Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

The Economic Strategy for Bath and North East Somerset (B&NES) update in 2014, focusing on key sectors, business support, and opportunities for growth. The strategy aims to improve productivity, entrepreneurship, and wages by building on the area's strengths and business specialisms. It also emphasizes the importance of sustainable businesses and the Low Carbon & Environmental Goods & Services (LCEGS) sector.

What you will learn

Typology: Exams

1 / 68

This page cannot be seen from the preview

Don't miss anything!

Having weathered one of the longest recessions of recent times the national economy is recovering and forecasts are suggesting ongoing growth for the remainder of the decade. Bath & North East Somerset is well placed to take advantage of this recovery. We have many strengths we can build on : an enviable quality of life : a World Heritage city : two high quality Universities : a strong Further Education sector and a well-qualified workforce.

Our vision is that: Bath & North east Somerset will be internationally renowned as a beautifully inventive and entrepreneurial 21st century place with a strong social purpose and a spirit of wellbeing, where everyone is invited to think big – a ‘connected’ area ready to create an extraordinary legacy for future generations

Locally the West of England economy has shown particular resilience. Increases in both resident and workplace employment have seen the sub-region out-perform the national economy and the West of England Local Enterprise Partnership is seeking to build on this underlying strength by setting out ambitious growth proposals in its Strategic Economic Plan published in 2014.

This Plan seeks to deliver a minimum of 65,000 new jobs by 2030 building on the area’s track record in innovation and creativity and a rich heritage and cultural vibrancy.

It is vital that the Bath & North East Somerset area seizes the opportunity to be part of and share in the projected economic growth and prosperity of the wider sub-region. We have a nucleus of employment in the knowledge economy which can support economic growth and deliver a more productive, higher value local economy.

Bath, together with Bristol is highlighted as having an internationally-significant and fast-growing high tech sector in a new Centre for Cities/McKinsey & Company report. The Review highlights the issues that must be addressed. House prices are 40% higher than the national average. Average wages are 10% lower. Long term unemployment, particularly long term youth unemployment, remains an issue. There is a shortage of industrial space and we lack the overall quality of office space that modern businesses demand.

Our ambition is to increase the overall number of jobs in B&NES by 11,500 and by focussing on “priority sectors” where the area has particular strengths we can increase overall productivity and raise average earnings.

Bath and in particular the Bath City Riverside Enterprise Area, has a key role to play in delivering future economic growth. The Review also highlights the importance of promoting additional employment in the Market Towns, supporting key housing & transport projects and addressing employability and skills in the workforce. In addition we have widened the scope of the Strategy to embrace the whole economy and ensure the contribution and potential of the wider visitor and cultural sectors, both in economic and “place” terms, is taken into account.

The Economic Strategy remains very much a partnership document which will require partnership working, both locally and sub-regionally, to address the identified priorities. We look forward to making our aims and objectives a reality for people living and working in Bath & North East Somerset.

Cllr Ben Stevens Cabinet Member for Sustainable Development for B&NES

Colin Skellet OBE Chair of West of England Local Enterprise Partnership

Jon Hunt Director of Research & Innovation at University of Bath

Tim Middleton Vice-Provost Research and Enterprise. Research and Graduate Affairs Bath Spa University

Matt Atkinson Chair of Bath and North East Somerset Learning & Skills Partnership

Ian Bell Executive Director of The Initiative in B&NES

Angela MacAusland FSB Branch Chairman for Bath

4 The Economic Strategy for Bath and North East Somerset (update 2014): Introduction

In 2010 B&NES Council approved its

first Economic Strategy, developed in

conjunction with the B&NES Economic

Partnership. The Strategy contains a number

of strategic priorities and detailed actions

and a commitment to review and refresh the

document after a period of three years.

ECONOMIC STRATEGY REVIEW 2014

5

The review provides an opportunity to take into account major changes in the economy over the past 3 years and the way public and private sector services are now provided. Our aim is to broaden the scope of the Strategy to reflect these changes and to include actions that address wellbeing and reduce inequalities

as well as to foster growth in key employment sectors.

In particular the review of the economic strategy puts wellbeing and the quality of place at the heart of the outcomes it is aiming to deliver.

