Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

The concept of financial frictions and their impact on macroeconomics, specifically in relation to leverage. It discusses how financial frictions can amplify the macroeconomic effects of exogenous changes and impact the aggregate economy through financial shocks. The document also touches upon the concepts of missing markets, moral hazard, and the lemons problem.

Typology: Lecture notes

1 / 37

This page cannot be seen from the preview

Don't miss anything!

Shengxing Zhang LSE October 3, 2017

I (^) Leverage ratio: Value of debt Value of equity I (^) What is the determinant of leverage? I (^) What is the implication of leverage on macroeconomics?

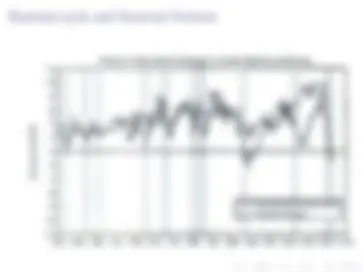

Amplification. The initial driving force of movements in economic activities are nonfinancial factors such as drops in productivity or monetary policy shocks. However, as investment and employment fall, the credit ability of borrowers deteriorates more than the financing need after the drop in economic activity. This could happen, for instance, if the fall in investment generates a fall in the market value of assets used as collateral. The presence of financial frictions will then generate a larger decline in investment and employment compared to the decline we would observe in absence of financial frictions. Therefore, financial frictions amplify the macroeconomic impact of the exogenous changes.

Financial shocks. The initial disruption arises in the financial sector of the economy. There are no initial changes in the nonfinancial sector. Because of the disruption in financial markets, fewer funds can be channeled from lenders to borrowers. As a result of the credit tightening, borrowers cut on spending and hiring, and this generates a recession.

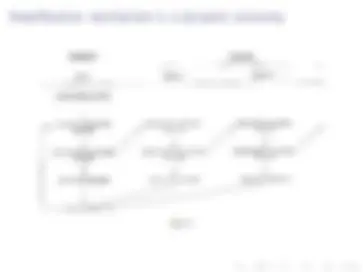

I (^) The economy lasts two periods I (^) Two types of agents: farmer and gatherer I (^) Farmers I (^) endowed with k 0 F units of land I (^) values consumption at period 2: U(cF 1 , c 2 F ) = c 2 F I (^) production of period 2 good using kF^ units of land: AkF I (^) Gatherer can produce consumption goods at constant unit cost in period 1 I (^) endowed with K � k 0 F units of land I (^) preference: U(c 1 G , c 2 G , h) = cG 1 + c 2 G I (^) production function using k units of land: G (kG^ ), with G 0 (kG^ ) > 0, G 00 (kG^ ) < 0, G 0 ( 0 ) = A. I (^) Land: in fixed supply, K ; the value of land at period 2: p 2.

max c 2 F ,c 1 G ,c 2 G ,h,kF^ ,kG cF 2 + c 1 G + c 2 G subject to c 2 F = AkF^ + p 2 kF c 1 G + c 2 G = G (kG^ ) + p 2 kG K � kG^ + kF kG^ , kF^ � 0. Simplified problem: max kF^ ,kG^ � 0 ,kF^ +kG^ =K (A + p 2 )kF^ + G (kG^ ) + p 2 kG Solution: A = G 0 (kG^ ) ) kF^ = K , kG^ = 0.

I (^) two markets at period 1: I (^) market for one period bond: R I (^) land market: p 1

maxkG (^) ,bG (^) ,cG 1 ,c 2 G c 1 G + c 2 G s.t. c 1 G � bG R

K � k 0 F

c 2 G = G (kG^ ) + p 2 kG^ � bG^ , bG^ ✓p 2 kG^. Substitute c 1 G , c 2 G by the budget constraints in period one and two, and then write down the Lagrangian. L = bG R

@kG^ = �p 1 + G 0 (kG^ ) + p 2 + �G^ ✓p 2 = 0

A competitive equilibrium is allocations c 1 G , c 2 G , c 2 F , h, kG^ , kF^ and prices R, p 1 such that I (^) Given prices, allocations solve the problem of gatherers and famers. I (^) The markets for land and bond clear.

I (^) Market clearing for the bond market: bG^ + bF^ = 0. If �1 < bG^ < 0 and bB^ > 0, R = 1, �G^ = 0. I (^) Market clearing for the land market. p 1 = G 0 (kG^ ) + p 2 + �G^ ✓p 2 = G 0 (kG^ ) + p 2. Assume that A is large enough so that the borrowing constraint of the farmer is binding kF^ and bF^ satisfies: p 1 kF | {z } land purchase = p 1 k 0 F | {z } down payment