resources •

Turkey: Indices of wholesale prices, cost of living and terms of trade

Turkey: Turkey: Estimates of State expenditures by broad categories of service, general and annexed budgets • • • • • • • • • • • • Turkey: Estimates of economic development expenditures by principal sector, general and annexed budgets • .0 • 0

-iX-

LIST OF TABLES (continued)

Statistical Tables

Agriculture I. Acreage of principal crops, by country

II. Production of principal crops, by count~y III. Indices of agricultural production • • •• IV. Animals and animal products, by country V. Egypt, Israel and Turkey: Food balance sheet VI. Institutional agricultural credit, by country

VII. Nmnber of tractors used in agriculture, by country •

Industry VIII. Industrial production index, selected countries

IX. Quantum indices of output in certain industries, major producing COuIltries it <!iI eelS 61 e G eGO l!l • 0 e elii'. .. X. Employment in manufacturing and mining, selected countries

Foreign trade XI. Geographic pattern of trade, by country • • • • XII. Major exports excluding petroleum, by couptry XIII. Major imports, by country • • • • •. • • • •. XIV. Indices of quantmll and unit value, and terms of trade, selected countries e e Go e e e 0 fl Gee " e e e

Petroleum XVI. Production of crude petroleum, by country l~II. Output of major refinery products, by country

Transportation

XVIII. Railway freight traffic, selected countries

XIX. Railway passenger traffic, selected countries XX. International seaborne shipping, selected countries XXI. Number of motor vehicles in use, selected couptries XXII. Civil aviation revenue traffic, by country •

XXIII. Suez Canal traffic, selected years

-x-

Page

116 119

123

124

126 (^12 ) 128

129

130 131

132 137 140

144 145

146 147

149 150 151

152 153 154

A corrmon characteristic of the countries of the Middle East is the intense conscious desire of peoples and Governments in the region for rapid economic development on a large scale. Although efforts expended in this direction and results achieved varied considerably from country to country, all eight countries included in the present study registered advances in production and income during the five-year period under consideration. Industrial production, on the whole, showed a steadier and faster expansion than agricultural production. 1/ Agricultural production oscillated considerably, owing to the great dependence of agriculture in most parts of the region on climatic conditions. On the other hand, the expansion of industry - though relatively fast - has not affected proportionately the rate of growth of total production, since industrial production is but a small percentage of total production in the region.

Development efforts in the form of relatively long-term investments were made throughout the region in fields such as irrigation, flood control, transportation, and public utilities, including water, electricity and communication facilities, as well as in industry. Public investment in the region as a whole increased faster than private investment. In 1956, private investment in Egypt, Iran, Iraq and Israel represented a fraction of public investment, ranging between 50 and 75 per cent, being lowest in Iraq and highest in Israel. In Turkey, Syria and Lebanon, private investment exceeded public investment.

Collective development efforts represented by marked increases in public investment during the last five years proceeded concomitantly with rising consumption expenditures. Increases in public consumption were particularly noticeable in the fields of defence, education and welfare. Public expenditure on ordinary bUdgets increased in each of the countries covered by the study. During the four-year period 1953-1956, this increase ranged from a moderate rate of 20 per cent, as in the case of Egypt, to as high a rate as 130 per cent in Israel. Among other countries, Syria showed an increase of over 90 per cent, and Lebanon and Iran about 70 per cent.

If development expenditures are added to the ordinary expenditures, the rates of increase during the same period become much steeper. The lowest would be about 35 per cent in Jordan, about 40 per cent in Turkey and Egypt and over 50 per cent in Iraq, and they would range between 120 and 170 per cent in the remai.ning countries. Total public expenditure in most of the countries under review constitutes a sufficiently sizeable proportion of national income to be capable of exercising a strong effect on prices. It ranges on the average from about 10 per cent in Lebanon and Iran to about 20 per cent in Egypt, about 25 per cent in Syria, over 30 per cent in Jordan and over 40 per cent in Israel and Iraq.

An exception is to be found in Israel, where agricultural production at

whereas industrial production rose by 43 per cent (see table 33).