7

ECONOMICSTRATEGY

Theme

PEOPLE

Priority

Theme

BUSINESS

Priority

Theme

PLACE

Priority

8 The Economic Strategy for Bath and North East Somerset (update 2014): Introduction

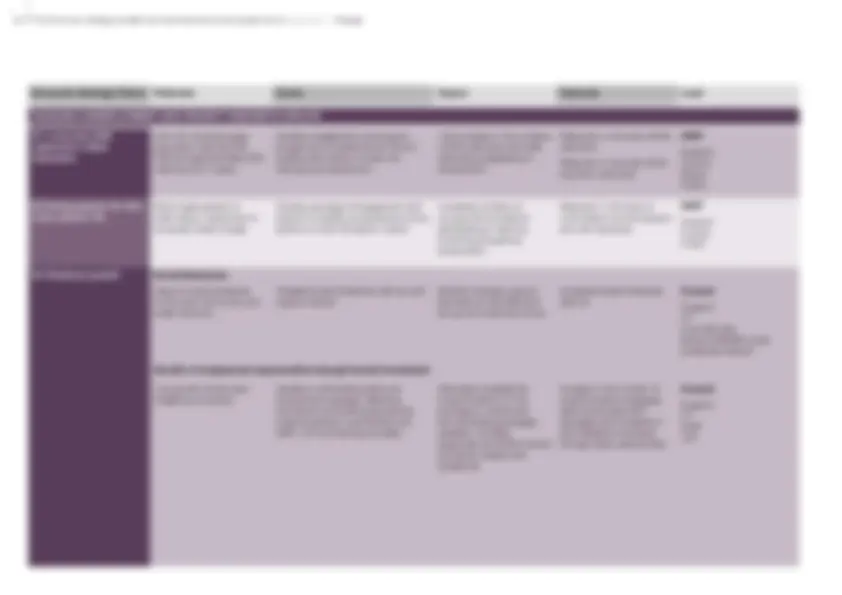

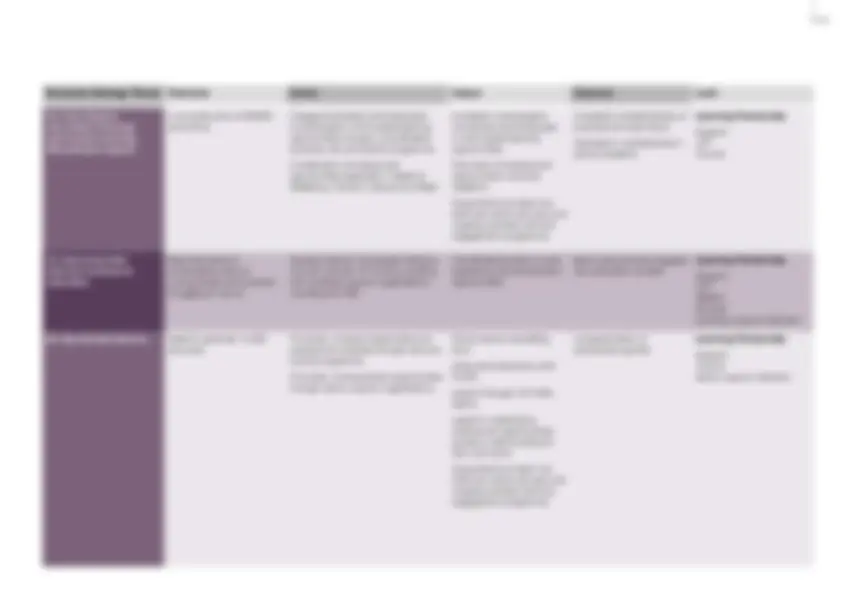

In order to ensure that the Strategy also considers its relationship with the environment and equality/social inclusion two cross-cutting ‘core values’ have been established: ‘Sustainability’ and ‘Health & Wellbeing’.

By establishing each of these important economic issues as core values we can ensure a strategic approach to local economic development which is sustainable, includes all parts of the economy, and where no-one is excluded.

Businesses and residents are reducing their energy and waste costs and preparing for the future climate. This increases competitiveness and creates work for environmental businesses which grow and move to the area, bringing greeen jobs. Use of local food and energy is increasing economic resilience and a circular economy is developing, where waste is a valuable resource.

