Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Information for the analysis of financial statements of morrisons plc for the years ended february 2008 and 2007, and the preparation of financial statements for rhys ltd for the year ending december 2008 and june ltd for the year ending december 2008. Trial balances, financial statements, and calculations of financial ratios.

Typology: Exams

1 / 8

This page cannot be seen from the preview

Don't miss anything!

Section A - Answer ALL parts (a, b and c) – 40 marks

QUESTION 1

The following is a trial balance for June Ltd for the year ending 31/12/2008:-

£’000 £’ Debit Credit Accruals 100 Administration expenses 650 Bad debt provision to 31/12/2007 84 Bank 10 Cars accumulated depreciation to 31/12/2008 40 Cars at cost 200 Creditors 160 Debentures repayable on 31/12/2025 116 Direct wages 7 Interest paid 53 Land and buildings at valuation 31/12/2007 666 Plant and equipment accumulated depreciation to 31/12/

Plant and equipment at cost 1, Prepayments 333 Purchases 1, Retained profit as at 31/12/2007 17 Revaluation reserve as at 31/12/2007 666 Sales 3, Distribution expenses 500 Share capital (£1.00 ordinary shares) 2, Stock 31/12/2007 1, Trade debtors 330 ______ 7,166 7,

It has come to light that the following additional information has not been taken into account in the preparation of this trial balance:-

i) The company issued for cash 100,000 new shares for £2.50 per share on 31/12/2008, receiving the full issue proceeds on that day. Included in the £2. per share was a £1.50 share premium.

ii) After a final stock take on 31/12/2008, stock was valued at the lower of cost and net realisable value at £600,000, (before taking into account item (iii)).

Question continues overleaf

TURN OVER

SECTION B - Answer TWO questions – each question carries 20 marks

QUESTION 2 – (answer both parts a and b) - (20 marks)

Rhys Ltd started business on 1 January 2008 and its year ended 31 December 2008. Rhys Ltd entered into the following transactions during the year.

Rhys Ltd received funds for share capital of £60,000 on 1 January 2008.

Mrs. Jones loaned the company £80,000 on 1 January 2008 at 4% per annum. Interest was to be paid six monthly in arrears on the 1 July 2008 and 1 January

Rhys Ltd paid £1,000 in cash for advertising in ‘The Aber Chronicle’ on 1 February 2008.

During the year Rhys Ltd purchased in total 2,000 units of materials at £1 per unit. Two units were needed to manufacture one finished good. Rhys Ltd manufactured all of these units to produce 1,000 units of finished good by 31 December 2008.

Total heating and lighting costs paid in cash for the year were £1,500.

It was estimated that further heating and lighting costs of £500 were incurred within the year, but were still unpaid as at 31 December 2008.

500 finished goods units were sold to customers at £10 each on a credit basis.

As at 31 December 2008 Rhys Ltd had received £3,000 in cash for the sale of the finished goods in (7) above.

A further 200 finished goods were sold to customers at £30 each as cash sales.

Rent on the premises of £12,000 was paid for two years from 1 January 2008, and business rates for the same period of £6,000 were also paid.

Salaries and wages were paid for January to November amounting to £4,000 but the December payroll cost of £400 had not been paid.

A secondhand van was purchased in cash for £9,000 on 1 January 2008 and expected to last for 3 years. Rhys Ltd assumes a zero residual value and the company uses the straight line method of depreciation.

You can assume that for stock purposes that there have been no losses or rejects in the manufacturing process.

Required:

a) Present the above transactions in a T account format. (12 marks)

b) Prepare a trial balance for Rhys Ltd for the year ending 31 December 2008. (8 marks) TURN OVER

QUESTION 3 (answer all parts a, b and c) – (20 marks)