-1-

Rapidly rising public expenditures outstripped ordinary government revenues and resulted in public deficits in most countries. If the last five years are taken together as one period, only Ira~, Lebanon and Syria would show a net surplus. In 1956, however, even Ira~ and Lebanon had deficits; Lebanon is estimated to have had a further deficit in 1957. The Lebanese deficits, however, are not financed by public borrowing but represent reduction in reserves. In some of the other countries there was a considerable increase in public debt. In the three-year period 1954-1956, public debt increased by 6 per cent in Iran, 18 per cent in Syria, 20 per cent in Turkey, 33 per cent in Israel and 80 per cent in Egypt.

Expanding national expenditures, public and private, for practically all the countries of the region, seem to have outstripped resources available from domestic sources. Ira~ is the only country which did not show a deficit in its balance of payments throughout the period under consideration. For the three-year period 1954-1956, Syria's deficit on current account of goods and services was the lowest, amounting to 7 per cent of total imports. The deficit of Israel for the same period was the highest, amounting to 88 per cent. The deficits of the other countries were 15 per cent for Egypt, 22 per cent for Iran, 27 per cent for Turkey, and 68 per cent for Jordan. There are no official figures for Lebanon, but rough estimates place the Lebanese deficit at 15 to 20 per cent of total imports.

Import surpluses reflected in the above deficits were financed by different means in the different countries. Foreign aids and loans have been the chief source of external finance for Israel, Iran, Jordan and Turkey. 2/ The chief source of external finance in Egypt has been the sterling balances accumulated during the Second World War, in addition to the recently stepped up returns from the Suez Canal since its nationalization. Lebanese and Syrian deficits have been financed chiefly by the inflow of private capital; in the case of Syria there has been in addition a recent increase in oil transit royalties as a result of a new agreement with the Ira~ Petroleum Company.

The pressure on domestic resources - with the conse~uent dependence of the region on foreign sources of finance - has arisen not only as a result of conscious collective efforts for economic and social development and for defence, but also because of a comparatively rapid population growth in practically all the countries of the region. For the most part the growth was attributable to a d.eclining mortality rate. In Israel and Jordan there was the added factor of immigrants and refugees.

The p+essure exerted upon the various price levels, as a conse~uence of the rapid rise of aggregate demand throughout the region, was further intensified in some countries by rapidly rising wages. In Israel in particular, where there is a strong labour movement which is well organized, the rise has been considerable;

g/ Oil royalties are not considered in this context as a foreign source of finance but rather as a return for exports of production or services; thus the Iranian deficit is calculated after accounting for net oil exports. The case is similar for Ira~, where the current account of goods and services includes oil transactions and in conse~uence shows a net surplus.

was brought about without an excessive rise in costs because of transfer of labour from agriculture to industry. The moderate rise in the price level experienced in the last two years is perhaps an indication that not much more labour can be thus transferred without impairing agricultural production unless methods of production are changed. It may also be an indication that as the country moves into higher stages of economic development, and despite the availability of large amounts of foreign currencies, imports alone cannot satisfy all the requirements of a growing economic activity.

The behaviour of the Egyptian price level was very similar to that of Iraq except for a steeper rise in the last two years. Fluctuations in import surpluses during the period tended to counteract the effects of domestic fiscal policy. As government deficit declined during the first part of the period, balance of payments deficits also declined. In the latter part of the period, with increased deficit financing, balance of payments deficits also expanded. Import surpluses were financed chiefly out of accQmulated sterling balances. Another disinflationary force emanated from a decline in private investment which counteracted to a large extent the inflationary pressure arising from rapidly growing public investment. The somewhat sharp rise in the price level experienced during the last two years is attributable chiefly to the vast expansion in public expenditure, partly financed by domestic borrowing.

The price level in Iran rose sharply between 1951 and 1954. Prior to that period efforts had been launched to combat the inflationary pressures generated during the war years by reducing public deficits, increasing imports and stimulating local production. These efforts were thwarted by the interruption of revenue from petroleum following its nationalization in 1951. In consequence, imports were drastically reduced and government bu.dget deficits increased sharply. The net effect was an upward pressure on prices. This pressure was reduced considerably in the period 1954-1957, owing to grants and loans from the United States Government and the subsequent refluence of oil revenue. Deficit spending was greatly reduced despite the large increase in public investment resulting from the new seven-year development programme. Foreign exchange proceeds multiplied, thus facilitating the import of large quantities of investment and consumption goods. Domestic production also expanded. The increase in the supply of domestic and imported goods has had a stabilizing effect on the price level during the last three years.