Give all residents the opportunity to take part in BANES economic success, which will create fairer life chances, ensure healthy standard of living for all, and enable people to stay healthy

Focus on preventative spend to tackle the social and health problems which prevent people from realising their potential

Create fairer life chances through fair employment and good work for all

Ensure a healthy standard of living for all

Support sustainable businesses and the Low Carbon & Environmental Goods & Services (LCEGS) sector

Maximise the local multiplier effect; increasing local food production and local food consumption to promote growth in incomes and jobs as well as the local cultural offer Enable existing businesses and residents to “green” by reducing their energy use and adapting to the future climate

10 The Economic Strategy for Bath and North East Somerset (update 2014): Economic Context

There is considerable evidence that the UK economy is making substantial progress in recovering from the global economic downturn which began to have an impact in the spring of 2008. Indeed, the 2014 Budget announcement (HM Treasury, Budget Report – March 2014) gives the following summary medium-term economic forecast for the UK economy (2014 to 2018):

Source: ONS, Office for Budget Responsibility, March 2014

These forecasts are made in the light of major restructuring of the UK economy, particularly in such sectors as Finance and the Public Sector, which suggests that the short-term to medium-term prospects for the UK economy are ‘good’. In turn, the prospects for the West of England and Bath & North East Somerset economies should be viewed as equally optimistic.

Outturn Forecast

11

Economic Output Productivity

0.

Overall economic performance of the B&NES economy In 2011, the B&NES economy produced an estimated £3.8 billion of GVA output with total workplace employment of almost 92,000, equating to an average productivity per employee of £41,600. B&NES productivity performance is slightly lower than across the West of England and nationally (£43,100 per job and £42,400 respectively).

*GVA measures the contribution to the economy of each individual producer, industry or sector in the UK.

The main driver of B&NES’ lower productivity is the area’s above- average employment in public sector activities such as education and health (36% of B&NES’ workplace jobs are in the predominantly public sector activities of Public Administration & Defence, Health & Education compared to 29% across the West of England and 27% nationally) and the relatively large concentrations of employment in sectors such as retail and tourism.

As with the West of England and nationally from 2007 to 2011 the B&NES economy shrank during the 2008 economic downturn. Overall the output of the B&NES economy fell by 5.1% between 2007 and 2011 compared to a 1.9% decline across the West of England and a 5.4% decline nationally. Productivity also fell across B&NES over the period, by 5.6%, compared to productivity declines across the West of England and nationally of 4.2% and 4.5% respectively.

West of England

England

13

The chart below shows trends in resident and workplace employment for 2007 to 2013 for the B&NES economy. In 2013 B&NES had resident employment of around 87,000, around 1,000 more than pre-downturn. However, workplace employment in 2013, at 87,000, is some 2,000 lower than the pre-downturn level of 89,000.

Over the period, resident employment has been relatively more volatile, declining by far more than workplace employment before recovering more quickly in 2011 as employment fluctuations in the wider sub-region affect people working outside B&NES.

The chart below compares the trends in resident and workforce employment in B&NES with the performance of those measures in the West of England sub-region and nationally for 2007 to 2013

Resident Employment Workplace Employment

90,

88,

78,

86,

84,

82,

80,

2007 2008 2009 2010 2011 2012 2013

Workplace Employment Resident Employment

West of England England

14 The Economic Strategy for Bath and North East Somerset (update 2014): Economic Context

The above average representation

in sectors such as Information &

Communications, Creative & Digital,

Environmental & Low Carbon and

Health & Wellbeing is also supporting

the local economy to recover more

quickly.