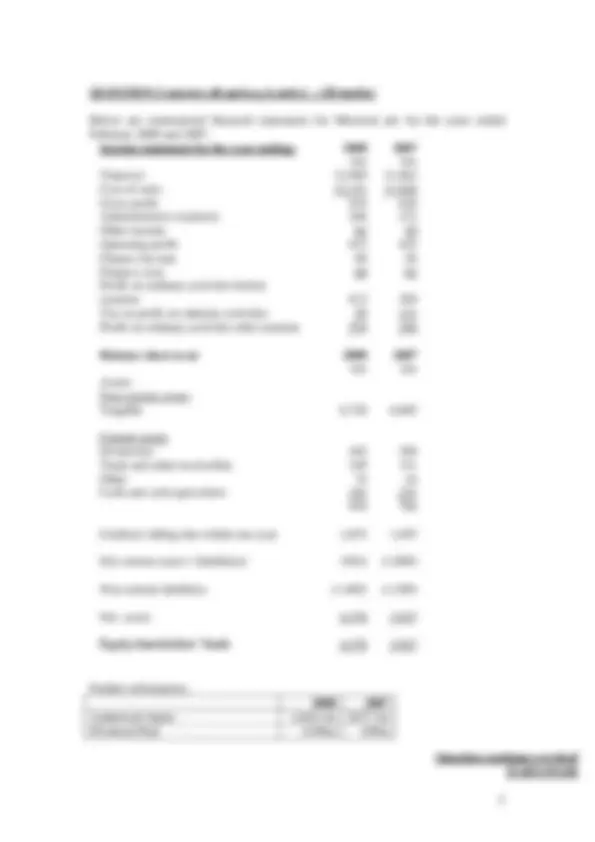

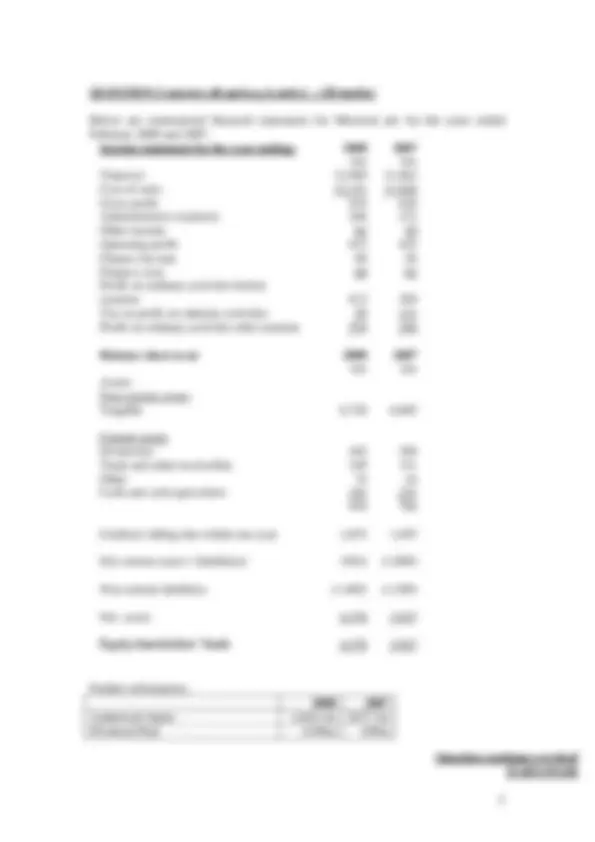

Below are summarised financial statements for Morrison plc for the years ended February 2008 and 2007. Income statement for the year ending: 2008 2007 £m £m Turnover 12,969 12, Cost of sales 12,151 11, Gross profit 818 636 Administrative expenses 268 272 Other income 62 59 Operating profit 612 423 Finance income 60 28 Finance costs 60 82 Profit on ordinary activities before taxation 612 369 Tax on profit on ordinary activities 58 121 Profit on ordinary activities after taxation 554 248

Balance sheet as at: 2008 2007 £m £m Assets Non-current assets Tangible 6,726 6,

Current assets Inventories 442 368 Trade and other receivables 199 151 Other 78 16 Cash and cash equivalents 191 231 910 766

Creditors falling due within one year 1,853 1,

Net current assets / (liabilities) (943) (1,089)

Non-current liabilities (1,405) (1,589)

Net assets 4,378 3,

Equity shareholders’ funds 4,378 3,

Further information:- 2008 2007 Authorised shares 2,664.3m 2657.5m Dividend Paid £108m £98m

Question continues overleaf TURN OVER

QUESTION 4 (answer all parts a, b and c) – (20 marks)

Annie, Bunny and Cathy are dentists who carry out their business activities in the form of a partnership. The partners have agreed to share partnership profits in the ratio 3:3:2.

The partnership agreement states that interest on capital should be at a rate of 3% per annum and interest on drawings should be at a rate of 4% per annum.

The partnership agreement states that Annie and Bunny should receive a salary of £50,000 and £70,000 per annum respectively. There was an amendment to the partnership agreement on 30 October 2008 that would allow Cathy to receive a salary of £12,000 per annum from 1 November 2008.

The balances on the partners capital and current accounts at 1 January 2008 were:

Capital Accounts £ Annie 80, Bunny 70, Cathy 50,

Current Accounts Annie 16, Bunny 28, Cathy 33,

The partnership drawings for the year to 31 December 2008 were: Annie £10,000, Bunny £12,000 and Cathy £8,000.

Bunny made her drawings on 1 January 2008, Cathy made her drawings on 1 June 2008, and Annie made her drawings on 1 October 2008.

The unadjusted net profit for the year to 31 December was £200,000. The following information relating to the net profit figure is available.

i) The net profit excludes some accrued expenses of £20,000. ii) The net profits includes rent of £12,000 paid in advance for the Dentists practice for the six months ending 28 February 2009. iii) The net profit does not include an invoice for dentist sundries of £3,000.

Required:

a) Prepare the current and capital accounts of the partnership showing clearly the partners appropriation account covering the year to 31 December 2008. (12 marks)

b) Explain two ways in which goodwill can be recognised in the balance sheet of a partnership. (4 marks)

c) What issues would you want to include as part of a partnership agreement? (4 marks) TURN OVER

SECTION C - Answer ONE question – 20 marks

QUESTION 5 – (20 marks)

A friend of yours has just inherited £1,000,000 and a successful, small but rapidly growing local company has asked him to invest some of this money with them. He cannot understand that if the net assets of the company are £350,000 why he is being asked to pay £700,000 for a 30% share in the company.

Explain why he may have to pay £700,000 and discuss what other information he would want to acquire and evaluate before determining the company’s ‘real’ value.

QUESTION 6 – (20 marks)

Your recently retired mother has become a shareholder in British Airways and has received a copy of the company’s annual report and financial statements. She thinks this is a very good document but then is highly surprised to learn that you have also read a copy even though you are not a shareholder.

Explain to your mother the other types of users who may read company accounts and the use and purpose they make of this information. Could any of these users be in potential conflict with your mother’s position as a shareholder?

QUESTION 7 – (20 marks)

Profitable firms have been known to go bankrupt, whilst firms making losses have been known to have considerable cash surpluses. Explain the reasons for this apparent anomaly.