Only two countries in the region, Israel and Turkey, experienced a continuous rise in prices during the period under consideration. Both countries had undertaken heavy public expenditure on development and defence. Between 1953 and 1956, public consumption in Turkey rose by 33 per cent and in Israel by 180 per cent. Public investment during the same period also rose - by 77 per cent in Turkey and by 136 per cent in Israel.

The economic programme in Israel has been directed towards a fast development of the country's productive facilities and the maintenance of a relatively high level of living for a rapidly increasing population while keeping up large outlays on defence and the settlement of immigrants. Having to perform these tasks against a background of limited natural resources has brought about strong inflationary pressures, despite the heavy reliance of the economy on foreign resou.rces in the form of loans and grants amounting, in the four years 1953-1956,

to an annual average of about 15 per cent of national income. Inflationary tendencies have been further strengthened by an increasing real ~age level bolstered by a strong labour organization.

The Turkish Government is also cOIT@itted to a programme ~hich involves rapid development in the fields of agriculture) transportation and industry as ~ell as large defence outlays. In addition to public expenditure) private consumption and private investment increased at a comparatively rapid rate in the period 1953-1956. Pressures on the price level have been aggravated by the ease of credit in general) substantial budget deficits and the method of financing guaranteed prices for agricultural products. The expansion of domestic production has not been sufficient to meet these pressures) ~hich have led to a continuous rise in the price level. Rising prices) however) have been tempered by a continuous substantial import surplus made possible through foreign loans and grants. On the other hand) a steady decline in exports aggravated the adverse balance of payments situation and led - during the past t~o years - to further tightening on imports) resulting in a further upward pressure on domestic prices. In these circumstances) to achieve internal price stability) the Government is considering a slower rate of investment to bring this last more in line ,vi th available resources •

..

-5-

hand, has registered a far greater increase The index of all manufacturing 2/ shows a rise of 22 per cent between 1952 and 1955. Tbis rate of increase seems to be kept up in 1956 with no sign of recession in 1957. 3/ The over-all picture of the economy as represented in the figures on availability and use of resources prepared by tbe National Planning Commission (table 1) is one of continuous growtb, except for a brief recession in 1952, attributable cbiefly to a local political situation of transition to tbe present government regime. Altbough no figures for 1957 are available, tbere is no reason to expect a baIt to, or a reversal in, the upward trend.

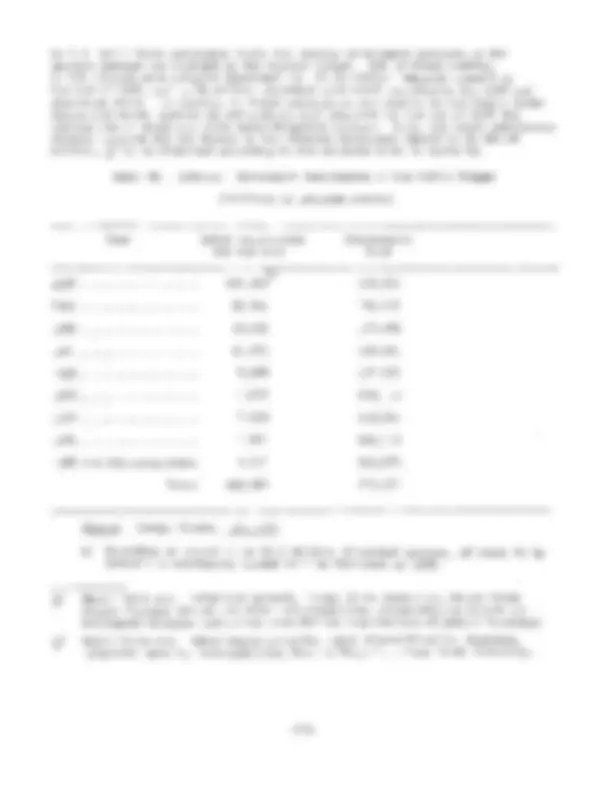

Table 1. Egypt: Availability and Use of Resources at Current Prices (Millions of Egyptian pounds)

Item (^1950 1951 1952 1953 1954 )

Availabilities: Domestic production · · ·^ · · ·

Net import surplus · · · (^) · · ·

°

Total availabilities (^818 968 873 878 969) 1,0 29 1,

Uses: --private consumption. · ·^ · ·^ ·^

Government consumption · · · ·

Total consumption (^703 825 757 762 834 907 ) Private investment · · ·^ ·^

Public investment • ·

Changes in stocks (^). ·

Total investment 115 143 116 116 135 122 110

Source: National Planning Commission, Office of the Secretary-General (unpublished material). The figures for government consumption and for domestic production exclude payments of salaries and wages to regular government staff.

