Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

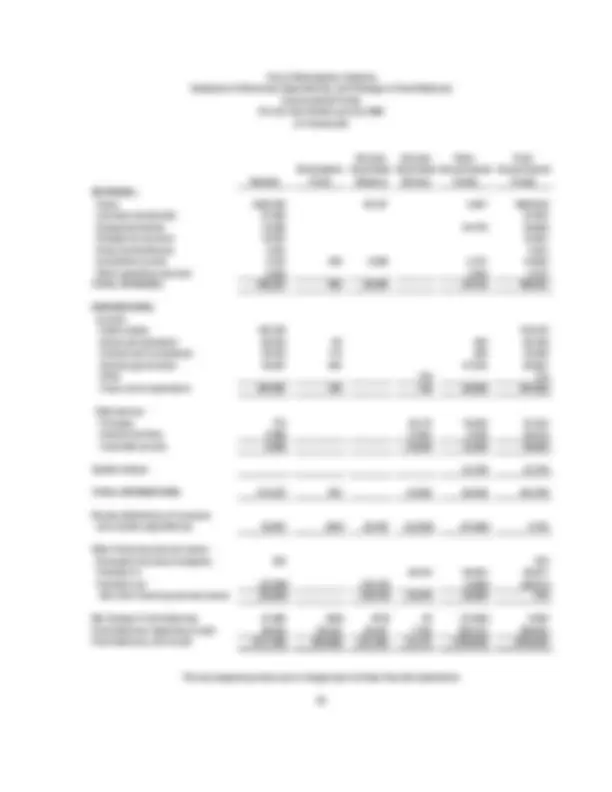

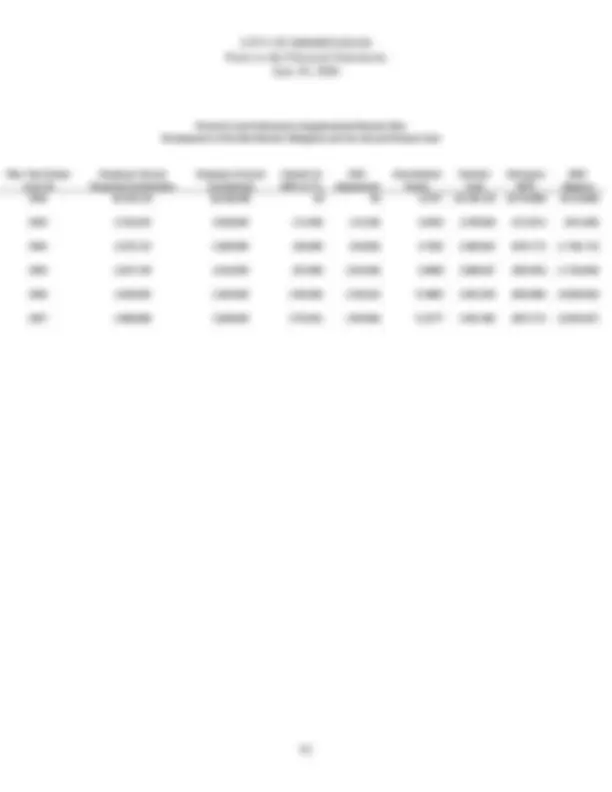

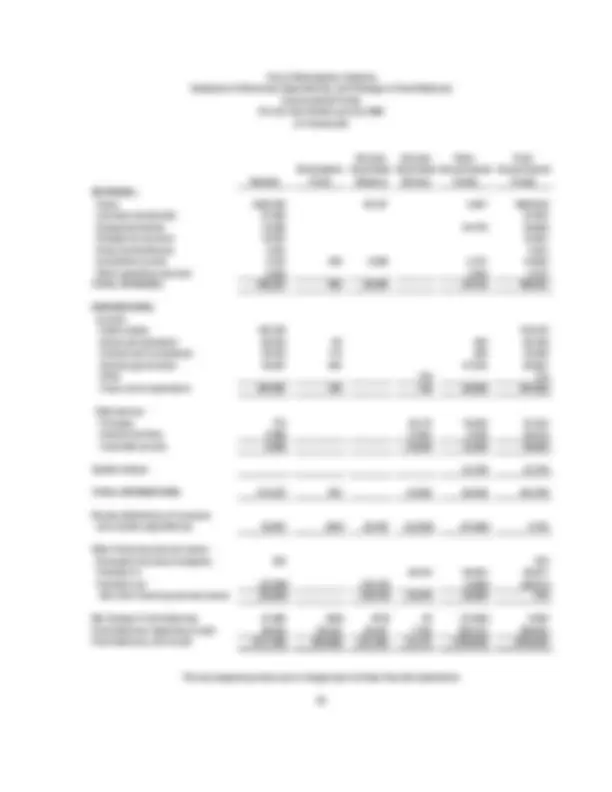

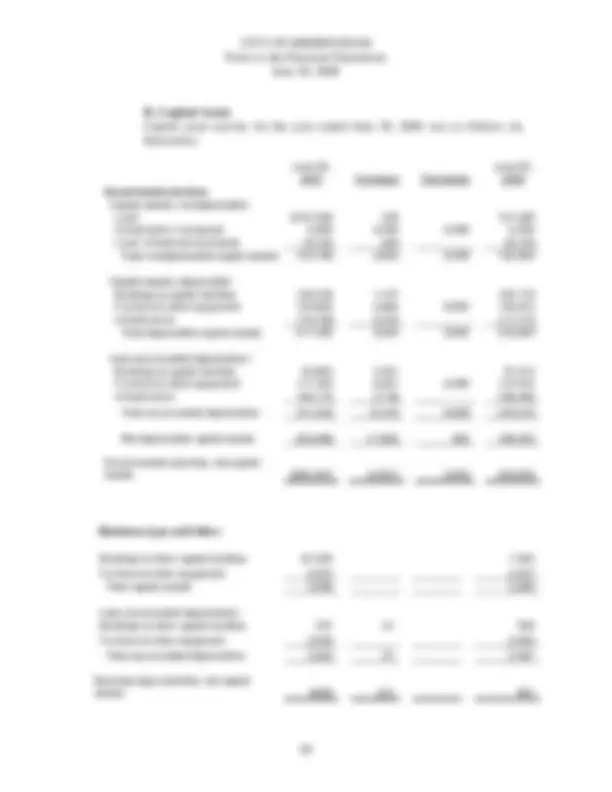

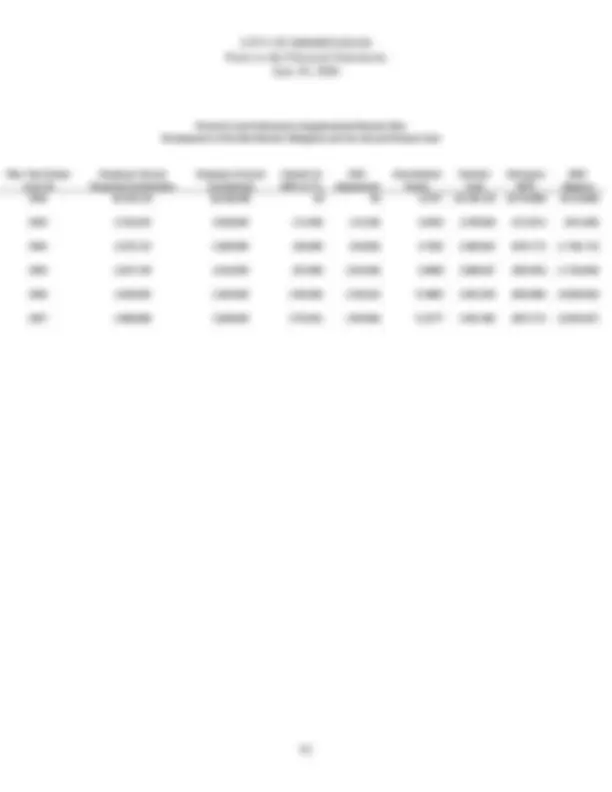

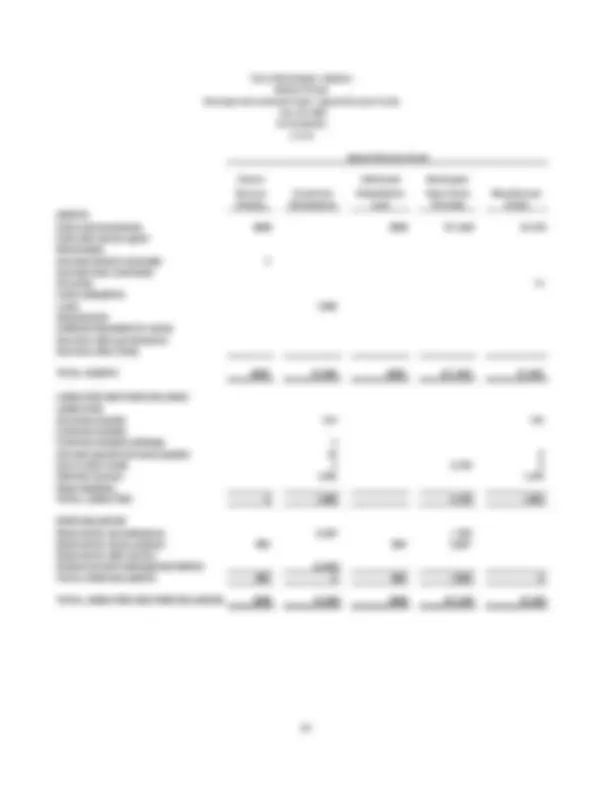

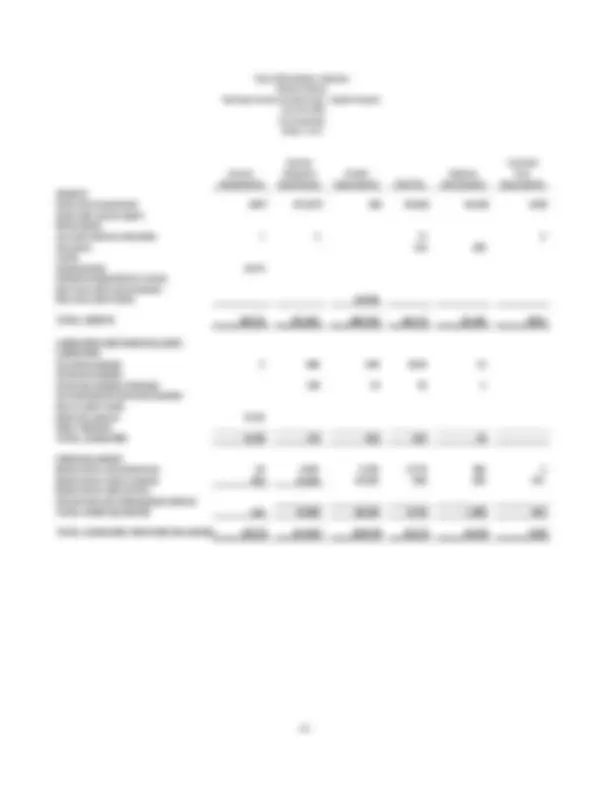

The balance sheets for various special revenue funds of the City of Birmingham, Alabama for the fiscal year ended June 30, 2008. The funds include Federal, HUD Rental, Birmingham Revenue, Community Rehabilitation, Water Works, Miscellaneous, Sharing, Development, Loan, and Proceeds. The balance sheets detail the assets, liabilities, and fund balances for each fund.

Typology: Lecture notes

1 / 119

This page cannot be seen from the preview

Don't miss anything!

INTRODUCTORY SECTION

**- List of City Officials

- City of Birmingham Organization Chart

FINANCIAL SECTION

**- Independent Auditor’s Report

As management of the City of Birmingham, Alabama (City), we invite our readers to review this overview and analysis of the financial activities of the City for the fiscal year ended June 30, 2008 (fiscal year 2008). Its purpose is to provide an introduction and overview readers should use to interpret and analyze the City’s basic financial statements and financial activities based upon currently known facts, decisions and