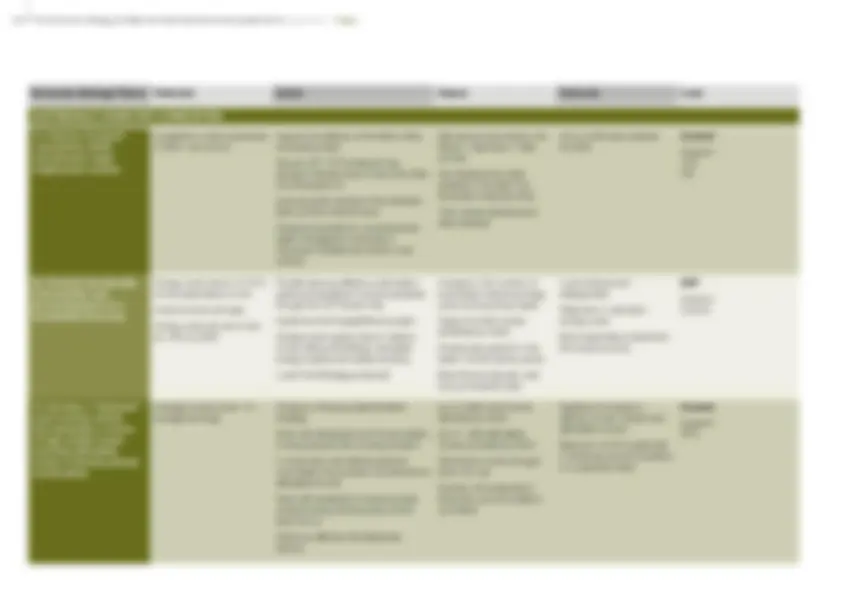

16 The Economic Strategy for Bath and North East Somerset (update 2014): Business Theme

To promote business growth which

delivers increased productivity

and earnings and provides local

people with access to sufficient

quality sustainable jobs across the

economy

17

INTRODUCTION

19

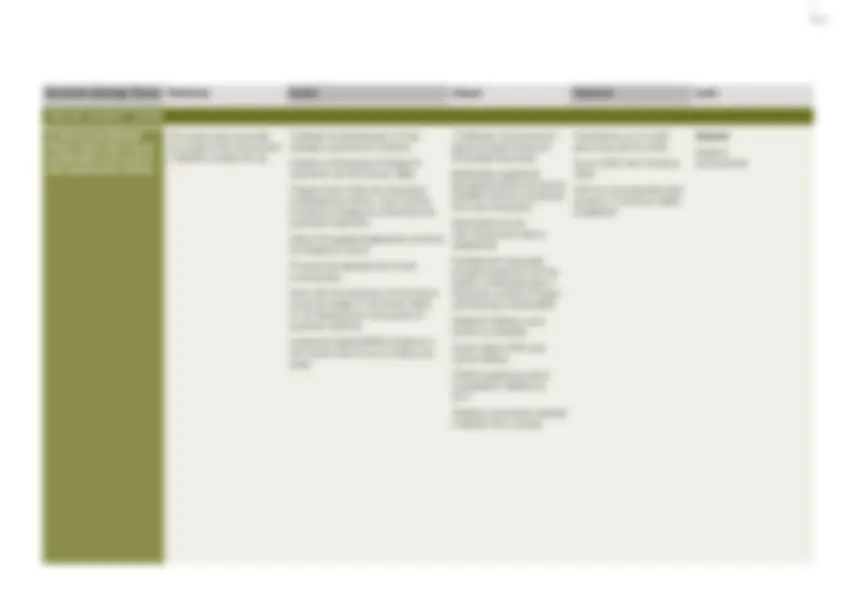

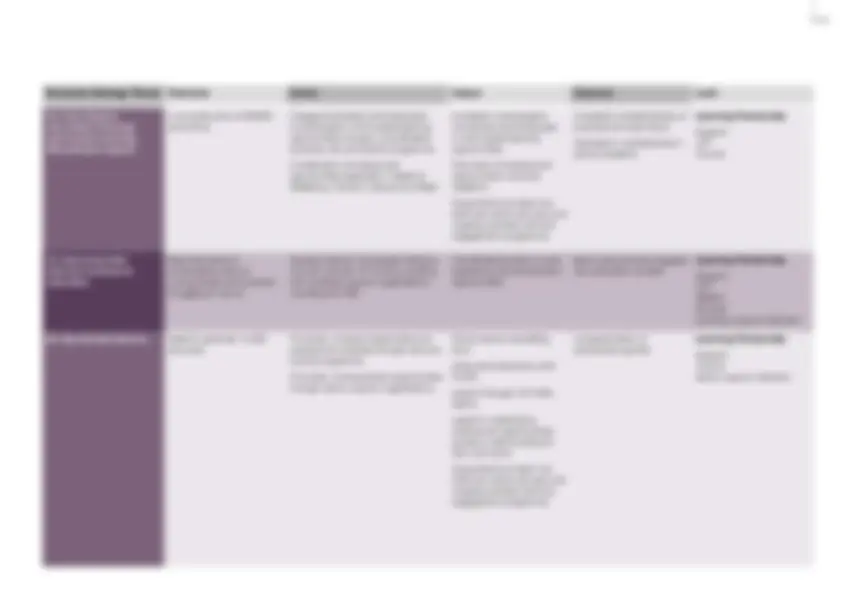

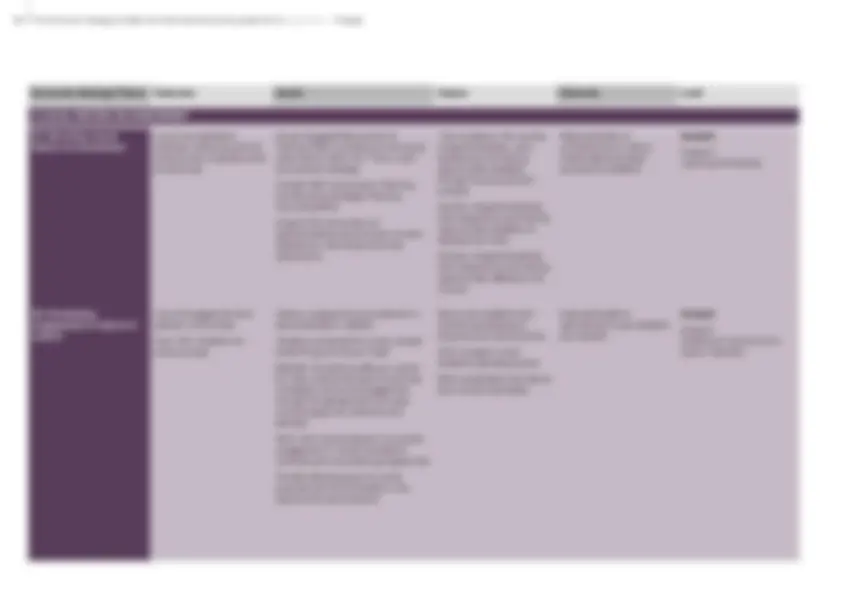

The priority business sectors Priority sectors are seen as strategically important to the local economy. Their “strategic” importance is because they are large employers and/or higher value added and/or are higher growth, or are expected to demonstrate higher growth in the future. They are the sectors to ‘prioritise’ for support and intervention as they are essential in ensuring the longer-term competitiveness and stability of the local economy.

There are 8 Priority Sectors in B&NES defined as “Core” or “Key” sectors. Core sectors currently employ significant numbers of people locally and will continue to be important in employment terms. Key sectors are generally smaller in employment terms but higher value added and offer the potential for significant future expansion.

20 The Economic Strategy for Bath and North East Somerset (update 2014): Business Theme

PRIORITY SECTOR

EMPLOYMENT GVA OUTPUT LOCATION QUOTIENT

TOTAL £m PER EMPLOYEE £

Tourism / Leisure / Arts & Culture 10,300 £205 £19,900 1.

Retail 10,200 £233 £22,900 1.

Health & Well-being 11,100 £337 £23,700 1.

Financial & Professional Business Services 8,500 £672 £79,000 0.

ICT / Creative & Digital 5,800 £418 £72,000 1.

Advanced Engineering & Electronics 2,700 £159 £58,900 0.

Environment & Low Carbon 1,300 £238 £183,300 1.

Their employment and overall economic contribution (GVA output) is set out in the following table together with their ‘location quotient’ – their representation in the local economy compared with the national economy The priority sectors cover 58% of B&NES’ total employment (excluding self-employment).

In terms of their output contribution, and because on average the Priority Sectors are higher value-added in terms of productivity, they account for a much larger share of B&NES’ total output; the eight priority sectors account for 64% of B&NES’ GVA.

The priority sectors have the

potential to deliver up to 11,

new jobs in B&NES by 2030 and

make a significant contribution to

increasing the area’s GVA output

and productivity.