Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

A detailed analysis of a stock tracking project, outlining the investment strategies employed, key trades, and performance metrics. It provides insights into the use of equities, options, short sales, mutual funds, closed-end funds, and exchange-traded funds (etfs) in portfolio management. The document also includes a breakdown of the best and worst performing trades, highlighting the rationale behind each decision. This project offers valuable insights into practical investment strategies and portfolio diversification.

Typology: Slides

1 / 12

This page cannot be seen from the preview

Don't miss anything!

Summary

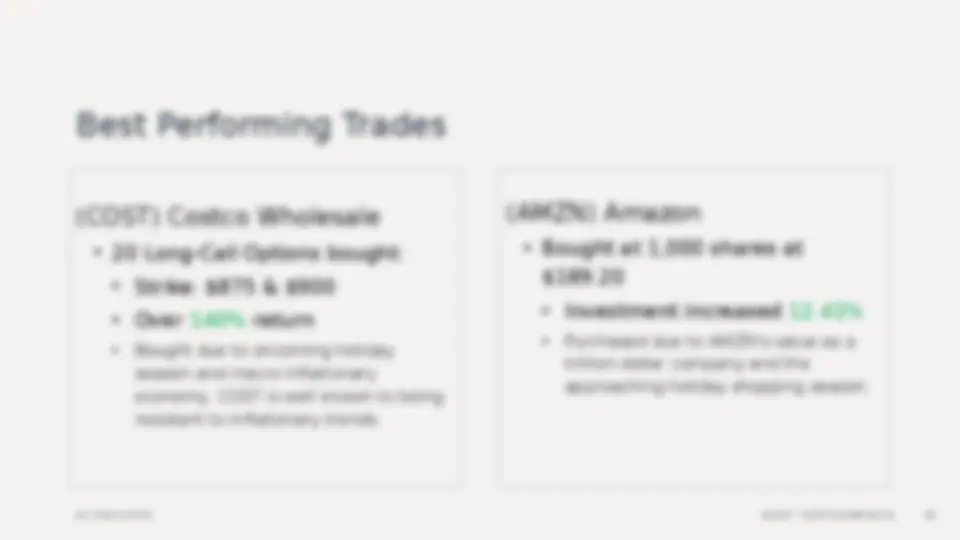

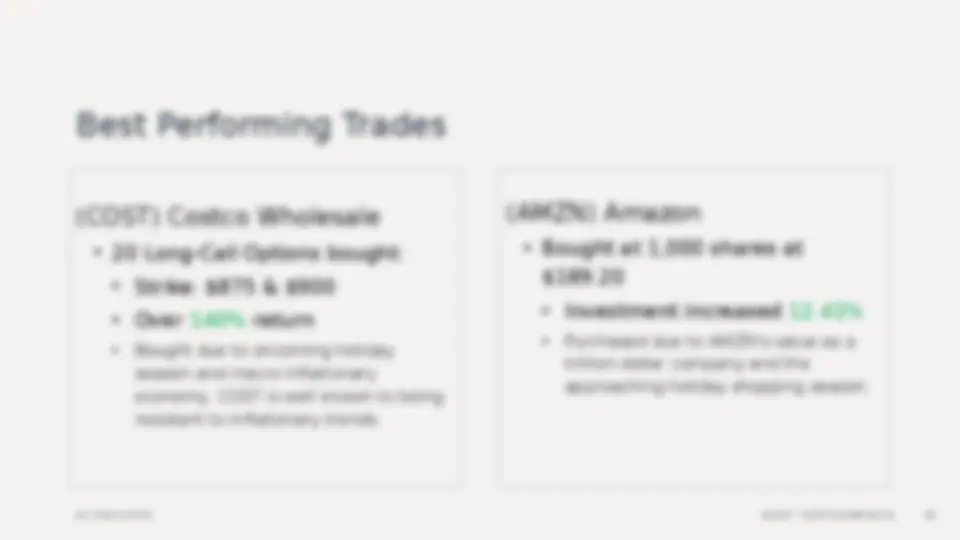

Best Performing Trades (COST) Costco Wholesale

(AMZN) Amazon

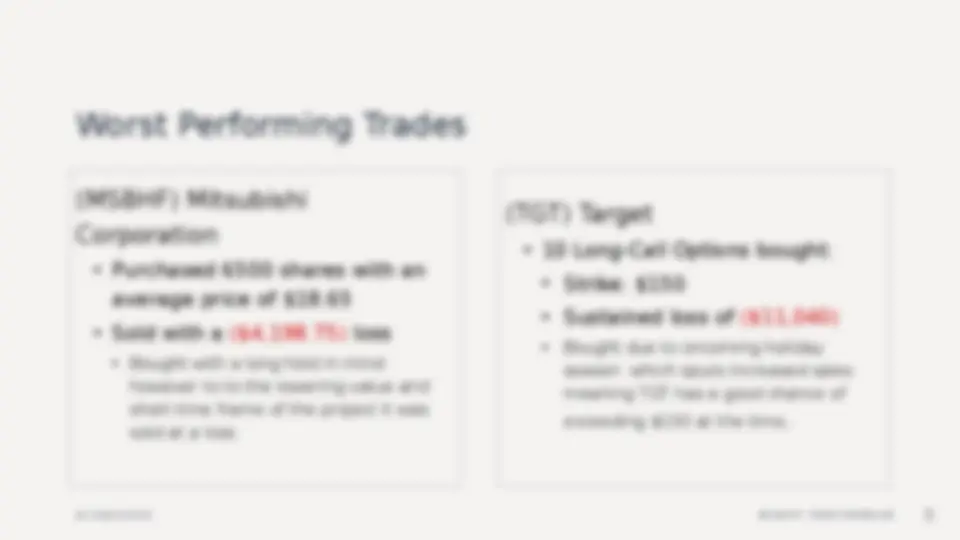

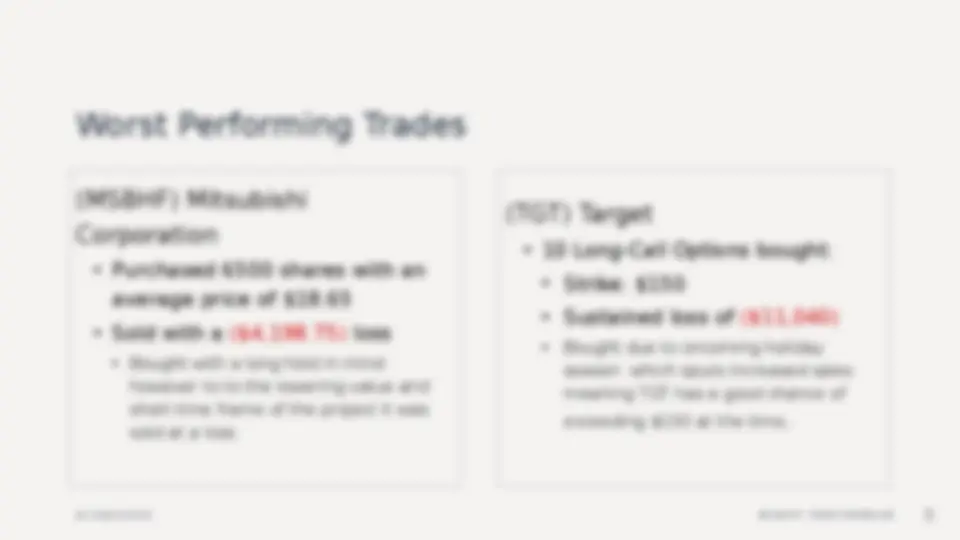

Worst Performing Trades (MSBHF) Mitsubishi Corporation

(TGT) Target

exceeding $150 at the time.

Short Sales COMPANIES

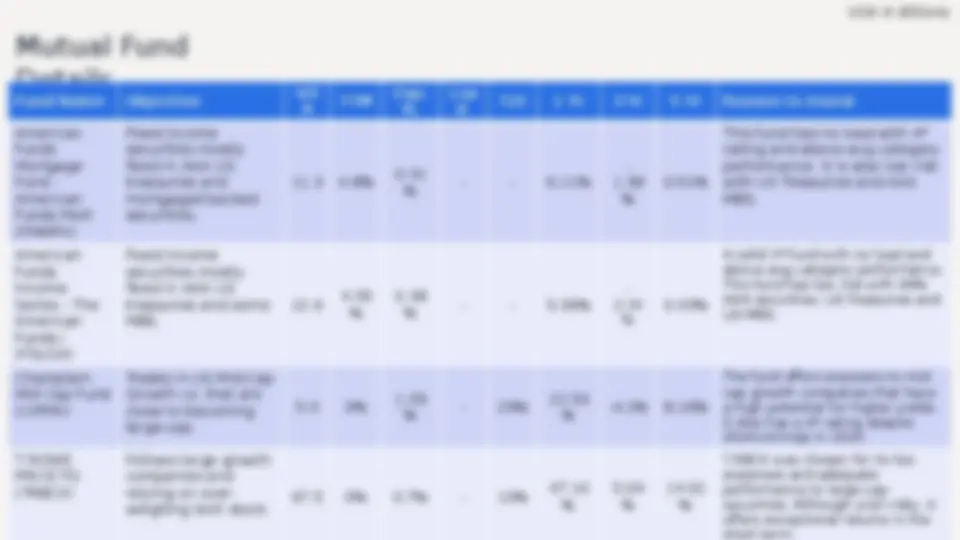

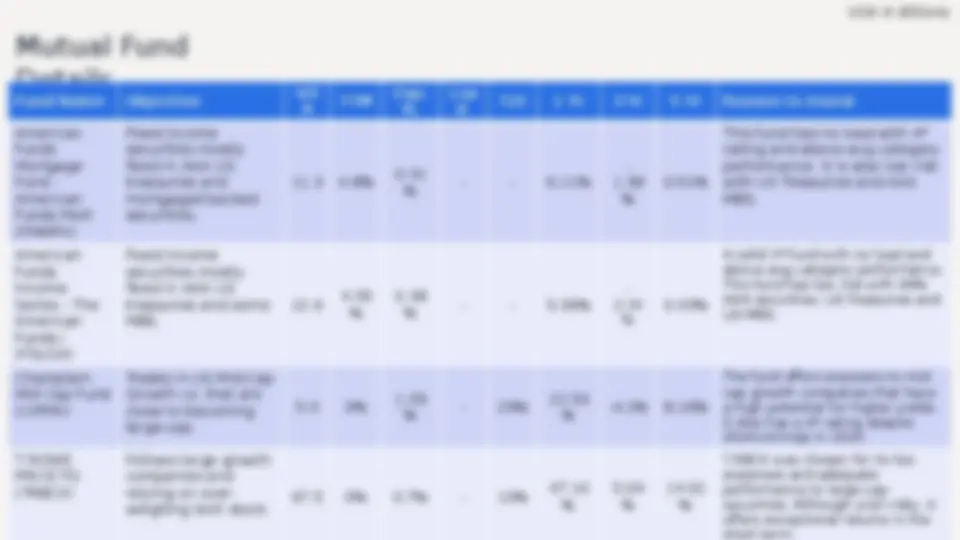

Mutual Funds

CEFs

ETFs