When the total domestic product shown in table 1 is deflated by the general wholesale price index, the following result is obtained (in millions of Egyptian pounds):

Total domestic product at 1953 prices • • 821

3./ Prepared^ by^ the^ National^ Planning^ Commission,^ Section^ of^ Production^ and Employment (unpublished material).

-7-

It will be noted that growth in real terms thus obtained does not differ sUbstantially from growth calculated at current ~rices exce~t in 1956, when, at constant ~rices, tbe total domestic ~roduct sbows a decline ratber tban an increase. It is evident from tbis com~arison tbat tbe growtb acbieved during tbe period under consideration bas come about witbout great fluctuations in tbe ~rice level exce~t after 1955 wben actual develo~ment expenditures were ste~~ed up considerably.

Price movements

Price movements in Egypt are sbown in table.2. indices of wbolesale ~rices and cost of living, tbe for particular grou~s of cOll@odities as well as for s~ecial im~ortance to tbe Egyptian economy.

In addition to tbe general table ~resents price indices individual commodities of

b/ ~/

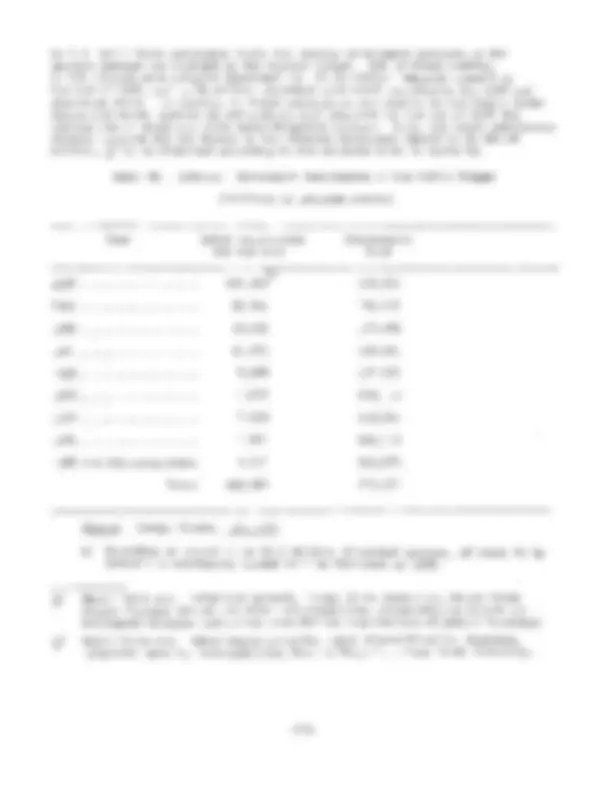

Table 2. Egypt: Indices of Wholesale Prices, Cost of Living, and Foreign Trade

(1953 :: 100)

Item (^1951 1952 1953 1954 1955 1956 1956 ) (January-June)

vmolesale prices: General "...^ · ·

..^108 105 100 97 99 110 107 Building materials · · .. 89 108 100 94 99 III^109 Textile ~roducts (^). · ·^

Cotton (Asbmouni) a/ ·

Rice (Burma) c/ -: •• · 75

Cost of living: All items. (^). 108 107 100 96 96 98 97 101 Food 110 107 100 101 103 104 103 108 Im~orts, uni t value e/ 87 103 100 96 99 100

Source: United Nations, Monthly Bulletin of Statistics, 1957 and January 1958; unit value indices of imports and exports taken from United Nations, Yearbook of International Trade Statistics, 1956,Vol.l (Sales No.: 1957.XVII.6). Domestic/im~ort pri ce c. i. f. Liverpool, spot, Egyptian Asbmouni, fully good. Domestic/import price c.i.f. Liverpool, spot, EgJ~tian Karnak, fully good. Average of export contract ~rices f.o.b., white rice, No.1 small mill s~ecial ngasein. Export price f.o.b. Galveston, IWA sales, No.1 bardwinter; average export price obtained by deducting tbe average export subsidy from tbe average domestic f.o.b. quotation. Value indices are cbained indices com~uted by tbe Fisber ideal formula.