conditions. We encourage readers to consider the information presented here in conjunction with additional information that we have furnished in our letter of transmittal at the front of this report and the City's financial statements, which follow this section.

FINANCIAL HIGHLIGHTS

business licenses, and property taxes accounted for the majority of the increase.

OVERVIEW OF THE FINANCIAL STATEMENTS

The government-wide financial statements are designed to provide readers with a broad overview of the City’s finances, similar to that presented by private sector businesses. The City’s basic financial statements are comprised of the following:

Government-wide Financial Statements Government-wide financial statements provide the reader with both long-term and short-term information about the City’s financial condition. Changes in the City’s financial position may be measured over time by increases or decreases in net assets as shown on the Statement of Net Assets. The Statement of Activities shows how the City’s net assets changed during the fiscal year. Both of the government-wide financial statements distinguish functions of the City that are principally supported by taxes and intergovernmental revenues (governmental activities) from other functions that are intended to recover all or a significant portion of their costs through user fees and charges (business-type activities). The governmental activities of the City include general government, public safety, highways and streets, sanitation, economic development, and culture and recreation. The business-type activity of the City is the Emergency Management Communications District (E911).

Fund Financial Statements Fund financial statements report the City’s operations in more detail than what is presented in the government-wide financial statements. Fund financial statements

Table of Financial Statements

Government-wide Financial Statements

Governmental Funds

Proprietary Funds

Fiduciary Funds

Scope Entire City government (except fiduciary funds)

Activities of the City that are not proprietary or fiduciary

Activity of the City that operates similar to businesses

Activities for which the City acts as trustee for someone else’s resources Required financial statements

Accounting basis and measurement focus

Accrual accounting and economic resources focus

Modified accrual accounting and current financial resources focus

Accrual accounting and economic resources focus

Accrual accounting and economic resources focus

Type of asset/liability information

All assets and liabilities, both financial and capital, and short-term and long-term

Only assets expected to be liquidated and liabilities that come due during the year or soon thereafter; no capital assets nor long-term debt included

All assets and liabilities, both financial and capital, and short-term and long-term

All assets and liabilities, both short- term and long-term

Type of inflow/outflow information

All revenues and expenses during the year, regardless of when cash is received or paid

All revenues and expenses during the year, regardless of when cash is received or paid

All revenues and expenses during the year, regardless of when cash is received or paid

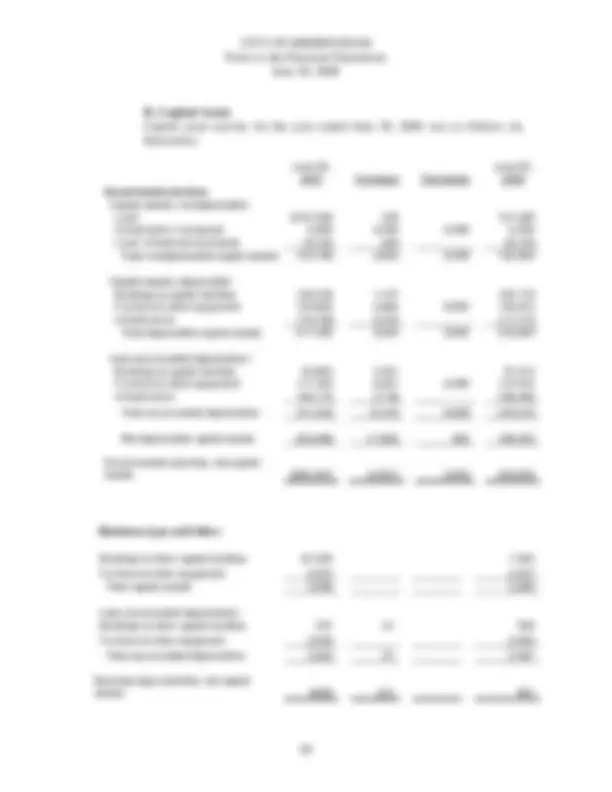

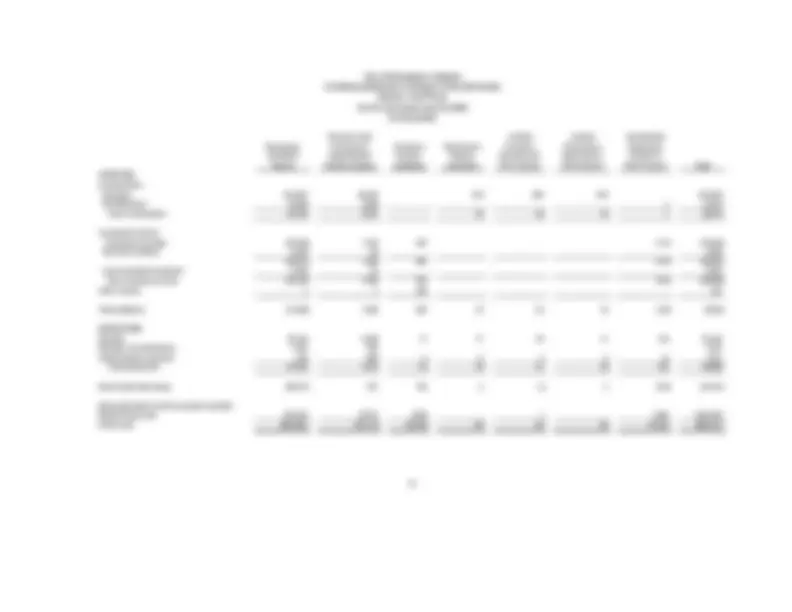

Net assets represent the difference between the City’s total assets and its total liabilities. Changes in the net assets can be a useful measuring tool for governments to gauge their performance over time. The City's net assets that are invested in capital assets net of related debt reflects its investment in capital assets (e.g., land, buildings, machinery, and equipment), less any related debt used to acquire those assets that are still outstanding. The City uses these capital assets to provide services to citizens; consequently, these assets are not available for future spending. Although the City's investment in its capital assets is reported net of related debt, it should be noted that the resources needed to repay this debt must be provided from other revenue sources, since the capital assets themselves cannot be liquidated to satisfy these liabilities.

The City’s restricted net assets of approximately $278 million are subject to bond and warrant covenants and by federal and state grant requirements. Overall, the City’s total net assets increased by approximately $19 million in fiscal year

There was a decrease in net assets of $559,000 in the Emergency Management Communication District, Emergency Management Communication District, an enterprise fund, which is the City’s sole business-type fund. The increase in expenditures for the District occurred due to an increase in personnel costs to maintain the operations of the District.

Condensed Statement of Net Assets

The following table presents a condensed statement of the City’s net assets at June 30, 2008 and 2007: